Big retailers were edging out smaller competitors for decades and the pandemic-induced shopping environment helped cement their standing as they push deeper into e-commerce and delivery. Walmart (NYSE:WMT) Inc. WMT posted a banner year in 2020 and its outlook remains strong. Now, its year-long underperformance could make for an enticing entry point into the world's largest retailer.

Looking to the Future

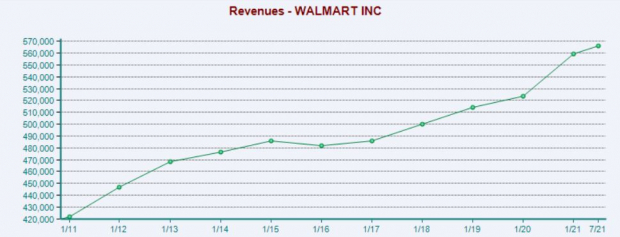

Walmart’s revenue climbed 7% last year (its fiscal 2021), while its comparable sales climbed 9%. Expanded delivery and various pick-up options helped drive 80% e-commerce growth. In an effort to directly challenge Amazon’s AMZN popular Prime service, which includes many delivery perks, WMT launched last fall its own subscription service dubbed Walmart+.

The service costs $98 a year ($12.95/month) and offers free deliveries, discounts on fuel, access to new-age in-store checkout offerings, and more. The subscription service reached roughly 32 million U.S. households in one year, according to a recent Deutsche Bank (DE:DBKGn) report.

Walmart is also focused on landing partnerships with up and coming and digital native retailers. This includes teaming up with secondhand e-commerce clothing firm ThredUp, partnering with Shopify (NYSE:SHOP) SHOP to bring more small businesses to its own third-party marketplace, and more.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

On top of that, WMT is set to benefit from the booming digital advertising industry, as more dollars shift away from legacy media. Google GOOGL and Facebook (NASDAQ:FB) FB still grab a lion’s share of the digital advertising market, but as more online searches begin on e-commerce sites, the money is following. Amazon and Walmart both have growing digital ad units, with WMT’s high-margin ad business on track to be a multi-billion-dollar-a-year segment in short order.

WMT has spent and partnered with fintech firms to improve its own in-house financial services offerings. The company is also slowly building out its telehealth services around the country to complement its in-person Walmart Health centers.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Other Fundamentals

Walmart, like Target TGT, Costco COST, and other big-box retailers, posted its strongest performance in years in 2020. Despite the tough comparisons, Zacks estimates call for WMT’s revenue to climb another 1% this year and 2.2% higher next year to reach $578 billion. Both of these mark improvements from earlier estimates.

At the bottom end, its adjusted earnings are projected to jump 16% and 5%, respectively during this same stretch. WMT topped our EPS estimate by 14% last quarter and 39% in Q1. The company’s overall earnings outlook has improved recently to help it grab a Zacks Rank #1 (Strong Buy).

WMT lands a “B” grade for Growth in our Style Scores system and its Retail – Supermarkets space is in the top 11% of over 250 Zacks industries at the moment. This showcases broader positivity heading into the vital holiday shopping season, even with supply chain worries and pricing concerns. And August’s consumer spending data pointed to a strong and resilient U.S. consumer sector.

Wall Street analysts are bullish on Walmart, with 12 of the 19 brokerage recommendations Zacks has at “Strong Buys.” Three more recommendations are “Buys” and none come in below a “Hold.” And its 1.59% dividend yield edges out the recently-rising 10-year U.S. Treasury and the S&P 500’s 1.30%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

With these fundamentals, some investors might be surprised to know that WMT has lagged far behind the market in the past 12 months, down around 4% compared to the benchmark index’s 26% climb. The downturn is part of a broader sector-wide pullback after a surge off the coronavirus lows.

Walmart has also experienced a rather up and down stretch in 2021 and it closed regular hours Wednesday roughly 9% below its records. WMT sold off heavily after its Q2 release as investors took profits and speculated how the delta variant and other headwinds would impact pricing and the holiday season.

WMT shares have still outclimbed its sector in the last five years and just barely lagged behind the benchmark—mostly due to its recent performance. The drop has Walmart trading near its year-long lows at 21.3X forward earnings, which marks over a 20% discount to its sector.

Therefore, investors with long-term outlooks might want to consider scooping up the retail titan at what appears to be a solid entry point.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (NASDAQ:AMZN): Free Stock Analysis Report

Target Corporation (NYSE:TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Costco Wholesale Corporation (NASDAQ:COST): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (NASDAQ:GOOGL): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

To read this article on Zacks.com click here.