An important week of fundamental data for the British pound kicked off with some Brexit news, and the outline of what is likely to happen during the transition period before the UK’s exit from the European Union. This announcement was enough to send the British pound sharply higher, and whilst today’s below forecast inflation data, namely the CPI came in at 2.7% instead of 2.8% the release has only managed put a light dent in the currency’s bullish tone.

However, two upcoming events that will have much more of an impact on gbp, are tomorrow’s FOMC, and the BOE meeting on Thursday.

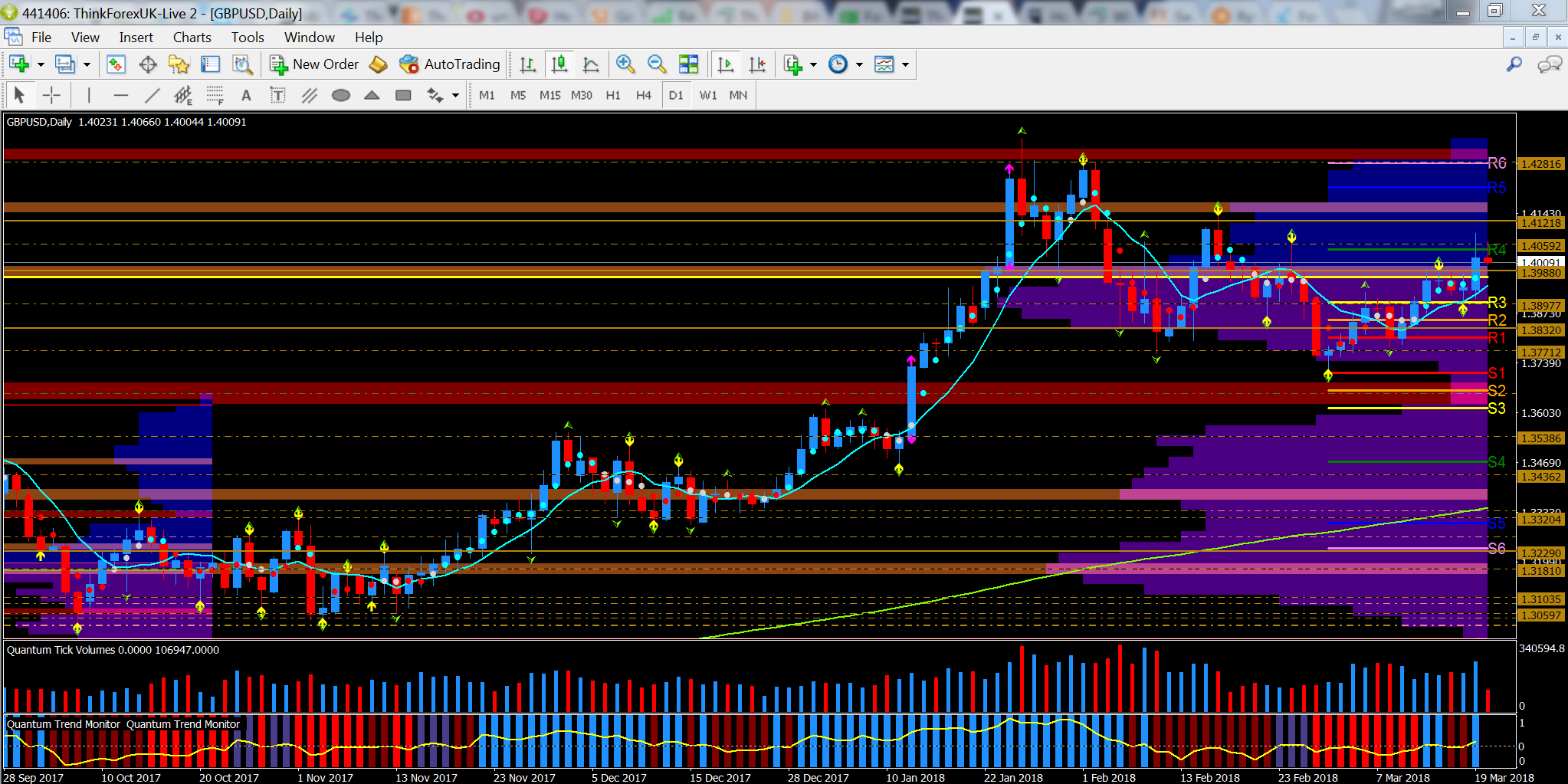

From a technical perspective for cable yesterday’s bounce from the 1.39 region on good volume also ensured the pair moved through the volume point of control at 1.3970 before some late session selling resulted in a candle closing with a deepish upper wick. Of itself this candle would suggest some weakness and a pullback to follow, which we have seen in this morning’s trading following the CPI data. To the upside the key level for cable is our R4 Camarilla price point at 1.4045, which according to the protocol a hold above and on good volume would be the classical set up for a potential breakout trade, with the first price target in the 1.4120 region, and thereafter 1.4212 and 1.4280, which is the early February high for the pair. However, with the FOMC tomorrow, and the US Dollar Index finding support at the key 90 level any such set up remains in the balance. To the downside the VPOC at 1.3971 offers decent support, but any break on the FOMC, or even Thursday’s BOE would see cable back down to test the R3 at 1.3901 setting up the prospect for a sharper reversal lower.

