The Chinese economy is slowing down to multi-year lows. GDP growth was 6.4% y/y in 4Q18 was the lowest in 28 years. However, monthly indicators hold out hope of a change in trend. Industrial production and retail sales accelerated their growth instead of the expected slowdown. In addition, market participants hop on the boost effect from tax and monetary stimulus in the coming months. In this regard, the data from China should be regarded as the fact that the situation was bad but will improve soon. We can see the light of the rising sun there.

This approach explains the persistence of positive market dynamics. The Chinese market, which had previously nervously reacted to the national statistics weakening, continued to grow this time, adding 0.4% since the beginning of the day after strengthening by 2% on Friday.

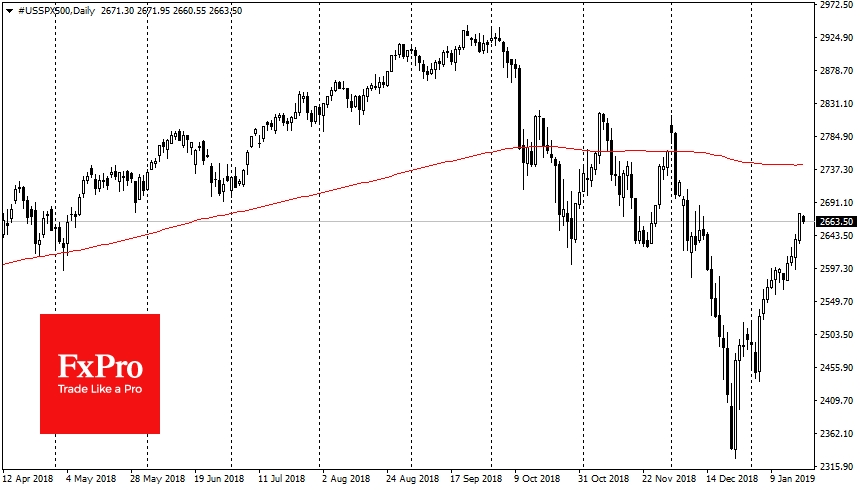

The U.S. market, on the contrary, is under pressure due to the prolonged government shutdown. Over the weekend, President Trump did not make any new proposals for the Democrats to get things moving, so American markets came under pressure at the start of trading on Monday. S&P 500 is down 0.4% after strengthening by 1.4% on Friday. On the contrast with China, it is still midnight in the U.S.

A similar situation with the U.S. dollar. At the beginning of the day on Monday, the dollar slightly loses after rising 0.3% on Friday. Thus, U.S. markets are waiting for further signals from politicians, being under moderate pressure, the dollar also shows indecision, while Asian markets continue their recovery.