Wall Street's third quarter earnings season kicks off this week with 30 S&P 500 companies, including six Dow components, set to report their latest results.

Most of the focus will fall on the major US banks, such as JPMorgan (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), Bank of America (NYSE:BAC), Goldman Sachs (NYSE:GS), and Morgan Stanley (NYSE:MS). In addition to those names, this week’s earnings line-up also includes Johnson & Johnson (NYSE:JNJ), United Airlines (NASDAQ:UAL), Delta Air Lines (NYSE:DAL), Walgreens (NASDAQ:WBA), and UnitedHealth Group (NYSE:UNH).

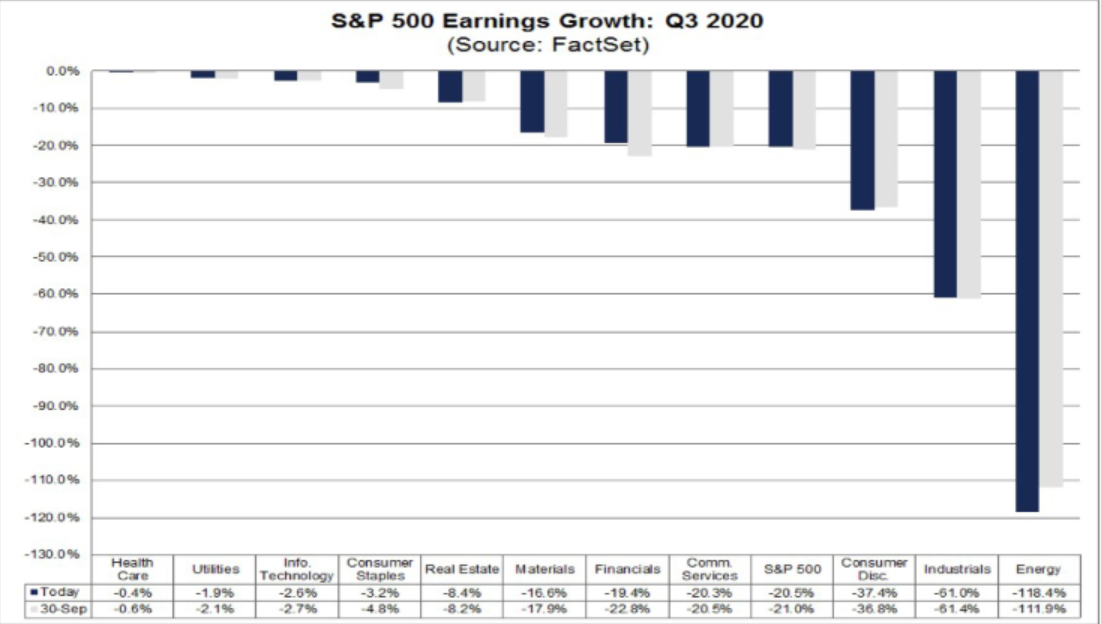

FactSet data shows analysts anticipate Q3 S&P 500 earnings will drop by 20.5% when compared to the same period last year, mainly due to the negative impact of COVID-19 on several industries. If confirmed, Q3 2020 would mark the second-largest year-over-year (Y-o-Y) decline in earnings reported by the index since the second quarter of 2009, trailing only the previous quarter, when earnings plunged by a whopping 31.6%.

All 11 sectors are projected to report a Y-o-Y decline in earnings, led by the Energy, Industrials, and Consumer Discretionary sectors.

