June usually marks a drought for major earnings releases, with Q2 earnings season not starting in earnest until mid-July, and major central banks are generally in a near-term holding pattern as they await more clarity on how economies are recovering from a pandemic-driven global recession.

So it’s a good time to take a step back and review the technical outlook for major global indices. Below, we highlight the key trends, levels to watch, and technical biases for four major indices:

Dow Jones Industrial Average Technical Analysis

- Medium-term trend: Up

- Key support: 33,600

- Key resistance: 34,800

- Near-term technical bias: Bullish

The oldest US index, the Dow Jones Industrial Average has been on a tear since the COVID-driven trough last March, though prices have taken a bit of a breather over the past two months.

The recent consolidation between support at 33,600 and 34,800 has alleviated the overbought condition in the RSI indicator and allowed the longer-term 200-day exponential moving average time to “catch up” with prices; in other words, the recent price action can be viewed as a healthy pause within the context of a longer-term uptrend.

Now, traders will watch for a confirmed break above 34,800 to signal the next leg higher in the uptrend, with only a break below the 50-day EMA and horizontal support at 33,600 calling the bullish bias into question.

NASDAQ 100 Technical Analysis

- Medium-term trend: Sideways

- Key support: 13,000

- Key resistance: 14,500

- Near-term technical bias: Neutral

Of all four indices we examine here, the tech-heavy NASDAQ 100 is arguably the weakest from a technical perspective. Prices are trading above both the upward-trending 21- and 50-day EMAs, but only marginally, and the RSI indicator hasn’t hit “overbought” territory yet this year, indicating tepid buying pressure.

After months of choppy, inconsistent trade, bulls will need to see a confirmed break above the year-to-date high at 14,050 to renew the longer-term bullish trend and open the door for a move toward 15,000 this year.

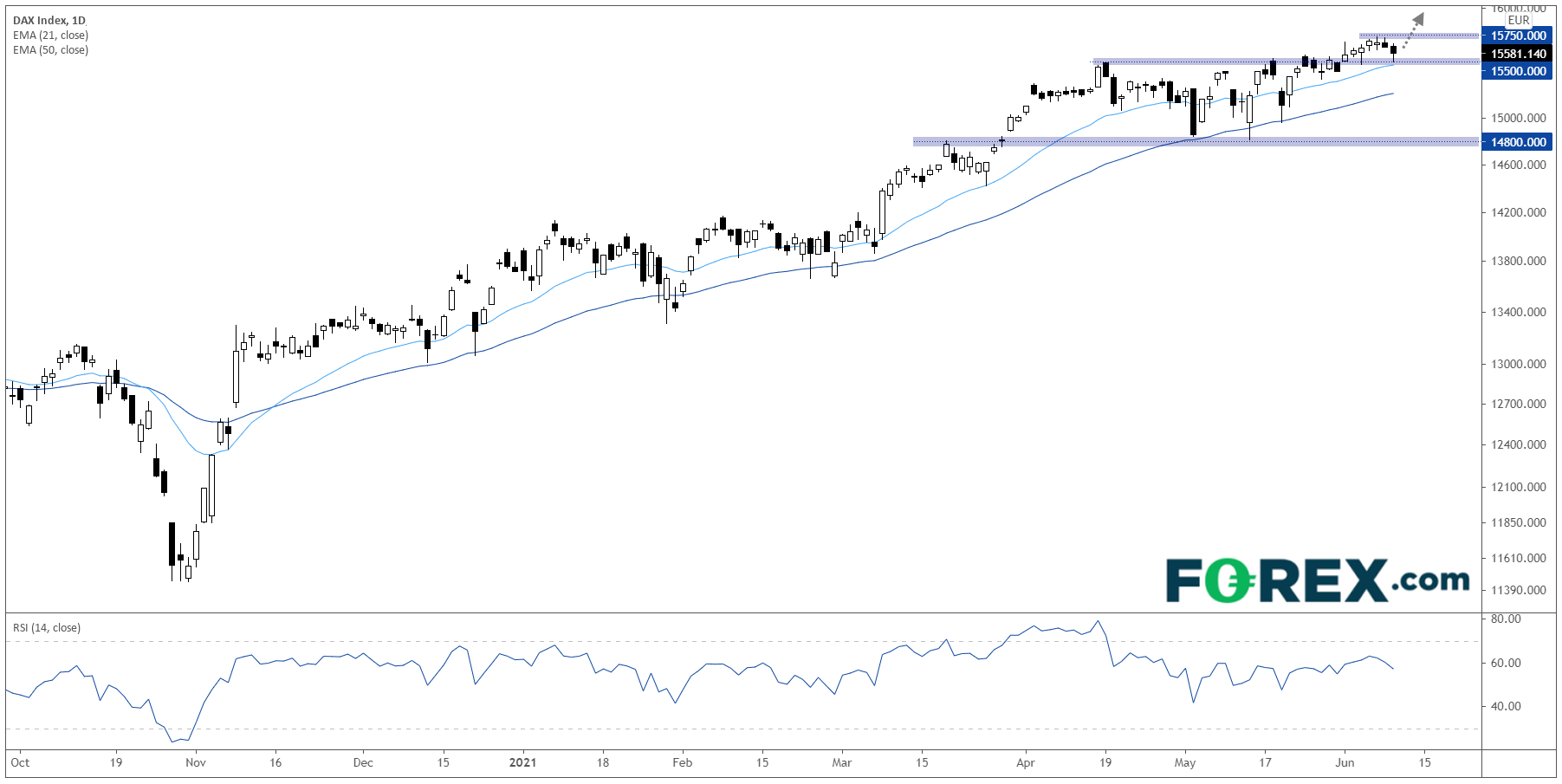

DAX Technical Analysis

- Medium-term trend: Up

- Key support: 15,500

- Key resistance: 15,750

- Near-term technical bias: Bullish

In contrast, Germany’s benchmark bourse—DAX—is clearly in the strongest technical position of the major indices. The DAX set a fresh record high just last week and pulled back to bounce off previous-resistance-turned-support at 15,500 in yesterday's trade, signaling that the breakout is more likely legitimate.

The RSI is not in overbought territory, signaling the potential for more upside in the short-term as long as the key 15,500 level holds.

FTSE 100 Technical Analysis

- Medium-term trend: Up

- Key support: 6,800

- Key resistance: 7,150

- Near-term technical bias: Bullish

Looking at its chart, the UK’s FTSE 100 index is a middle-of-the-road amalgamation of the other indices we’ve examined so far. The medium-term trend is clearly still bullish, with prices holding above their upward-trending 21- and 50-day EMAs and the RSI indicator consolidating after touching overbought territory last month.

As with the Dow, the month-to-date sideways consolidation should be viewed as a healthy development for the longer-term trend, unless near-term support in the 7,000 is broken. A strong breakout above 7,150, though, would strengthen the bullish case for a retest of record highs in the upper-7,000s later this year.