Conatus Pharmaceuticals Inc. (NASDAQ:CNAT) incurred a loss of 13 cents per share for the fourth quarter of 2018, narrower than the Zacks Consensus Estimate of 14 cents and the year-ago quarter’s loss of 15 cents.

Revenues came in at $7.4 million, down 15.9% year over year due to lower reimbursement from partner Novartis (NYSE:NVS) for the costs incurred to support development of Conatus’ lead pipeline candidate, emricasan. Moreover, the top line marginally beat the Zacks Consensus Estimate of $7 million.

Conatus has no approved product in its portfolio at the moment. The revenues generated by the company are all related to its collaboration with Novartis for the worldwide development and commercialization of emricasan.

Shares of Conatus have rallied 13.9% so far this year, outperforming the industry’s increase of 9.9%.

Quarter in Detail

In the fourth quarter, research and development expenses were $8.9 million, down 18.3% from the year-ago period’s figure, mainly on account of lower spending associated with the ongoing ENCORE studies on emricasan. This was partially offset by higher spending related to new product candidate development.

General and administrative expenses were $2.5 million, marginally up from the year-ago quarter’s $2.3 million on higher personnel costs.

Full-Year Results

For 2018, Conatus generated revenues of $33.6 million, indicating a decrease of 5.1% year over year. In 2018, the company incurred a total loss of 59 cents per share, narrower than the year-ago loss of 61 cents.

Emricasan in Focus

Emricasan, a caspase inhibitor, is being developed for the treatment of patients with fibrosis or cirrhosis caused by nonalcoholic steatohepatitis (NASH). Conatus acquired the worldwide rights to emricasan from Pfizer (NYSE:PFE) in July 2010.

The company is conducting three ongoing phase IIb ENCORE studies on emricasan for treating fibrosis or cirrhosis induced by nonalcoholic steatohepatitis (NASH). The programs are, namely ENCORE-NF (for NASH fibrosis), ENCORE-PH (for portal hypertension) and ENCORE-LF (for liver function).

Last December, Conatus announced top-line results from a phase IIb ENCORE-PH. In the program, emricasan demonstrated clinically meaningful treatment effects on compensated NASH cirrhosis patients, who stand at a risk of passing to the decompensation state. However, the study failed to meet its primary endpoint. Following a post hoc analysis, emricasan demonstrated a clinically meaningful treatment impact compared with placebo. Additional results are now expected in mid-2019.

Meanwhile, in February 2019, Conatus completed enrolling patients in the phase IIb ENCORE-LF. Top-line data from the study is expected in mid-2019.

Top-line findings from the ENCORE-NF are awaited in the first half of 2019.

The company is focused on developing emricasan as positive outcomes from these investigations will pave the way for a phase III efficacy and safety assessment on the candidate for the given disease.

On fourth-quarter conference call, Conatus announced that it has selected CTS-2090,currently in preclinical development, to move into clinical studies. CTS-2090 is an orally active, potent and highly selective inhibitor of caspase 1. The company plans to submit an investigational new drug (IND) application to begin clinical studies on the candidate by the first half of 2020.

Guidance

Conatus expects the 2019-end balance in the range of $10-$15 million excluding any potential milestone payment under the Novartis collaboration.

As of December 31, 2018, Conatus had cash, cash equivalents and marketable securities of $40.7 million compared with $49.6 million as of Sep 30, 2018.

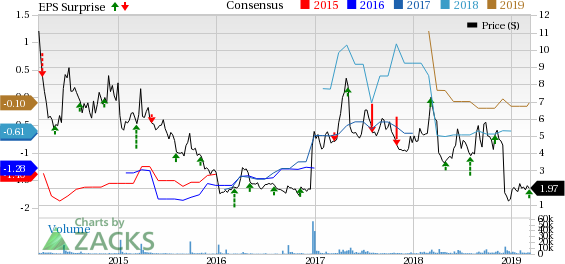

Conatus Pharmaceuticals Inc. Price, Consensus and EPS Surprise

Zacks Rank & Key Pick

Conatus carries a Zacks Rank #3 (Hold). A better-ranked stock in the same sector is Bovie Medical Corporation (NASDAQ:APYX) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bovie Medical’s loss per share estimates have narrowed 6.8% for 2019 over the last 60 days.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

Novartis AG (NVS): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Conatus Pharmaceuticals Inc. (CNAT): Free Stock Analysis Report

Bovie Medical Corporation (APYX): Free Stock Analysis Report

Original post

Zacks Investment Research