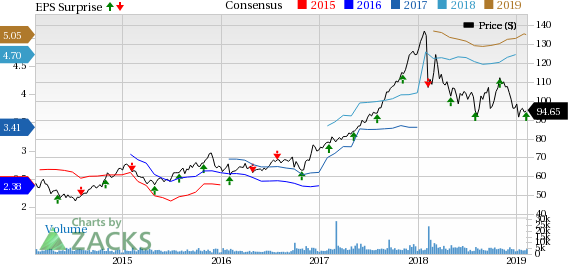

Cboe Global Markets, Inc.’s (NYSE:CBOE) fourth-quarter 2018 adjusted earnings of $1.54 per share beat the Zacks Consensus Estimate of $1.35 by 14.1%. Moreover, the bottom line soared 77% year over year.

The reported quarter benefited from better growth across all business segments. The company’s record financial results in the quarter under review underscore the operating leverage intrinsic to its business model. The company remains committed to a disciplined expense management while executing its important strategic growth initiatives and working toward adding long-term shareholder value.

Full-Year Highlights

For 2018, Cboe Global reported adjusted earnings of $5.02 per share, missing the Zacks Consensus Estimate by 0.6%. However, the bottom line surged 46.8% from the year-ago quarter.

Moreover, total revenues of $1.2 billion improved 22.2 % year over year.

Operational Details

Total revenues came in at $334.4 million, surpassing the Zacks Consensus Estimate by 7.2%. Moreover, the top line improved nearly 26% year over year.

Average daily volume for Options increased 29.4% year over year while the average revenue per contract or RPC rose 17.2% in the fourth quarter.

Total RPC for U.S. Futures decreased 6.3% year over year to $1.686 million. The company’s ADV improved 18.6% year over year.

Total operating expenses inched up 0.7% year over year to $158 million on the back of higher compensation and benefits, technology support services, facilities costs and other expenses.

Adjusted operating margin for the quarter under review was 66.6%, having grown 610 basis points year over year from 60.5%, denoting increased operating leverage from a higher revenue base.

Financial Update

As of Dec 31, 2018, CBOE Holdings had cash and cash equivalents of $275.1 million, skyrocketing 91.7% from $143.5 million at year-end 2017. Total assets were $5.3 billion in the fourth quarter, rising 1.1% from 2017-end level.

Total shareholders’ equity was $3.2 billion at the end of the reported quarter, up 4.2% compared with $3.11 billion as of Dec 31, 2017.

Share Repurchase and Dividend Update

The company paid cash dividends worth $34.7 million or 31 cents per share in the fourth quarter.

For 2018, the company bought back 1.3 million shares worth $140.9 million. As of Dec 31, 2018, the company has around $206.1 million left under its current share repurchase authorization.

2019 Guidance

Adjusted operating expenses are expected between $420 million and $428 million. This reflects an estimated decline of 2% to a nominal rise compared with the adjusted operating expenses of $426.8 million in 2018.

Depreciation and amortization expenses are anticipated between $35 million and $40 million excluding the amortization of acquired intangible assets of $138 million.

Capital expenditures are now projected in the $50-$55 million band.

The effective tax rate on adjusted earnings for 2019 is likely to be within 27-29%.

Zacks Rank

Cboe Global holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Players in Securities and Exchanges Industry

Among other players from the securities and exchanges industry having already reported fourth-quarter earnings so far, the bottom-line figures of MarketAxess Holdings Inc. (NASDAQ:MKTX) and Intercontinental Exchange, Inc. (NYSE:ICE) beat the respective Zacks Consensus Estimate while that of Nasdaq, Inc. (NASDAQ:NDAQ) came in line with the consensus mark.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

MarketAxess Holdings Inc. (MKTX): Get Free Report

Intercontinental Exchange Inc. (ICE): Free Stock Analysis Report

Nasdaq, Inc. (NDAQ): Get Free Report

Cboe Global Markets, Inc. (CBOE): Get Free Report

Original post

Zacks Investment Research