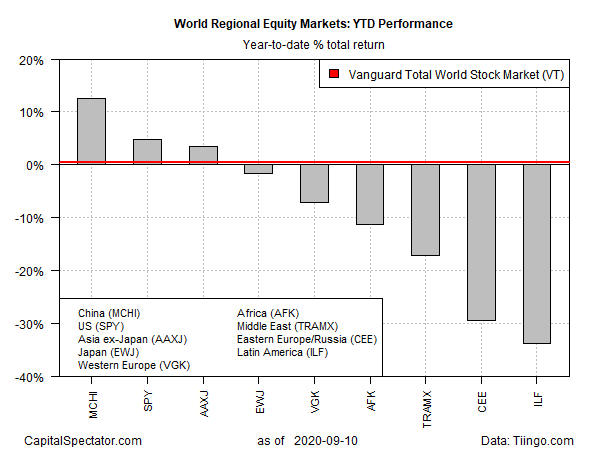

The recent round of selling has taken a bite out of stocks around the world, but the year-to-date results continue to favor China’s equities by a wide margin, based on a set of U.S.-listed exchange-traded products representing the major regions of the world through yesterday’s close .

Although iShares MSCI China has been pinched this week, the fund remains the clear performance leader in 2020. At Thursday’s close, MSCI (NASDAQ:MCHI)nwas up 12.6% year to date.

MCHI’s rise this year is well ahead of the second-best performer: U.S. stocks via SPDR S&P 500 (NYSE:SPY), which is ahead by a relatively modest 4.8%.

Global equities overall, based on Vanguard Total World Stock (NYSE:VT) (VT), are up a fractional 0.4% on the year.

MCHI’s latest dip below its 50-day moving average suggests to some technical analysts that the risk of a correction is growing for the ETF.

Warning signs are also accruing in turnover data and a rotation out of high-flying consumer shares in China. Shen Zhengyang, an analyst at Northeast Securities Co. advises:

“Turnover and liquidity conditions are not aligning in the best place for the market right now. We’re halfway through a correction.”

Most of the funds that track the major equity regions are currently posting losses for the year to date. The deepest setback at the moment: iShares Latin America 40 (NYSE:ILF), which is down 33.8% so far in 2020. Note that most of the fund’s loss this year unfolded in the first quarter; since late-June, ILF has been stuck in a relatively tight trading range.

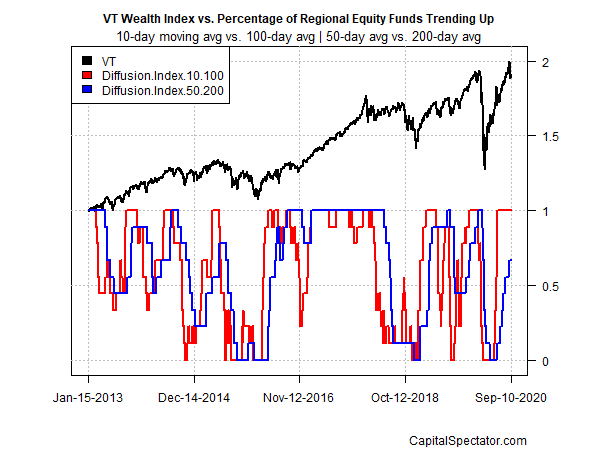

Profiling the ETFs above through a momentum lens currently indicates that all the funds are currently posting bullish momentum on a short-term basis, based on a 10-day vs. 100-day moving averages. For medium-term momentum, six of the nine regional funds are trending higher (using 50- and 200-day moving averages).

The question is whether the summer recovery in most corners of global equities has peaked? The next week or so could provide the answer as the crowd considers the risks that may be lurking in the fall and winter.