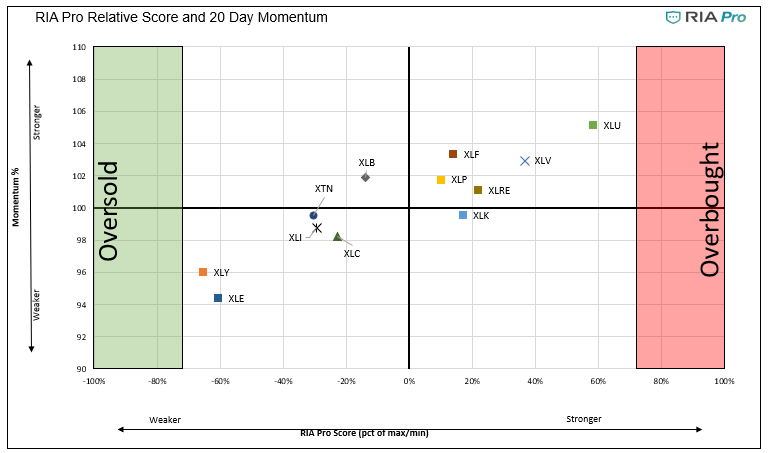

European Manufacturing Indexes were generally weaker than expected but it didn’t take the wind out of the sails of the U.S. Equity markets. They look to continue Friday’s gains, up a quarter to half a percent this morning. After dipping below $62 on Friday, oil is back up to $64 in early trading. On Friday we published the table below which shows Utilities (XLU) have the highest RIA Pro technical score and the most momentum.

Dallas Fed President Robert Kaplan, a strong proponent of tapering in the coming months, put the markets on alert that taper may not be as inevitable as many investors believe. Per Reuters: “any economic impact from the Delta variant of the coronavirus and he might need to adjust his views on policy “somewhat” should it slow economic growth materially.”

The problem with his statement is in trying to discern why economic activity is slowing. Delta is certainly playing a role, but fading stimulus, reduced consumer confidence, inflation, China, and a sharp reduction in pent-up demand are also weighing on the economy. Delta may be a convenient excuse for the Fed to delay tapering until next year. The initial market reaction to his comments was positive.

As we have noted China’s economic activity is weakening. The message is not lost on its equity markets. Hong Kong’s Hang Seng Index is now officially in bear territory, down 20% from its February peak. The S&P 500 is up 10%+ over the same period.

Zero Hedge put out an interesting piece titled Morgan Stanley Spots a Flashing Red Market Risk warning about option gamma flip points. Morgan Stanley says gamma “flips to short below 4250. That is where we could hit an air pocket.” On Monday, in our Gamma Band Update, Erik Lytikainen pegged the S&P 500 gamma flip level at 4205. The gamma flip point is where dealers, on average, have to sell stocks versus buying them to hedge their options books. Given the increased volume in options, and call options, in particular, these flip points provide a level where the recent bout of selling could accelerate. In addition to key moving averages which have served investors well recently, gamma flip points another level of technical guidance worth following closely.

After a relentless grind higher, some key manufacturing metals such as copper and iron ore have begun to fall in price. Copper for instance is trading at $4.00, down from a high of $4.80 in early May. Iron ore is down 30+% over the same period. Not surprisingly the Australian dollar is also trading weaker as it is a large exporter of metals and minerals. China, whose economy has been slowing markedly, accounts for 42% of Australia’s exports. The second leading country they export to is Japan, constituting only 13%.

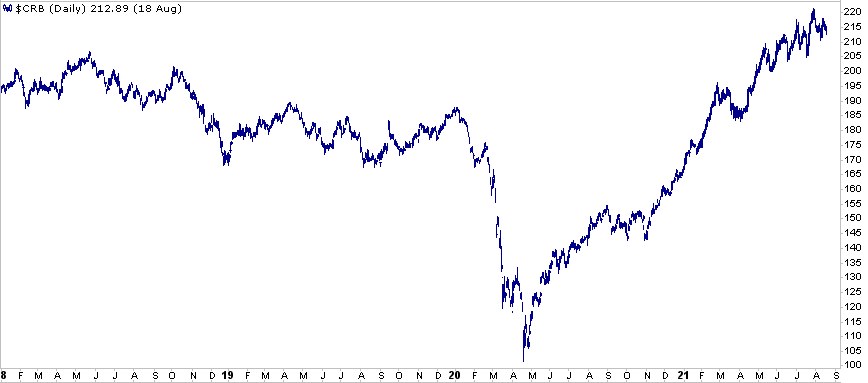

Despite the declines in some key industrial metals, the well-followed CRB commodity index, shown below, has yet to break its uptrend. The index is weighted 41% to agricultural products, 39% to energy, 13% to industrial metals, and 7% to precious metals.