Investing is challenging enough without bringing emotions into the equation. Unfortunately, humans are emotional, and as a result investors often place too much reliance on their feelings, rather than using objective information to drive rational decision making.

What causes investors to make irrational decisions? The short answer: our “amygdala.” Author and marketer Seth Godin calls this almond-shaped tissue in the middle of our head, at the end of the brain stem, the “lizard brain” (video below). Evolution created the amygdala’s instinctual survival flight response for lizards to avoid hungry hawks and humans to flee ferocious lions.

Over time, the threat of lions eating people in our modern lives has dramatically declined, but the human’s “lizard brain” is still running in full gear, worrying about other fear-inducing warnings like Iran, Syria, Obamacare, government shutdowns, taxes, Cyprus, sequestration, etc. (see Series of Unfortunate Events)

When the brain in functioning properly, the prefrontal cortex (the front part of the brain in charge of reasoning) is actively communicating with the amygdala. Sadly, for many people, and investors, the emotional response from the amygdala dominates the rational reasoning portion of the prefrontal cortex. The best investors and traders have developed the ability of separating emotions from rational decision making, by keeping the amygdala in check.

With this genetically programmed tendency of constantly fearing the next lion or stock market crash, how does one control their lizard brain from making sub-optimal, rash investment decisions? Well, the first thing you should do is turn off the TV. And by turning off the TV, I mean stop listening to talking head commentators, economists, strategists, analysts, neighbors, co-workers, blogger hacks, newsletter writers, journalists, and other investing “wannabes”. Sure, you could throw my name into the list of people to ignore if you wanted to, but the difference is, at least I have actually invested real money for over 20 years (see How I Managed $20,000,000,000.00), whereas the vast majority of those I listed have not. But don’t take my word for it…listen or read the words of other experienced investors Warren Buffett, Peter Lynch, Ron Baron, John Bogle, Phil Fisher, and other investment titans (see also Sidoxia Hall of Fame). These investment legends have successful long-term investment track records and they lived through wars, recessions, financial crises, and other calamities…and still managed to generate incredible returns.

Another famed investor, William O’Neil, summed this idea nicely by adding the following:

