Asian stock indices retreated from their record levels on Monday, indicating cautious profit-taking and a pause in growth. However, it is worth paying attention to the very serious overbought conditions in the markets, which gives us a cautious view.

Last Friday, the US published a relatively weak labour jobs report. However, it failed to generate a meaningful sell-off in the markets as investors were encouraged by the legislators' greater desire to provide stimulus.

The president-elect Biden is considering giving out $1200 to Americans and economists see the sluggish labour market report as an excuse for the Fed to increase its QE programme later this month.

The stock market steadily added in November on the news about progress with the vaccine, which the market sees as a positive signal. However, at the end of last week, the growth momentum was driven by fundamentally bad news that spurred hopes for more support from the government and the central bank.

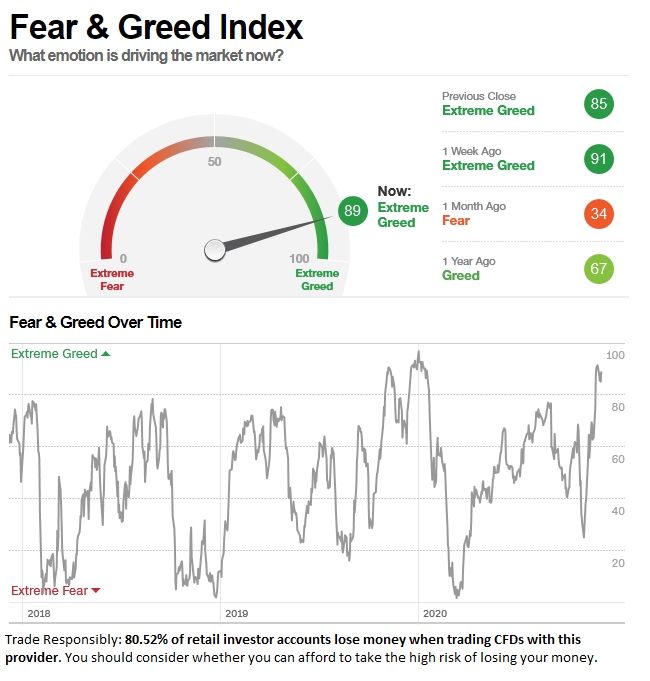

The Greed and Fear Index monitored by CNN is in the "extreme greed" mode at 89, having been at 91 a week earlier. These are very high levels that we last saw at the end of 2019 and in the first month of 2020.

The seasonality is now on the bull's side. Often at the end of the year, there are prevailing trends to fix losses to optimise taxes. At the same time, profitable strategies can generate new money. As in the previous year, the bullish sentiment may prevail until the end of January, reflecting the very extreme greed.

This is all the more so due to expectations of new support packages, which had been effectively pulling up stocks and commodity prices earlier this year, may now become the driver in the coming weeks.

At the same time, optimists should bear in mind that buying assets in the hope of freshly printed money is a perilous strategy. Supporting the economy only covers some of the needs and lightens the recession, but does not reverse it completely.

It is difficult to predict precisely when markets will pull back on lack of optimism. However, it may well turn out that most assets are already sufficiently overbought for mid-term investors, and the yields/risk ratio is not in favour of new buyers this time around.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bullish Sentiment Dominates, But For How Long?

Published 12/07/2020, 06:58 AM

Updated 03/21/2024, 07:45 AM

Bullish Sentiment Dominates, But For How Long?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.