Cardano’s fate could be determined by its ability to break out of the $1.00-$1.30 price range.

Key Takeaways

- Cardano’s price action is contained within two critical price points that will determine where it moves next.

- On the upside, slicing through the $1.30 resistance level would be vital for ADA to rise to $2.00.

- If the $1.00 support fails to hold, investors may need to prepare for a 60% crash.

Cardano remains dormant, but as it edges closer to the apex of a consolidation pattern, the chances for an explosive price move increase.

Cardano Prepares For High Volatility

Most cryptocurrencies are enduring a consolidation period that will likely conclude in a substantial price movement.

For Cardano, the ongoing stagnation phase could lead to a 59.50% breakout in either direction. Such an ambiguous outlook is determined by the formation of a descending triangle on its daily chart.

This technical pattern developed due to the price action that ADA has seen since it reached an all-time high of $2.47 in mid-May. A series of lower highs created the triangle’s hypotenuse while its x-axis formed around $1.00, where most of the swing lows were capped.

Now, Cardano must either slice through the overhead resistance at $1.30, or the underlying support at $1.00 to confirm the direction of its trend. Given the importance of these price points, investors should wait for a decisive candlestick above this area to avoid any potential risks.

Breaking through the supply barrier at $1.30 could see the fourth-largest cryptocurrency by market cap head towards $2.00. But if sell orders pile up, leading to a breach of the $1.00 demand wall, Cardano could resume its downtrend to $0.40.

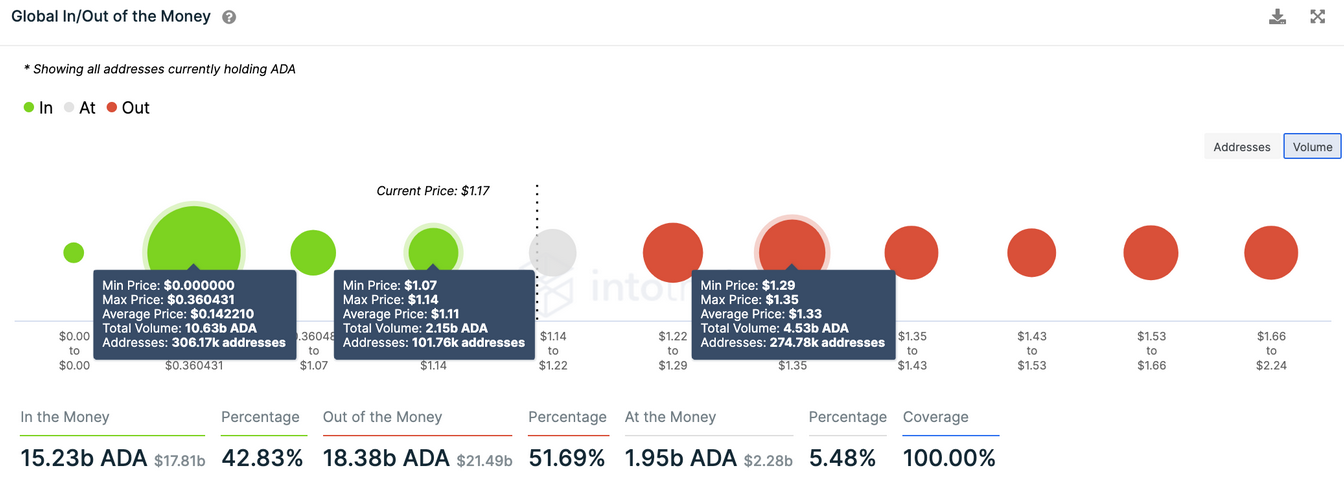

Cardano’s transaction history shows a similar outlook. Based on IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, the most significant concentration of underwater positions sits at $1.33. Here, roughly 275,000 addresses have previously purchased more than 4.5 million ADA.

These investors will likely try to break even in their long positions as prices rise, making it difficult for Cardano to experience a bullish breakout.

On the flip side, the IOMAP model reveals that the most crucial demand barrier below Cardano’s price lies between $1.07 and $1.14. Approximately 102,000 addresses bought 2.15 billion ADA around this price level.

A significant number of addresses would be “Out of the Money” in the event of a downswing that pushes Cardano below this price point. Such market conditions would likely increase the chances for these investors to exit their positions at the market value, pushing prices further down.

The IOMAP shows that the demand zone at $0.36 would likely keep ADA at bay if this were to happen.