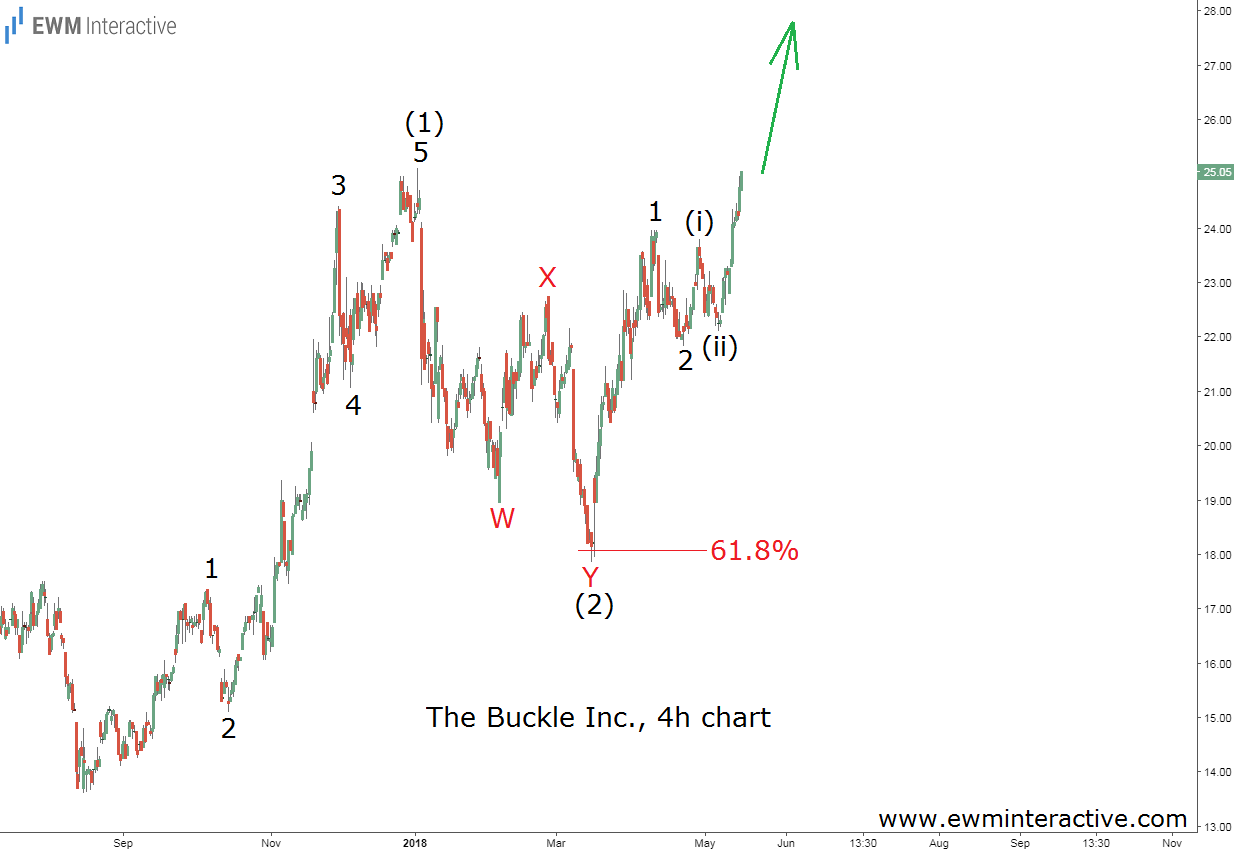

Two months ago, on March 15th, we published an Elliott Wave analysis of The Buckle Inc (NYSE:BKE), saying that “the stage is set for a surge.” At the time of writing, the stock was barely holding above the $18 mark after a decline of nearly 30%. But instead of joining the bears, we thought that was a buying opportunity, because of the perfect 5-3 wave cycle we found on the 4-hour chart of the stock shown below.

A five-wave impulse, followed by a W-X-Y double zigzag correction meant the price should be expected to move in the direction of the impulsive sequence. In addition, the 61.8% Fibonacci level could be relied on to act as support and discourage the bears. The very next day, on March 16th, The Buckle reported its financial results for the full fiscal 2018. Obviously, investors liked what they saw, because two months later Buckle stock is hovering around $25 a share.

The Buckle stock jumped from $17.85 to $25.05 for a total gain of 40.3%, while the S&P 500 has returned -1.3% during the same period. Judging from the updated chart above, the bulls are not done yet. It looks like wave 3 of (3) is going to lift the share price even higher. The company is expected to report earnings for the first quarter of fiscal 2019 on May 25th. If this count is correct, the market is already anticipating good news from this apparel retailer. $30 a share sounds like a reasonable first target from now on.

Disclosure: The author holds a long position in BKE stock.