- Equities rally on hopes of a ceasefire as Russian and Ukrainian foreign ministers meet

- Oil recoups some losses after tumbling on possible supply increase by OPEC

- Euro drifts lower ahead of crucial ECB meeting, firmer dollar eyes US CPI data

Cautious optimism for talks supports mood

The first high-level talks between Russian and Ukrainian diplomats are due to take place later today, spurring some optimism in hard-trodden markets. The foreign ministers of Russia and Ukraine are meeting in Turkey and there is some sign of progress, with both sides appearing to have toned down some of their demands ahead of the negotiations.

Recent language from the Kremlin suggests Russia is no longer intent on a regime change in Kyiv, while Ukraine’s president Volodymyr Zelensky has hinted he is open to keeping the country out of NATO.

Still, with cities like Mariupol remaining under heavy shelling from Russian forces, the stakes are high if there is no agreement today on taking steps towards achieving a ceasefire.

For investors, the talks have been the first encouraging development during this crisis and the hopes of a ceasefire triggered a short squeeze in oversold equity markets on Wednesday, propelling stocks higher.

European shares in particular stormed higher, with Germany’s DAX index closing almost 8% higher. The Euro STOXX 50 index also put on an impressive performance, jumping by 7.4%. On Wall Street, the Nasdaq Composite led the gains, rallying by 3.6%.

Asian markets were only catching up today, but European stocks and US futures were heading lower, paring some of their gains ahead of the big events that are coming up later.

Will the ECB put its normalization plans on hold?

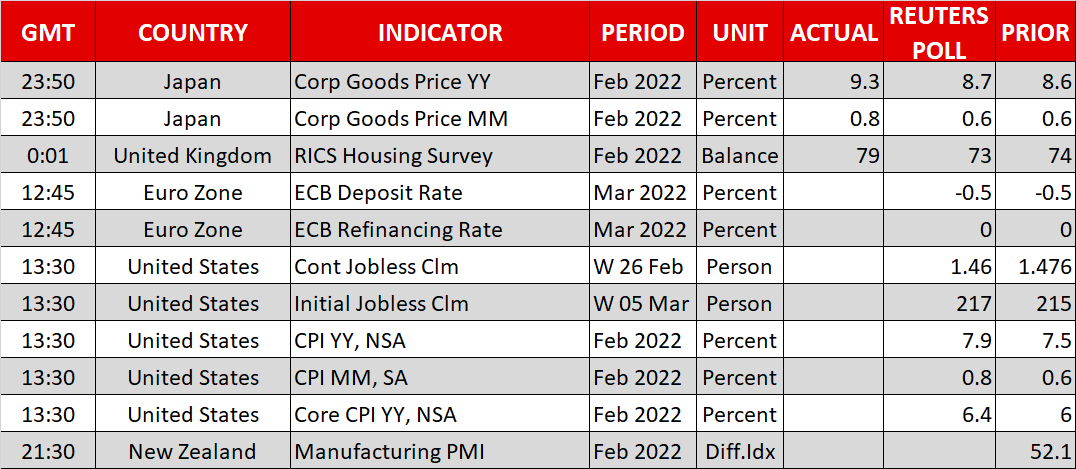

Aside from the Russia-Ukraine talks, investors will also be watching the European Central Bank’s policy decision at 12:45 GMT as well as the latest CPI release in the United States at 13:30 GMT.

The war in Ukraine has greatly exacerbated the inflationary spiral as commodity prices have shot up across the board, fuelling already simmering price pressures in the major economies.

Analysts are expecting America’s consumer price index to have hit 7.9% y/y in February. However, the US dollar may not necessarily get much of a boost from another strong print if there is a positive outcome in today’s peace talks.

Similarly, the euro could enjoy a relief rally from any de-escalation in tensions between Ukraine and Russia even if the ECB were to strike a dovish tone.

The ECB might delay an exit from its long-running asset purchase programme as the Eurozone economy is predicted to become a significant casualty of the conflict following the imposition of harsh sanctions against Russia. But with inflation in the euro area also surging sharply in recent months, a hawkish surprise is possible.

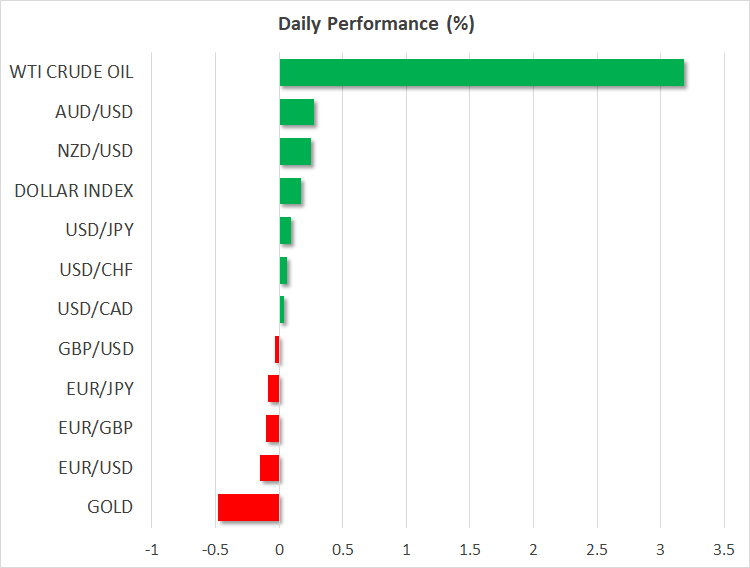

The euro bounced back sharply yesterday as risk appetite returned, climbing back above $1.10. Sterling and the commodity-linked aussie, kiwi and loonie also rebounded, but by a lesser extent. The dollar meanwhile took a tumble along with other safe havens.

Oil resumes rally, gold dips below $2,000/oz

Gold has fallen back below the $2,000/oz level as the easing risk aversion has given way to some profit taking. However, the notable upside reversal in US Treasury yields this week is also likely pressuring the precious metal.

But the biggest surprise yesterday was probably the massive drop in crude oil prices, which slumped by more than 12% after the United Arab Emirates indicated it supports increasing output to ease the shortages following the restrictions on Russian exports.

The comments from the UAE’s ambassador to the US were the first time an OPEC member has signalled willingness to raise output, though without the backing of Saudi Arabia, it’s hard to see such a move going ahead.

Hence, it’s too early to speculate on an OPEC supply boost and oil futures are headed back up again. Unexpected demands by Russia in the negotiations for renewing the Iran nuclear deal, which are endangering an agreement from being reached, may also be lifting oil prices today.