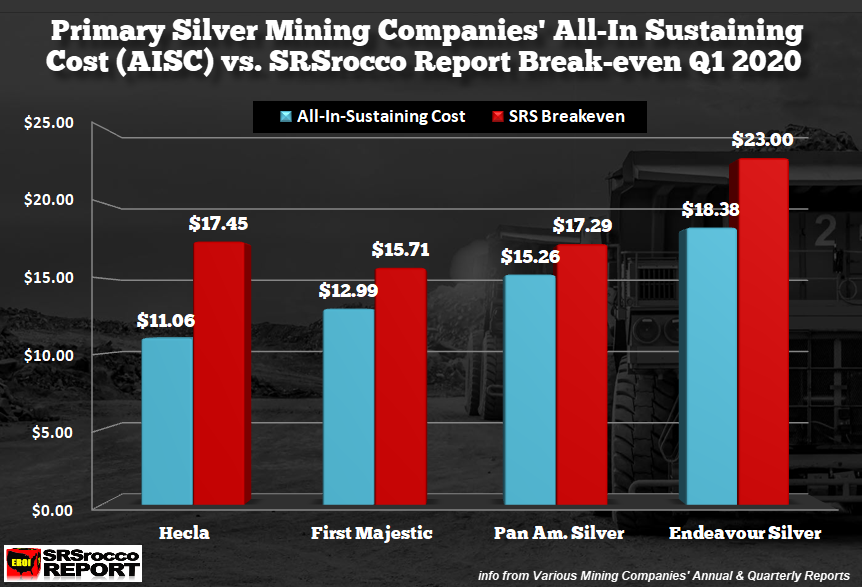

The chart of the week shows that some of the leading primary silver miners total REAL COSTS are higher than their published All-In Sustaining Cost. My analysis suggests that the companies’ All-In Sustaining Costs (AISC), are not really “All-In.” So, I quickly did my calculations based on these companies’ adjusted earnings. If I used their net income, their estimated Breakeven would be much higher.

In the chart below, the four primary silver mining companies (if we can still call some of them that) posted their AISC for Q1 2020. The biggest JOKE of them all is Hecla, which reported a low $11.06 All-In Sustaining Cost for silver. Well, that’s surprising when Hecla suffered a $17 million net income loss for the period. So, how could Hecla be losing money if its All-In Sustaining Cost was $11.06 when they received $16.94 per ounce for their silver during Q1 2020?

It’s quite simple… the All-In Sustaining Cost is a BOGUS METRIC used to confuse and bamboozle unsophisticated investors… and it works like a charm:

So, if you scan across the chart above, you will see the individual company’s AISC in BLUE, while the RED BARS show my simple estimated Breakeven for each. Endeavour Silver (NYSE:EXK) gets the TAKE ME OUT THE WOODSHED AWARD because it’s losing money hand-over-fist ever since it had to shut down its El Cubo Mine, a COMPLETE WASTE of a mine that should have never been acquired by the company.

In a nutshell, if you are a new investor looking for HOT silver mines to invest, do me a favor and pay no attention whatsoever to the All-In Sustaining Cost metric. I need to do more analysis in this area to help investors from buying the WORST CANDIDATES in the industry.