In a bid to expand its footprint across the globe, C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) acquired Milgram & Company Ltd.. The deal is worth approximately $62 million CAD (approximately $50 million USD). The buyout,expected to boost C.H. Robinson’s bottom line in 2018, will likely be financed via cash and funds from C.H. Robinson’s existing revolving credit facility. The buyout, however, is not projected to impact C.H. Robinson’s current-year earnings.

Milgram Background

Founded in 1951, Milgram is a privately held company, headquartered in Montreal, Quebec. With six offices in Canada and one in the United States, the company comprises around 330 employees, serving nearly 3,500 customers.

As an international freight forwarder, Milgram offers consulting, trade advisory, warehousing and distribution services. During the fiscal year ending May 31, 2017, the company had gross revenues totaling approximately $155.3 million CAD (approximately $124 million USD).

Benefits of Acquisition

C.H. Robinson, one of the largest third-party logistics companies in North America, expects Milgram’s commendable customer and carrier relationships to blend well with its service offerings and network. The combined entity is anticipated to add value to customer service while increasing the companies’ business scale. Milgram will be a part of C.H. Robinson’s Global Forwarding division. The company will also integrate Milgram to Navisphere, its single global technology platform.

C.H. Robinson is constantly looking to make acquisitions to expand its global presence. To this end, it acquired APC Logistics last year. This deal has boosted the company’s presence in the Austalia-New Zealand region.

Zacks Rank & Key Picks

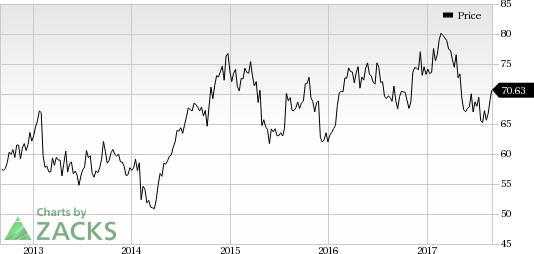

C.H. Robinson currently carries a Zacks Rank #5 (Strong Sell).

Investors interested in the Transportation sector may consider better-ranked stocks like DSV A/S (OTC:DSDVY) , Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (NYSE:PAC) and Grupo Aeroportuario del Centro Norte, S. A. B. de C. V. (NASDAQ:OMAB) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of DSV and Grupo Aeroportuario del Pacífico have gained more than 41% and 9% respectively, in a year, while Grupo Aeroportuario del Centro Norte shares have surged more than 26% over the last six months. Pls chk the figures and the stocks’restricted status before uploading

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Grupo Aeroportuario del Centro Norte S.A.B. de C.V. (OMAB): Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW): Free Stock Analysis Report

Grupo Aeroportuario Del Pacifico, S.A. de C.V. (PAC): Free Stock Analysis Report

DSV A/S UNS ADR (DSDVY): Free Stock Analysis Report

Original post