- Stocks plunged 10% since mid-August

- Unsettling CPI data and a worrisome FedEx earnings pre-announcement

- Positive seasonality begins over the coming weeks

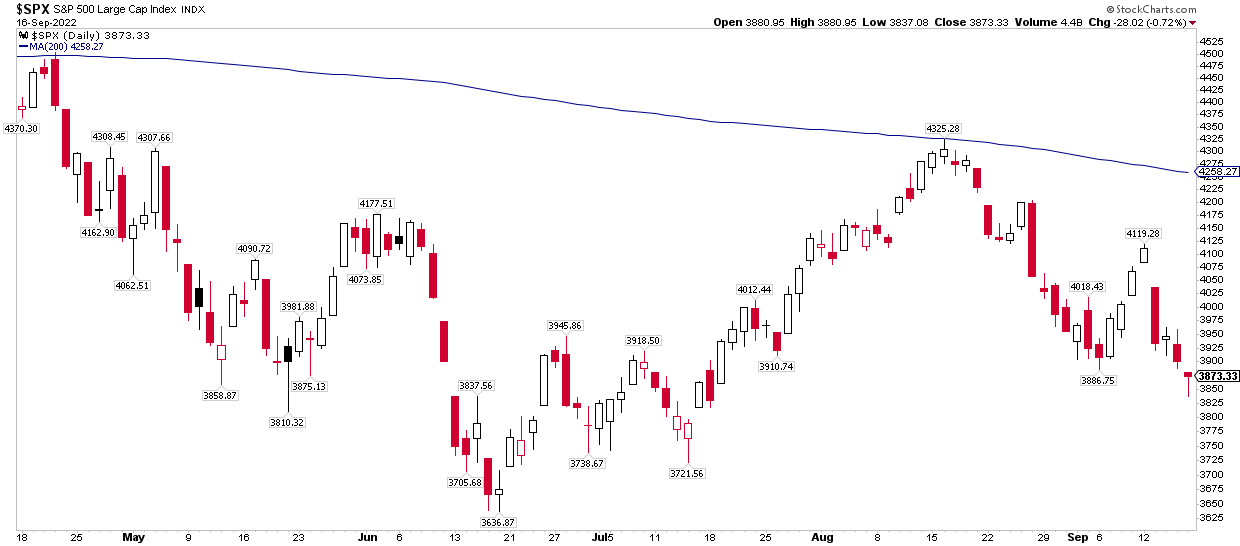

It was the best of times; it was the worst of times. That’s about how it has gone for the stock market in the last few months. The S&P 500 rose nearly 20% off its mid-June low to peak at its 200-day moving average during the middle of August. A trio of upbeat narratives permeated markets back then.

For starters, second-quarter corporate earnings verified much better than analysts had expected, and guidance was not too bleak, in aggregate, for the balance of the year. Then came the July jobs report which showed stellar employment gains—of course, that came with the side item of inflationary risks. Finally, those jitters were simmered when a cooler-than-expected July CPI report hit the tape back on Aug. 10. The SPX peaked at 4325 on Aug. 16.

S&P 500: Lowest In Nearly Two Months

Source: Stockcharts.com

Equities have cratered 10% from that rebound high, though. A painful message from U.S. Federal Reserve Chair Powell at Jackson Hole late last month was followed by a respectable nonfarm payrolls report earlier in September, but the bears really roared in wake of a hotter-than-expected August core CPI print.

