Let’s test the common “wisdom” that a double-digit dividend is unsustainable. The closed-end fund (CEF) we’re going to discuss today turns that notion on its head!

I’m talking about the PIMCO Dynamic Income Fund (NYSE:PDI), which, as it says in the name, is run by boutique CEF house PIMCO.

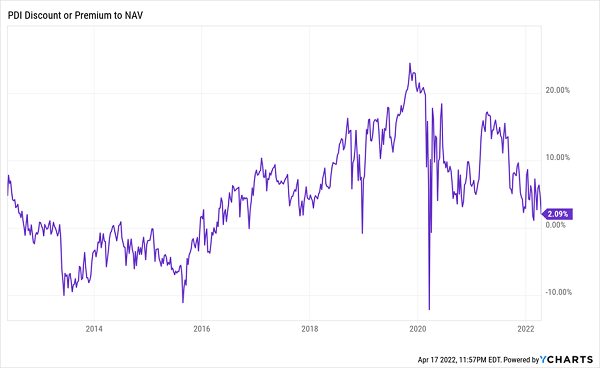

We all know that investors (and consumers in general) love a brand name, and that holds true with CEFs, too: due to the prestige associated with PIMCO’s moniker, its funds usually trade at huge premiums to net asset value (NAV).

Well, to be fair, it’s not just the company’s name that’s behind these premiums. PIMCO’s reputation is backed by a solid track record, including with PDI. The fund is worth paying attention to now for three main reasons:

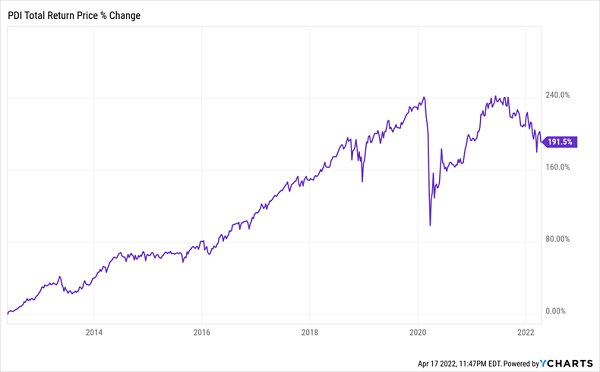

- It’s returned over 190% in the last decade.

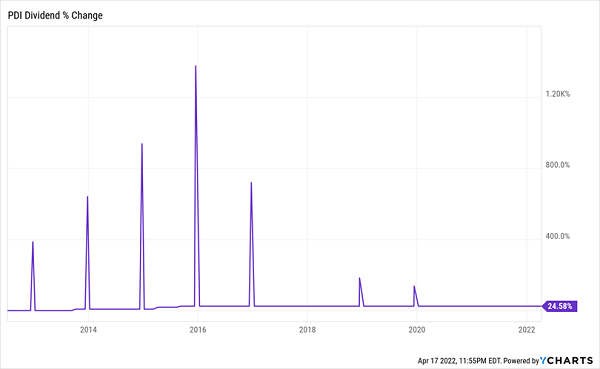

- It’s one of the highest-yielding CEFs, with a monstrous 11.6% dividend.

- It currently trades for less than it usually does.

Let’s hit each of these notes now.

A Big Profit, Despite Recent Pressures

While PDI’s total return was admittedly better before the early-2022 selloff, it has still given investors who got in early a nice profit. And PIMCO’s management team is something of a secret weapon here. Because even though the value of bonds and other debt securities falls when rates rise, what we don’t hear very often is that skilled managers can pivot their portfolios to account for this. (This, by the way, is why we always go with actively managed CEFs for our debt investments.)

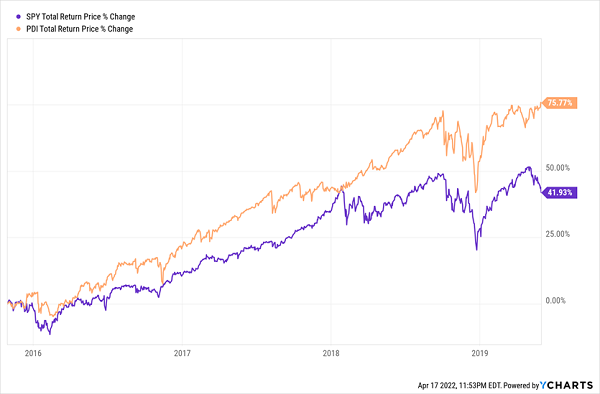

To see the power of skilled active bond management in action, look at the chart below, which runs from 2016 to 2019, when the Fed raised rates from 0.5% to as high as 2.25%. PDI returned 75.8% and beat stocks—something a corporate-bond fund just isn’t supposed to do.

All-Star Corporate-Bond Fund Defies Rising Rates, Crushes Stocks

That return is entirely due to PIMCO’s managers and unparalleled access to the bond market, thanks to its $2.2 trillion in assets, almost all of which is in debt securities. Now let’s move on to the fund’s valuation.

A Special Fund With a Special Price

Note that PDI traded at premiums in the high teens as recently as last year, and north of 20% prior to the pandemic. You can also see, on the right side of this chart, that the premium has tanked lately, due to the selloff. That’s left PDI cheaper than it has been for a long time: except for the darkest days of the pandemic, its value hasn’t been this low since 2018. And back then, the low price didn’t last long.

Now let’s wrap with a look at that yield. Sure, an 11.6% dividend sounds unsustainable, but the fund’s payout is not only stable, it’s growing:

Special Dividends and Payout Hikes Abound

Not only has PDI kept its high dividend stable, it’s raised its payout throughout its long history. Plus, all those spikes are times when the fund paid a special dividend to shareholders.

That big payout and strong performance history are why PDI has been beloved by investors for a long time—and that love will likely return soon.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."