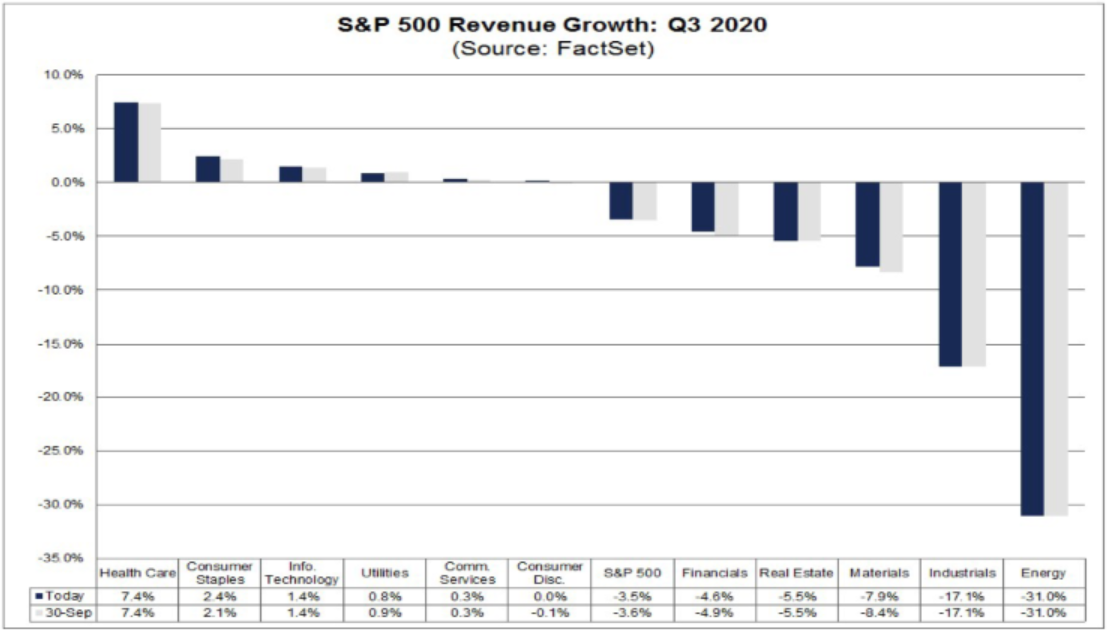

Revenue expectations are equally concerning, with sales growth predicted to slip 3.5% from the year-ago period. Five of the 11 sectors are anticipated to report a Y-o-Y drop in revenues, led once again by the Energy and Industrials sectors. On the other hand, five are predicted to publish annualized earnings growth, led by the Health Care sector. The Consumer Discretionary sector meanwhile is forecast to report flat Y-o-Y revenue.

Below we break down one sector whose earnings are projected to show relative strength and another sector expected to take the deepest dive:

Sector To Buy: Technology - Chipmakers Set To Boost Results

- Q3 EPS Decline Estimate: -2.6% Y-o-Y

- Q3 Revenue Growth Forecast: +1.4% Y-o-Y

The Information Technology sector is expected to report a drop of just 2.6% in earnings from a year ago in the third quarter, one of the smallest Y-o-Y declines among all sectors.

Five of the 13 sub-industries in the sector are anticipated to see higher earnings than a year ago, with the Semiconductor Equipment group likely to see a double-digit increase of 43.1%. Growth in EPS for the quarter is also forecast from the Systems Software segment, with earnings set to rise nearly 13% Y-o-Y.

Revenue meanwhile is projected to enjoy the third-biggest Y-o-Y increase at +1.4%, as the coronavirus outbreak and the shift to remote work forced many businesses to adapt and upgrade their computing operations.

Indeed, the Invesco QQQ Trust ETF (NASDAQ:QQQ), which tracks the performance of 100 of the largest non-financial stocks listed on the NASDAQ Composite is trading near its all-time high, up almost 35% this year.

Beyond the megacap tech stocks like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB), and Alphabet (NASDAQ:GOOGL), some of its largest holdings include NVIDIA (NASDAQ:NVDA), Adobe (NASDAQ:ADBE), Intel (NASDAQ:INTC), and Cisco (NASDAQ:CSCO).

Sector To Dump: Industrials - Airlines Expected to Lead Y-o-Y Drop

- Q3 EPS Decline Estimate: -61% Y-o-Y

- Q3 Revenue Drop Forecast: -42.2% Y-o-Y

Industrials are projected to report the second highest Y-o-Y earnings slump of all eleven sectors, at an astonishing -61%, trailing only the energy sector.

Of the 12 industries in the sector, 11 are expected to report a decline in earnings. Indeed, four of them are projected to report a drop of more than 30%: Airlines (-313%), Industrial Conglomerates (-50%), Aerospace & Defense (-42%), and Machinery (-33%).