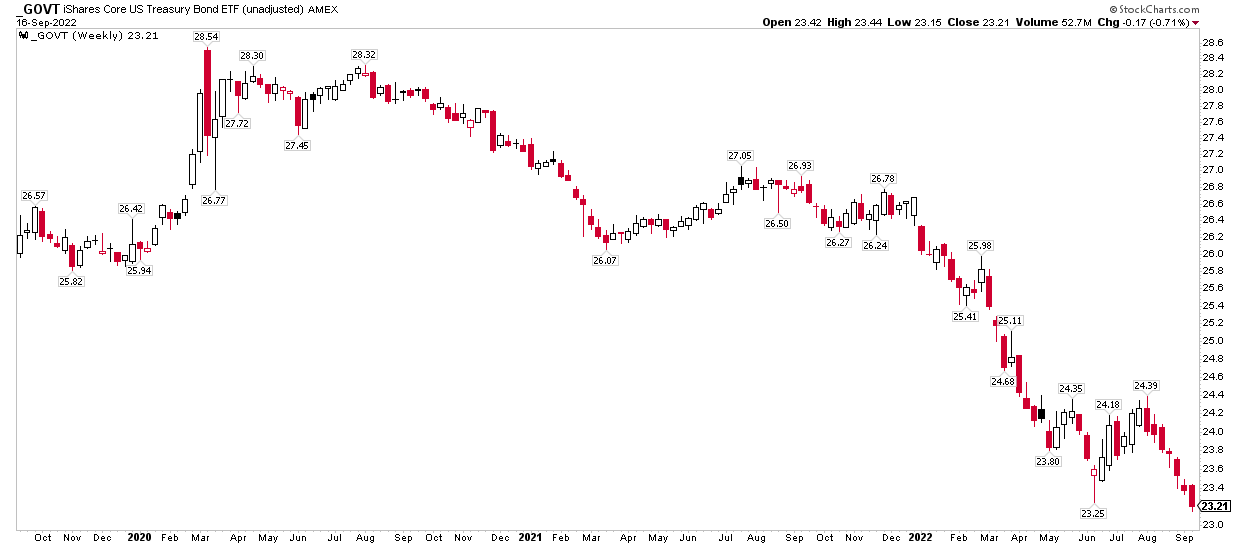

Large consumer price increases for the previous month stoked renewed inflation fears, helping to spark a cascade of selling in both the equity and fixed-income markets. The S&P 500 dipped to 3837 last Friday while the U.S. Treasury market notched fresh 30-month lows, as measured by the iShares U.S. Treasury Bond ETF (GOVT).

Treasury Bear Market Continues

Source: Stockcharts.com

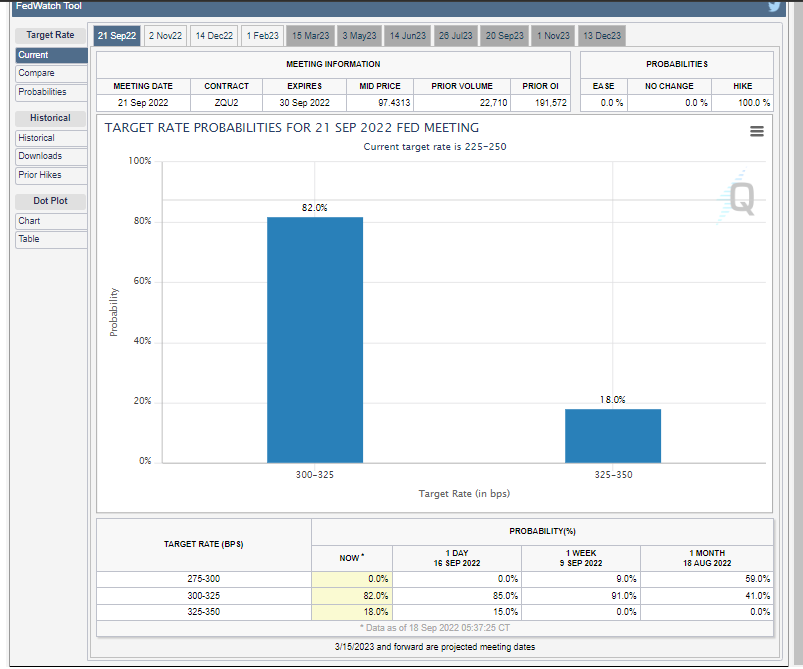

All eyes are now focused on the Fed. The market expects a 0.75 percentage point rate hike, but a full 1 percent increase cannot be ruled out. Bond traders have priced in about a one-in-five chance of a full percentage point hike while the terminal rate is seen as peaking near 4.5% by April next year.

Fed Rate Hike Probabilities

Source: CME Group

Meanwhile, the strength of corporate earnings is now much more in jeopardy following a bearish pre-announcement from Industrials-sector stalwart FedEx (NYSE:FDX) that sent its stock to the worst daily drop for the transports name since at least 1980. The third-quarter earnings season does not unofficially begin until the banks start reporting during the middle of October.

