CAD plunges after BoC urges caution

- The Bank of Canada kept its policy unchanged yesterday, as was widely anticipated, while the statement accompanying the decision had a relatively dovish tone. Even though the Bank noted the strength of recent economic data, such as employment and inflation figures, it appeared quite hesitant to signal any near-term rate hikes. Instead, policymakers ended the statement by indicating that they will continue to be cautious in making future adjustments to the policy rate.

- The Loonie plunged on the decision, possibly due to the absence of any hawkish signals that investors may have expected given the strength of the aforementioned data. Moving forward, the currency’s near-term direction will likely depend on the evolution of incoming data, as they could determine whether the BoC will hike in Q1 2018. At the time of writing, market pricing suggests roughly a 60% probability for a hike by March, according to Canada’s overnight index swaps. Should fresh Canadian data be strong in the next weeks, this percentage could rise and thereby, push CAD higher. On the other hand, weaker data could bring USD/CAD under renewed buying interest.

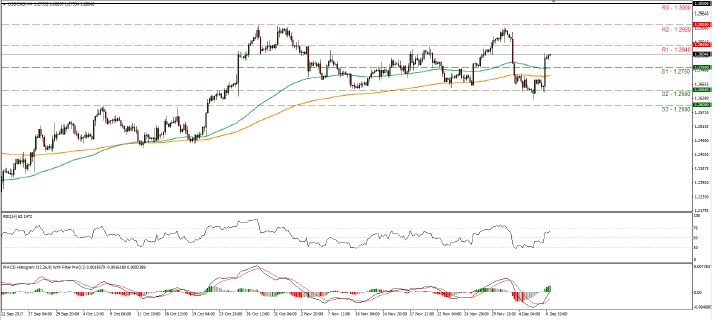

- USD/CAD surged after the BoC decision from near the 1.2660 (S2) support level to break above the resistance (now turned into support) level of 1.2750 (S1). During the European morning Thursday, the rate looks to be headed for a test of the 1.2840 (R1) hurdle. Despite yesterday’s surge, we believe that the pair could continue to trade in a sideways manner in the range established from the 25th of October, between the 1.2660 (S2) support barrier and the 1.2920 (R2) resistance. For the picture to turn to positive, we would like to see a clear break above the 1.2920 (R2) level. Something like that would signal a higher high on the 4-hour chart and could set the stage for more bullish advances, towards the 1.3000 (R3) zone. On the other hand, a break back below the 1.2660 (S2) support barrier could turn the picture negative, and open the way for further declines towards 1.2600 (S3).

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Bitcoin briefly tops 14,000

- Bitcoin continued to soar yesterday, briefly breaching the USD 14000 (R1) level, before pulling back a little. As usual, there was no clear fundamental catalyst behind the surge. Interestingly enough though, while BTC was gaining yesterday, other smaller alternative cryptocurrencies fell. This may signal that investors who owned alt-coins are opting for Bitcoins, given its ever-increasing popularity.

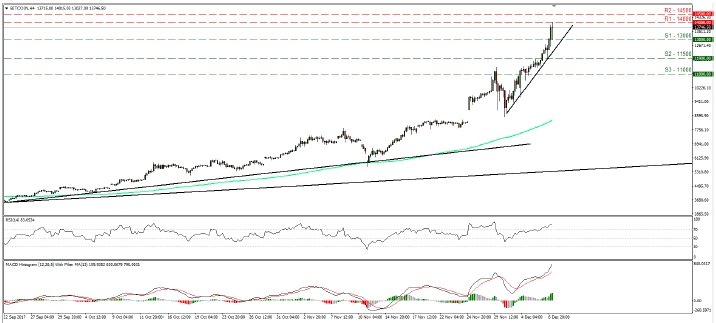

- Bitcoin prices surged yesterday after finding fresh buy orders slightly below 11900 (S2), to break briefly above the 14000 (R1) barrier. Should the bulls remain in the driver’s seat, we could see the cryptocurrency break the 14500 (R2) barrier and aim for the psychological territory of 15000 (R3). In case of a correction lower, we could see Bitcoin break below the 11900 (S2) support level and aim for 11000 (S3).

Today’s highlights:

- From Canada, we get the Ivey PMI for November, though no forecast is available.

- As for the speakers ECB President Mario Draghi will hold a press conference on the Basel banking reforms.

Support: 1.2750 (S1), 1.2660 (S2), 1.2600 (S3)

Resistance: 1.2840 (R1), 1.2920 (R2), 1.3000 (R3)

Support: 13000 (S1), 11900 (S2), 11000 (S3)

Resistance: 14000 (R1), 14500 (R2), 15000 (R3)