The Industrials sector is also anticipated to report the second largest Y-o-Y revenue decline of at -17.1%. The Airlines industry is once again forecast to be the largest contributor to the Y-o-Y decline in revenue for the sector, at -75%.

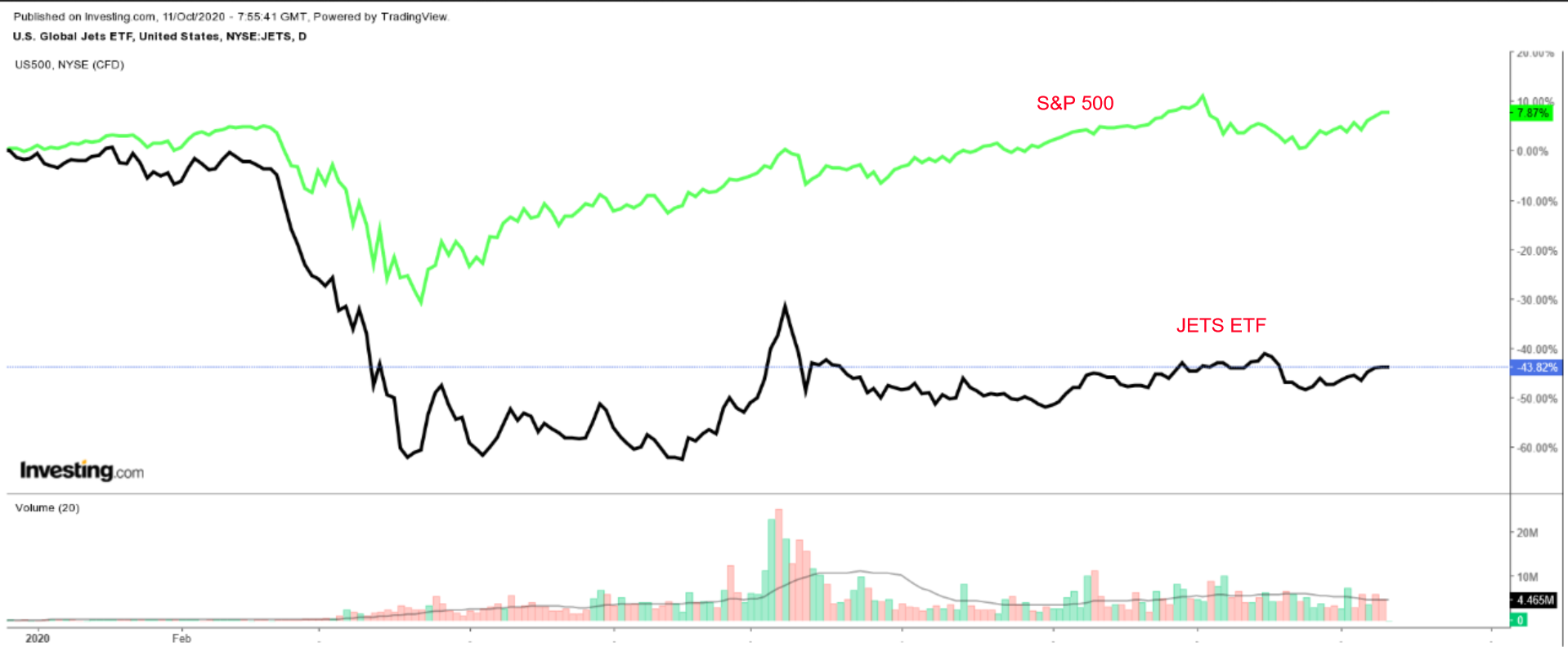

Not surprisingly, the US airline industry has drastically underperformed the broader market this year, with the sector’s main exchange traded fund—the US Global Jets ETF (NYSE:JETS)—down roughly 43% in 2020, compared to the S&P 500’s nearly 8% gain over the same timeframe.

Its top holdings include, Delta Air Lines, United Airlines, Southwest Airlines (NYSE:LUV), and American Airlines (NASDAQ:AAL).