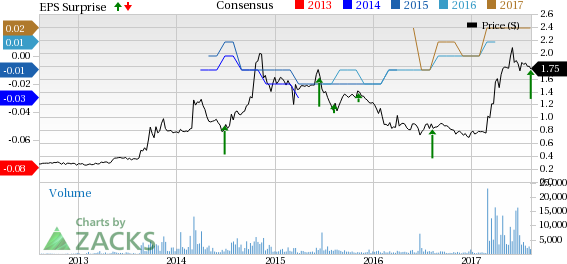

Premium branded spirits company Castle Brands Inc. (NYSE:ROX) reported a loss of 1 cent per share in the first quarter of fiscal 2018. The reported loss came in below the Zacks Consensus Estimate as well as the year-ago figure of a break-even.

Revenues & EBITDA

The company’s quarterly revenues of $20.9 million surpassed the Zacks Consensus Estimate of $18 million by 14.7%. Revenues also improved 24.5% year over year. The upside was driven by solid improvement in the company’s most profitable brands such as Jefferson's and Irish whiskeys, coupled with higher sales of ginger beer.

Sales of Goslings Stormy Ginger Beer increased 51.8% in the quarter, while that for Jefferson's bourbons grew 18.3%. Meanwhile, sales of Irish whiskey increased 32.3% in the quarter.

The company’s gross profit also improved 27.7% year over year to $8.6 million.

Adjusted EBITDA in the first quarter of fiscal 2018 jumped 57% year over year to $0.8 million.

Other Updates

In March, Castle Brands made a strategic investment for an additional 20.1% stake in its affiliate Gosling-Castle Partners Inc. or GCP. Castle Brands now has beefed up its ownership in GCP to 80.1% and extended the terms of the agreement through Mar 2030 with 10-year renewal terms from then on.

Sales of Goslings Rum and Beer have increased in the U.S. and internationally since the formation of GCP in 2005. Now, with the increase in ownership, Castle Brands’ strong sales and marketing initiatives are expected to boost Goslings Rum and Beer sales. This would help Castle Brands expand its consumer base, thus enhancing profitability.

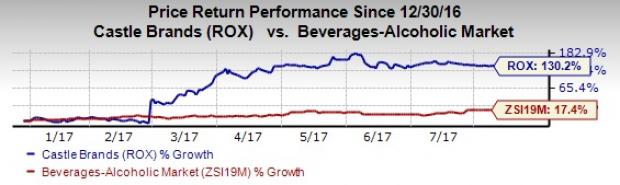

Stock Price Movement

Shares of Castle Brands have soared 130.2% on a year-to-date basis, outperforming the 17.4% growth of the industry.

Zacks Rank & Key Picks

Castle Brands has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked stocks in the industry are Compañía Cervecerías Unidas S.A. (NYSE:CCU) , Constellation Brands Inc. (NYSE:STZ) and The Boston Beer Company, Inc. (NYSE:SAM) , each carrying a Zacks Rank #2 (Buy).

Compañía Cervecerías is expected to witness 29% growth in its earnings this year.

Constellation Brands has an expected revenue growth rate of 20.6% for the current year.

Boston Beer has a solid earnings surprise history, beating the consensus mark in three of the four trailing quarters, with the average being 49.99%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Constellation Brands Inc (STZ): Free Stock Analysis Report

Castle Brands, Inc. (ROX): Free Stock Analysis Report

Boston Beer Company, Inc. (The) (SAM): Free Stock Analysis Report

Compania Cervecerias Unidas, S.A. (CCU): Free Stock Analysis Report

Original post