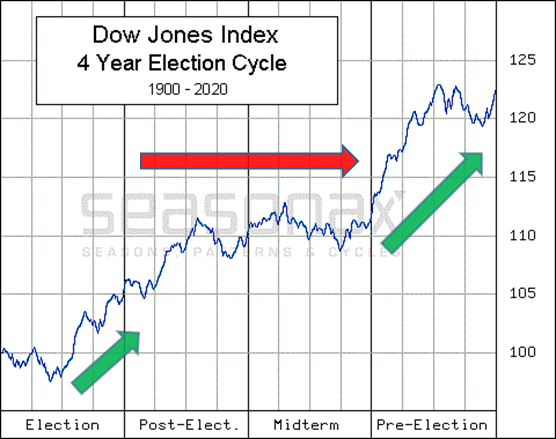

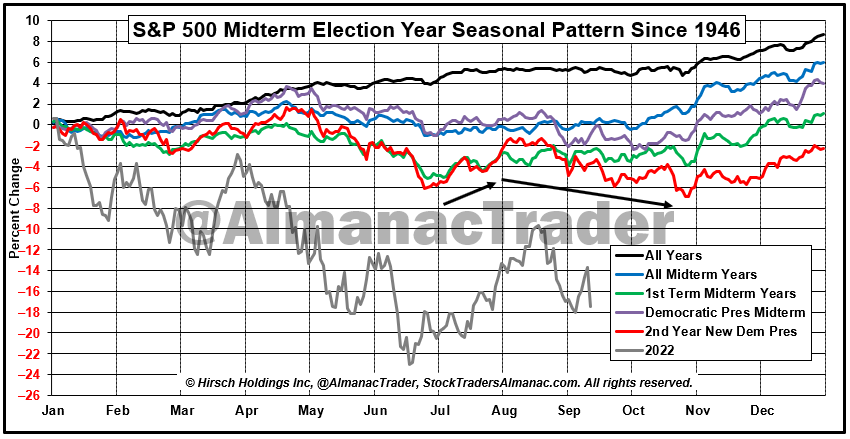

The good news for the bulls (and most investors who are unsettled with steep year-to-date declines on their brokerage statements)? Seasonality is about to turn from a headwind to a major tailwind.

As a technician, I recognize that seasonal trends should come second to price action. For example, if stocks are trending down, then that is a bigger factor to weigh than a historically bullish part of the calendar. Still, one cannot help but acknowledge that the fourth quarter of a mid-term election year has been the best time to get overweight stocks when looking out several quarters.

Fasten Your Seatbelts for Upward Price Action?

Source: Seasonax

Jeff Hirsch was kind enough to share with me the updated seasonal perspective on the S&P 500 through Sept. 13. My interpretation is that there could be more pain for the next few weeks, but all seasonal signs point to a rebound shortly before the Nov. 8 elections.

Mid-Term Year Weakness Through Early Q4

Source: Stock Trader's Almanac

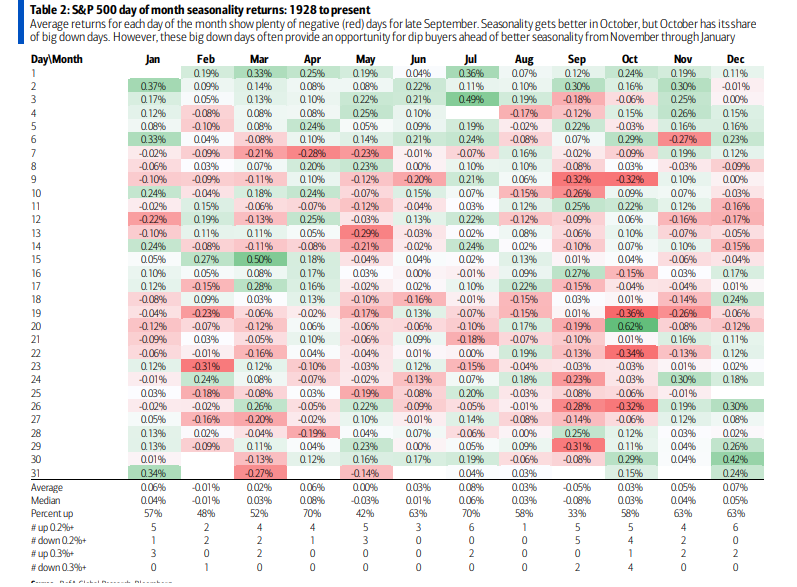

Very near-term, the final 10 trading days of September are often very weak, according to research from BofA’s Stephen Suttmeier, using S&P 500 price data going back to 1928.

Final Third of September Fraught with Risk

Source: Bank of America Global Research

The Bottom Line

After yet another options-expiration week drubbing, I expect more bearish risks to come over the near term. There’s light at the end of the tunnel, however. Seasonality turns bullish ahead of the U.S. mid-term elections through much of the pre-election year.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.