The Harmful Consequence of Brain on Pain

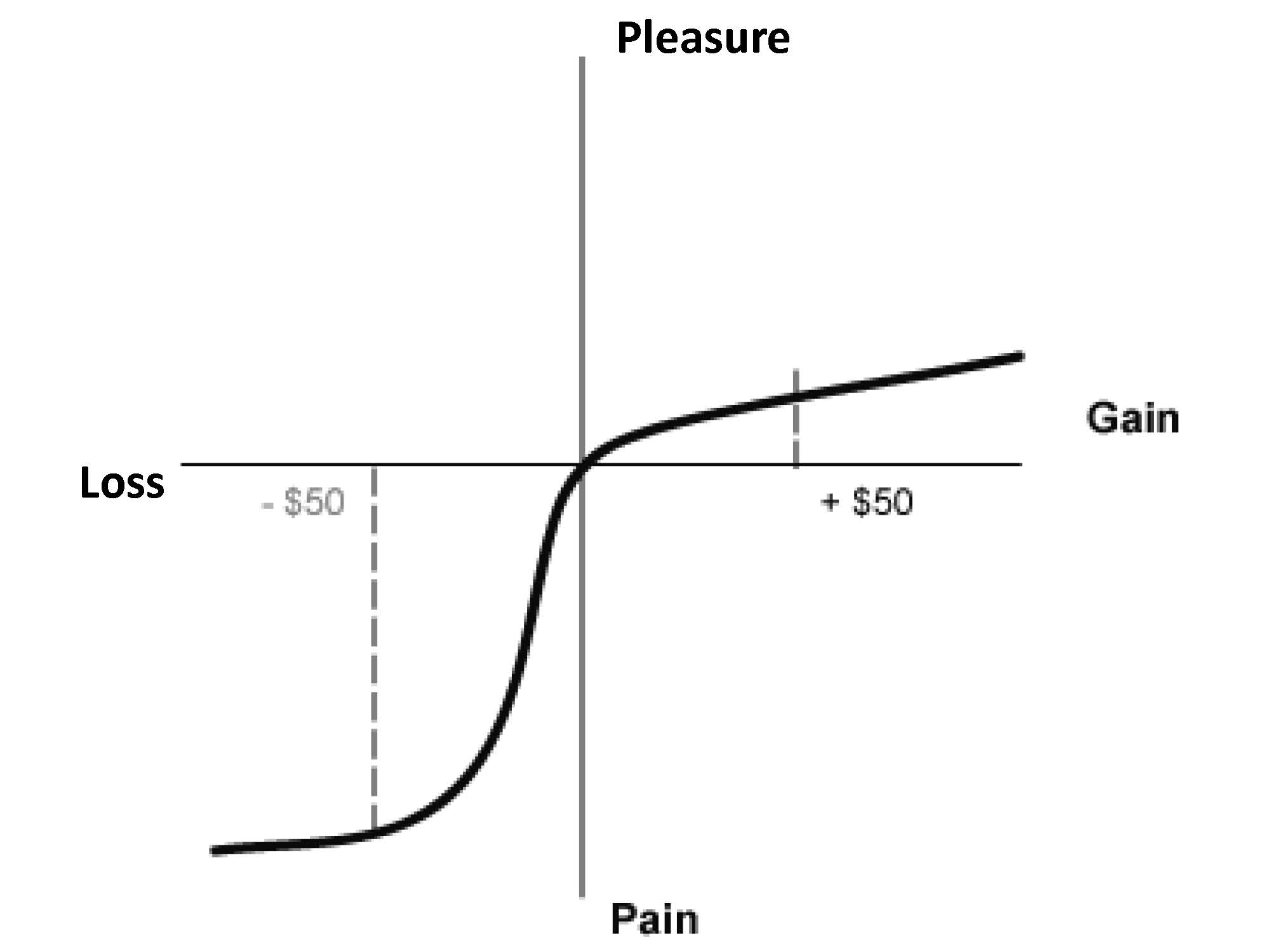

Besides forcing damaging decisions, another consequence of our lizard brain is its ability to distort reality. Behavioral economists Daniel Kahneman (Nobel Prize winner) and Amos Tversky through their research demonstrated the pain of $50 loss is more than twice as painful as the pleasure from $50 gain (see Pleasure/Pain Principle). Common sense would dictate our brains would treat equivalent scenarios in a proportional manner, but as the chart below shows, that is not the case:

Kahneman adds to the decision-making relationship of the amygdala and prefrontal cortex by describing the concepts of instinctual and deliberative choices in his most recent book, Thinking Fast and Slow (see Decision Making on Freeways).

Optimizing Risk

Taking excessive risks in technology stocks in the 1990s or in housing in the mid-2000s was very damaging to many investors, but as we have seen, our lizard brains can cause investors to become overly risk averse. Over the last five years, many people have personally experienced the ill effects of unwarranted conservatism. Investment great Sir John Templeton summed up this risk by stating, “The only way to avoid mistakes is not to invest – which is the biggest mistake of all.”

Every person has a different perception and appetite for risk. The optimal amount of risk taken by any one investor should be driven by their unique liquidity needs and time horizon…not a perceived risk appetite. Typically risk appetites go up as markets peak, and conservatism reaches a fearful apex near market bottoms – the opposite tendency of rational decision making. Besides liquidity and time horizon, a focus on valuation coupled with diversification across asset class (stocks/bonds), geography (domestic/international), size (small/large), style (value/growth) is critical in controlling risk. If you can’t determine your personal, optimal risk profile, then find an experienced and knowledgeable investment advisor to assist you.

With the advent of the internet and mobile communication, our brains and amygdala continually get bombarded with fearful stimuli, leading to disastrous decision-making and damaging portfolio outcomes. Turning off the TV and selectively choosing the proper investment advice is paramount in keeping your amygdala in check. Your lizard brain may protect you from getting eaten by a lion, but falling prey to this structural brain flaw may eat your investment portfolio alive.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Controlling The "Lizard" Brain, Making Rational Investment Decisions

Published 01/12/2014, 06:33 AM

Updated 07/09/2023, 06:31 AM

Controlling The "Lizard" Brain, Making Rational Investment Decisions

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.