CarMax Inc. (NYSE:KMX) is set to release fiscal third-quarter 2019 results on Dec 20, before the opening bell. The Zacks Consensus Estimate for the quarter to be reported is a profit of $1.15 on revenues of $4.67 billion.

The specialty retailer of used and new vehicles came up with better-than-expected results in the last reported quarter on the back of higher-than-expected sales in the used-vehicle segment. Moreover, the bottom line increased 7.2% year over year.

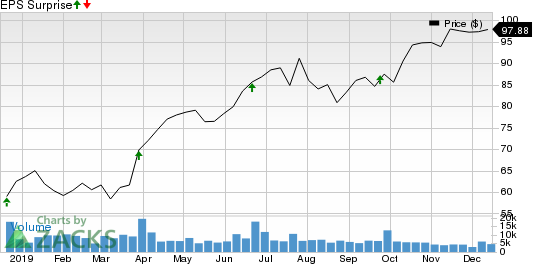

As far as earnings surprises are concerned, CarMax — whose peers include Advance Auto Parts, Inc. (NYSE:AAP) , O'Reilly Automotive, Inc. (NASDAQ:ORLY) and AutoZone, Inc. (NYSE:AZO) — is on an excellent footing, having surpassed the Zacks Consensus Estimate in each of the last four quarters, with average of 7.1%. This is depicted in the graph below:

Investors are keeping their fingers crossed and hoping that the company can continue winning ways by topping earnings estimates this time around too. Encouragingly, our model also indicates an earnings beat for CarMax in the to-be-reported quarter.

Trend in Estimate Revision

The Zacks Consensus Estimate for fiscal third-quarter earnings per share has been upwardly revised by a penny in the past 30 days to $1.15. This indicates an improvement from the year-ago reported earnings of $1.09 per share. The Zacks Consensus Estimate for revenues is pegged at $4,673 million, suggesting an improvement from $4,296 million reported in the prior-year quarter.

What the Zacks Model Says

Our proven model predicts an earnings beat for CarMax this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The company has an Earnings ESP of +0.21%.

Zacks Rank: CarMax currently has a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors at Play

CarMax’s extensive focus on the used vehicle market is likely to have buoyed earnings in the quartertobe reported.Expensive new vehicles led to robust demand for cheaply available used vehicles.This is anticipated to have driven sales. Evidently, the Zacks Consensus Estimate for used-vehicles sales, which contribute to bulk of its revenues, is pegged at $3,906 million. This indicates an increase from the year-ago level of $3,548 million. Used vehicle gross profit per unit is also expected to rise to $2,139 from $2,133 in the year-ago quarter.

The firm’s aggressive store expansion initiatives are expected to reflect on the upcoming results. The Zacks Consensus Estimate for net sales of wholesale vehicles is pegged at $634 million, pointing to an increase from $604 million generated in the year-ago quarter. Further, the consensus estimate for revenues from other segments is $154 million, implying an increase from $144 million recorded a year ago.

Overall, CarMax is likely to have benefited from increased revenues from used-vehicle and wholesale segments. Nonetheless, as the firm is undertaking aggressive store expansion initiatives, SG&A expenses are likely to have soared in the to-be-reported quarter, thereby denting margins to some extent.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

CarMax, Inc. (KMX): Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP): Free Stock Analysis Report

O'Reilly Automotive, Inc. (ORLY): Free Stock Analysis Report

AutoZone, Inc. (AZO): Free Stock Analysis Report

Original post

Zacks Investment Research