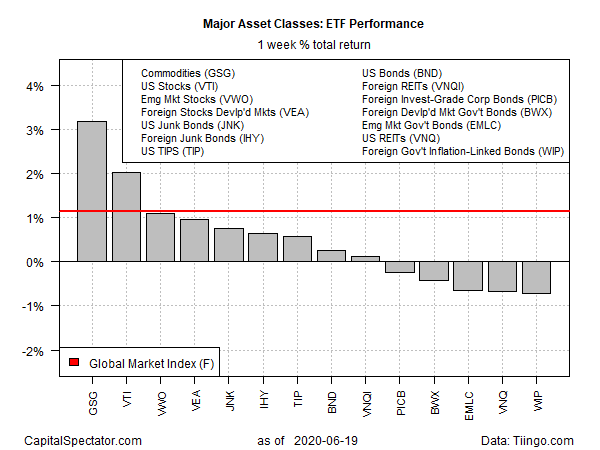

Broadly defined, commodities and US shares posted the highest gains for the major asset classes during the trading week through Friday, June 19, based on a set of exchange-traded funds.

The top performer, by far: iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG), which rose 3.2% last week. The gain marked the ETF’s seventh weekly advance during the past eight weeks.

Focusing on the tailwind of late for commodities, The Wall Street Journal reports: “Prices for raw materials including oil and copper are surging, as the world economy reopens for business, a signal to many investors that global growth is returning more quickly than anticipated.”

US equities were last week’s second-best performer for the major asset classes. Vanguard Total US Stock Market (NYSE:VTI) rose 2.0%, closing near the highest level since the coronavirus crash in March.

Last week’s biggest loser: inflation-linked government bonds ex-US (NYSE:WIP), which fell 0.7%, marking its second straight weekly decline.

The major asset classes overall rose 1.1%, based on the Global Markets Index that uses exchange-traded funds (GMI.F). This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, has posted gains in four of the past five weeks.

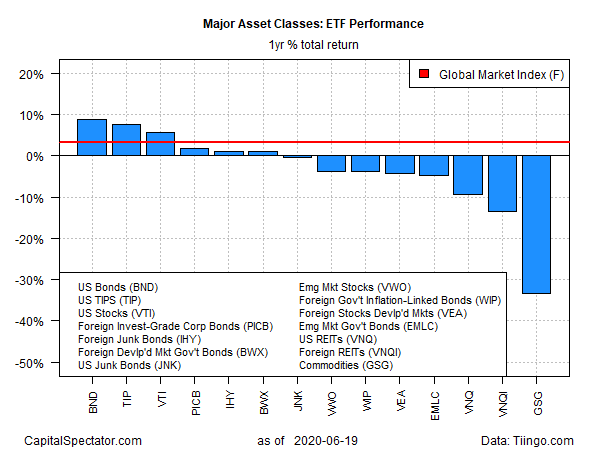

For the one-year trend, commodities continue to suffer the biggest decline. Despite recent gains, GSG remains deep in the red for the trailing 12-month window: a loss of more than 30%.

The biggest one-year winner for the major asset classes: a broad measure of investment-grade US bonds. Vanguard Total US Bond Market (NASDAQ:BND) is up 9.0% after factoring in distributions.

GMI.F’s one-year return through Friday’s close: 3.1%.

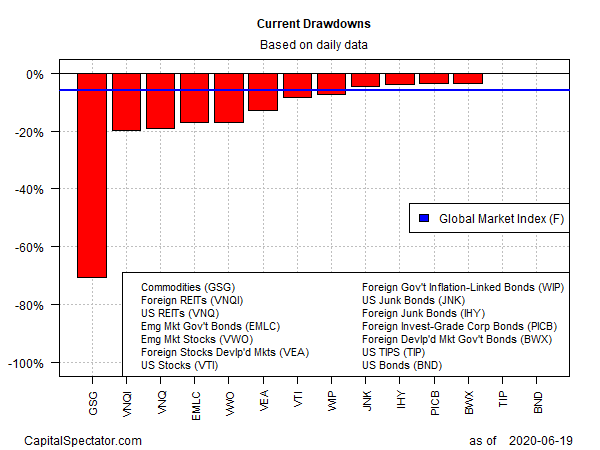

Ranking asset classes via current drawdown continues to show a wide range of results, ranging from a 70% peak-to-trough decline for commodities to the zero drawdowns for US investment-grade bonds (BND) and inflation-indexed Treasuries (TIPS).

GMI.F’s current drawdown: -5.9%.