Canada Retail Sales Strong

Data this morning showed that Canadian retail sales rose for the fourth consecutive month in June, edging up +0.1% to +CA$49.0B.

Sales were up in 6 of 11 subsectors, representing +38% of total retail trade.

Higher sales at general merchandise stores, clothing and clothing accessories stores, and building material and garden equipment and supplies dealers offset lower sales at motor vehicle and parts dealers and gasoline stations. Ex- the latter two subsectors, retail sales were up +1.1%.

After removing the effects of price changes, retail sales in volume terms increased +0.5%.

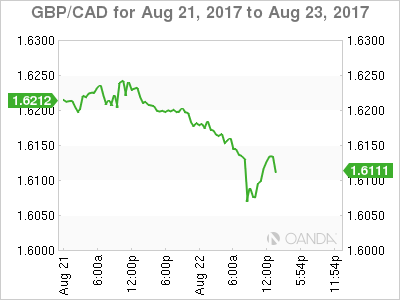

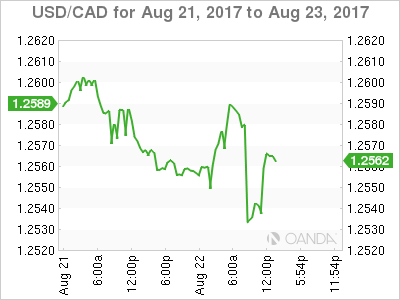

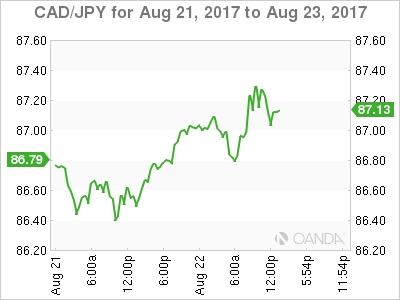

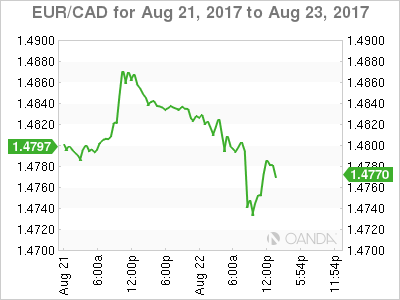

The loonie (CA$1.2550) is forecast to trade stable in a defined CA$1.24-$1.28 range for the foreseeable future because little new is expected from the upcoming Bank of Canada (BoC) meeting on Sept 6.

Dealers are not expecting anything dramatic in terms of shifting U.S rate expectations at this week Jackson Hole symposium and it is not clear that there are big swing factors in prospect for the Canadian monetary policy either in the coming month.

USD/CAD is trading generally in line with interest-rate differentials. In Canada, the market remains more confident than in the U.S that a further rate hike will be delivered before the end of the year.

Fed fund futures are currently attaching a +40% probability for a U.S rate hike, and a +66% probability for a BoC hike.

Note: At the start of August, the probability was +75%. If this process continues it would be consistent with USD/CAD trading back up to $1.2800 territory.

There is little reason for Governor Poloz at the BoC to downplay market expectations for a rate hike, but neither are they likely to feel compelled to reinforce hike expectations.

NAFTA

NAFTA negotiations are underway and in the early stages there is always scope for the rhetoric to sound more divisive as the sides adopt their starting negotiating position. But it is not clear that this will have a very large impact on the CAD.

The U.S, Canada and Mexico wrapped up their first round of talks on the weekend, vowing to keep up a blistering pace of negotiations.

In a joint statement issued at the end of five days of negotiations in Washington, the top trade officials from the three countries said Mexico would host the next round of talks from Sept. 1 to 5.

The joint statement said the three countries made “detailed conceptual presentations” across the scope of NAFTA issues and began work to negotiate some of the agreement’s texts, although it did not provide details on the topics.

Oil On CAD

The influence of oil prices over the commodity sensitive CAD has been declining during H2 and remains low.

The correlation between daily changes in the oil price and the exchange rate has been -0.13 over the last month. At the end of June, the measure was -0.64.

This may be because there has been less excitement in the oil story than in the BoC’s pivot toward the exit in recent months, but the trend of lower highs in the oil price since late February suggests a market still under pressure.