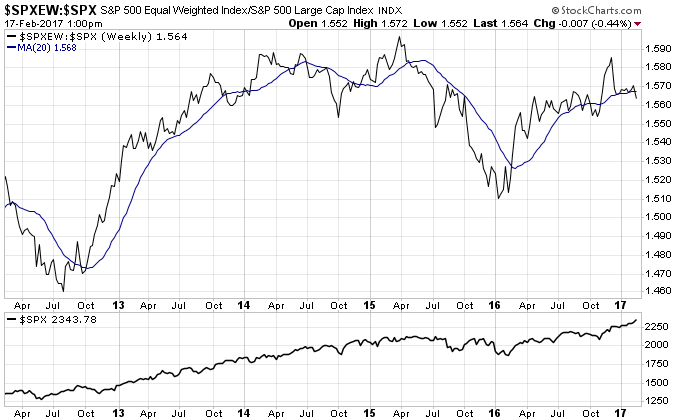

The ratio between S&P 500 Equal Weight Index (SPXEW) and the S&P 500 Index (SPX) is giving a small warning sign that, at the least, we’ll see some sideways consolidation over the next few weeks. As you can see from the chart below, a dip below the 20 week moving average generally results in consolidation. It often precedes pull backs of 5% to 15%.

The reason it occurs is that “smaller” big cap stocks are being sold as money is being moved into mega cap stocks. It takes more money to push a mega cap stock higher than it does to push a “smaller” large cap stock higher. It also takes less selling to drive the smaller stocks lower. Thus, mere rotation from large to mega caps creates a drag on SPX. At this point we don’t know if the rotation is just portfolio managers rebalancing or the start of a flight to safety so stay alert.

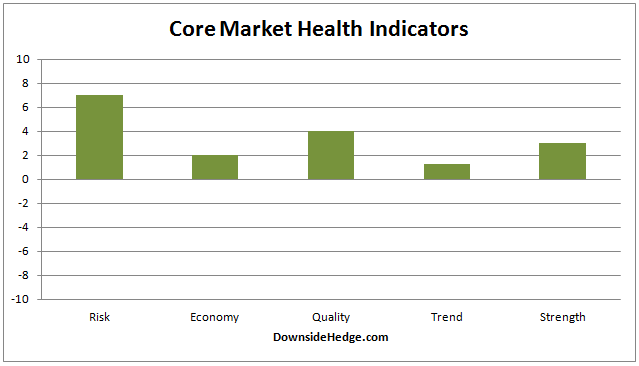

Over the past week, my core market health indicators mostly strengthened, but a few of them are showing enough weakness that it won’t take much price erosion to push them negative. Measures of market trend and strength are in the most danger from price. Measures of the economy are at risk, but for broader reasons.

Conclusion

Expect some consolidation ahead. It may be just sideways movement, but keep a close eye on the market because my core indicators are showing signs of weakness as the market pushes higher.