When billions of dollars flow into an ETF, it’s safe to assume this is because of its popularity among investors. The VanEck Vectors Junior Gold Miners ETF (NYSE:GDX) which invests heavily in junior gold miners around the world, can attest to this kind of popularity, with some $1.5 billion flowing into it this year alone. Total assets jumped 60 percent in 2017 to over $5 billion.

At some point, however, as is the case with the GDXJ, asset growth can outpace an ETF’s underlying index. As BMO Capital Markets reported in mid-April, there will be a massive rebalance trade around the GDXJ on June 17, with changes already taking place. The index methodology is now permitting larger companies to be added, with significant demand for around 18 potential new additions, in conjunction with down-weighting of existing names.

The new index methodology allows the ETF’s largest company by market cap to be $2.9 billion, versus $1.8 billion under the current method, reports Investor's Business Daily. This puts it over the traditional $2.5 billion limit for small caps.

Impacts of the “Pre-Balance”

So what will the “pre-balance” and official rebalance in June mean for investors? For starters, it may mean less exposure to small-cap names. As I told Kitco News, this is a disruptor for small-cap gold stocks, which are getting knocked down for no reason when they have great fundamentals.

In addition, the ETF will need to sell $3 billion worth of its existing holdings to buy the new large-cap additions, which will create a massive funding trade significantly impacting existing names, BMO continues.

The number of companies the GDXJ can invest in starting in June will go from 48 to 69.

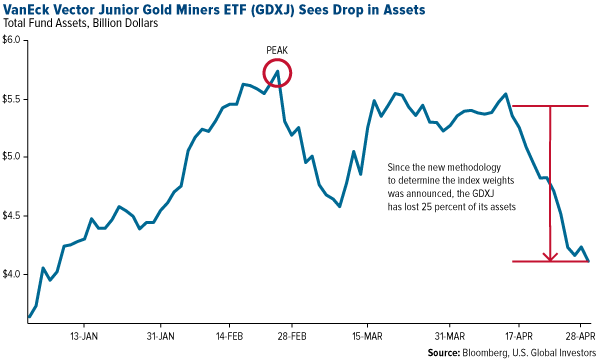

Sifting and Sorting For Opportunity

Since the GDXJ methodology update was announced, Macquarie Research reported last week that both the GDXJ and the VanEck Vectors Gold Miners (NYSE:GDX) have recorded large redemptions. Since April 13, the GDXJ has gone from $5.5 billion to $4.1 billion, losing approximately 25 percent of its assets. Similarly, the GDX went from $12.4 billion to $10.1 billion since the news – a drop of 19 percent.

“Indiscriminate selling pressure has been placed on the sector due to redefining the index methodology not based on the fundamentals of companies,”

explains portfolio manager Ralph Aldis. The investment universes of both the GDX and the GDXJ are defined by market cap and liquidity and designed like many ETFs are, to deliver beta but not alpha.

“There are no smart beta attributes to these ETFs, meaning we find a lot of high quality names are being indiscriminately sold down,” Aldis continues. “This may provide an excellent entry point for astute investors to pick up small-cap, high-quality growth names.”

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link above, you will be directed to a third-party website. U.S. Global Investors does not endorse all information supplied by this website and is not responsible for its content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the interview were held by one or more accounts managed by U.S. Global Investors as of 03/31/2017: VanEck Market Vectors Junior Gold Miners ETF (NYSE:GDXJ), VanEck Vectors Gold Miners ETF (GDX).

Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund's alpha.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.