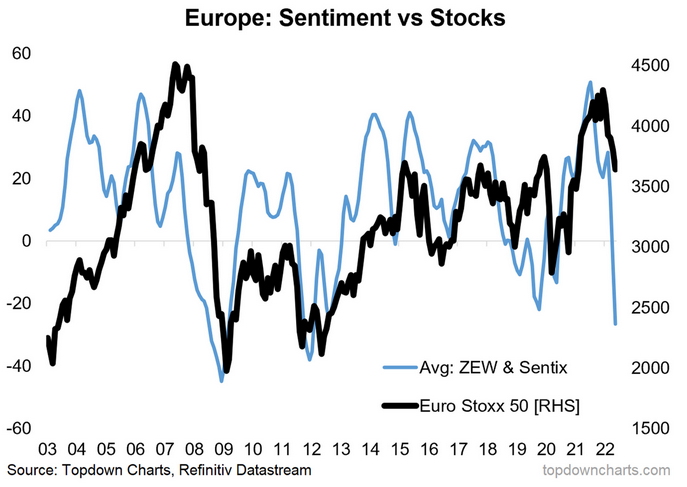

European Equities — Sentiment vs Stocks: After a very promising looking, indeed, almost textbook breakout last year, European equities have come all the way back down to support (former resistance), and the way sentiment is looking there could be still more downside to come.

In fairness, a big part of the shock drop in sentiment was the headline *fear factor* from geopolitics (but also the very real direct and indirect macroeconomic impacts of the Ukraine invasion e.g. shortages, inflation, tighter financial conditions).

While we might be able to write-off some of this as overreaction, the near-term macro/risk outlook for Europe remains sketchy as monetary conditions continue to tighten (growth headwinds), bank lending standards have tightened (and credit spreads are on a widening trend), not to mention apparent global recession risk.

Perhaps the only consolation for European equities is that support has held-up so far, and some might argue that sentiment is too pessimistic. It’s also entirely possible that the ECB either doesn’t even get a chance to hike rates, or finds itself back in renewed easing before long. So for now, neutral is the easy answer, with more of an eye on downside risks than upside risks given the prevailing macro currents.

Key point: European equities are at risk of further downside.