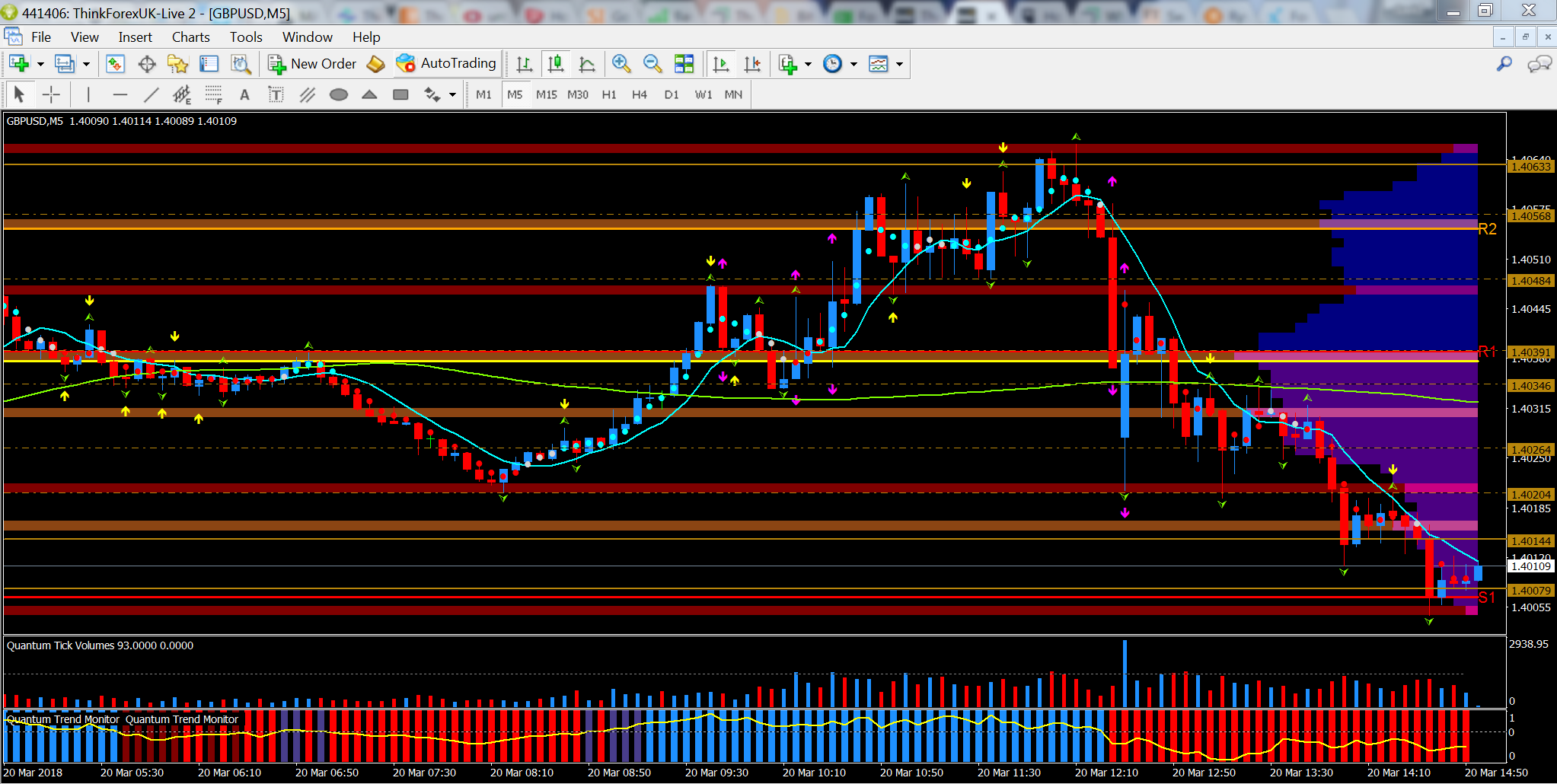

Meanwhile our intraday levels for cable are clearly shown on the 5 min chart where the pair is, at time of writing, at the bottom of our buffer zone that sits between 1.4037 and 1. 4006, from which is has been attempting to rise. Volumes in this time frame are below the average, and it will be interesting to see what NY traders make of cable later on today, and whether positive USD sentiment will prevail, thereby driving the pair lower.