The number—and severity—of new government policies have eased after an abrupt stoppage of electricity in some areas due to a sudden shut down of electricity generators. November could be the start of a calmer period in terms of policy. As such, the chances of an RRR cut in the fourth quarter are now lower and we are revising our yuan forecast

No more sudden electricity stoppages offer breathing room

Electricity is vital for households as well as for manufacturing and services. The sudden stoppage of electricity for around 10 days since 28 Sept. in various cities in China created chaos. The policy has been reversed due to complaints from residents and business owners.

The reversal of the sudden electricity stoppage suggests the government may not create any further policy shocks in the fourth quarter.

Other policies are still in place, e.g., data privacy compliance on technology companies and deleveraging in the real estate sector. These policies will continue into 2022 with the intention of creating structural change for better long term growth.

Inflation less worrying from falling coal prices

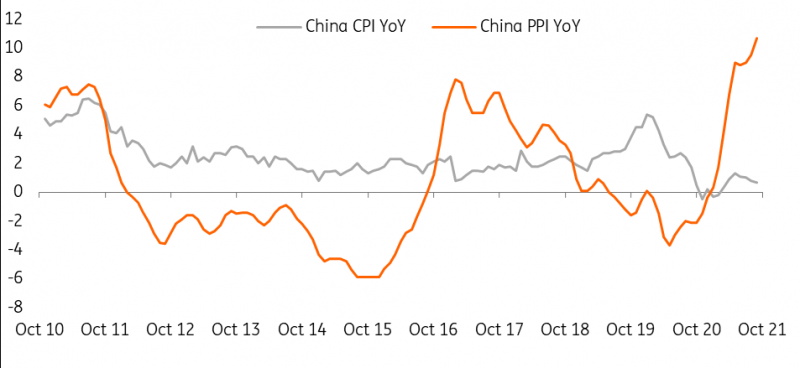

China has imposed a few restrictions to suppress coal prices, which is related to the cost of electricity supply this winter. PPI inflation in China should be confined to around 10% year-on-year for the rest of the year. This seemingly high PPI inflation is mainly a result of a low base effect. That said, the economic recovery from COVID around the world has also contributed to higher commodity prices.

CPI inflation in China has been low. But global freight disruptions have added some upward pressure on agricultural prices. This could be seen in October and November. But even with this, the rise in CPI should be moderate.

China CPI and PPI divergence

Revision of forecasts

As inflation is not a concern, the economic recovery should continue. Even if there are some bond defaults, the market should have already priced in these events. The People's Bank of China could also adjust liquidity via daily liquidity operations to stabilize interest rates and calm fears of a sharp increase in market risk.

We revise our forecast from a 0.5 percentage point broad-based required reserve ratio cut to no change in the RRR or policy interest rates in 2021.

The USD/CNY forecast is revised from 6.7 to 6.4 by the end of 2021 because of the revised forecast in the RRR and strong portfolio inflows from foreign demand for onshore assets, despite recent real estate events.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more