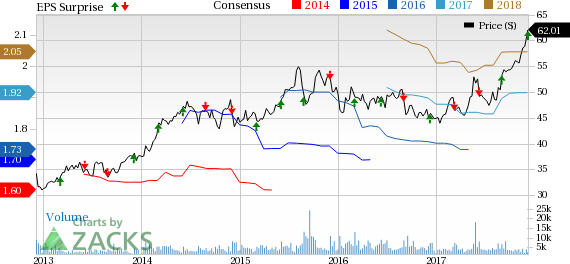

Brown-Forman Corporation BF.B delivered robust second-quarter fiscal 2018, wherein both earnings and sales topped estimates. This marked the company’s second straight quarter of earnings beat. Adjusted earnings of 62 cents jumped nearly 23% and surpassed the Zacks Consensus Estimate of 53 cents.

Net sales improved about 10% year over year to $914 million, after deducting excise taxes. However, on an underlying basis (excluding negative currency impact and other adjustments), sales increased 8% that marked the fifth straight quarterly growth. Moreover, the company’s sales, before accounting for excise taxes, came in at $1,166 million, up 11% from the prior-year figure of $1,055 million. The Zacks Consensus Estimate was pegged at $867.8 million.

The company’s robust underlying sales performance can be attributed to persistent momentum in its focus categories and strength in Jack Daniel’s, Woodford Reserve, Old Forester and Herradura brand families. Further, net sales gained from improved economies in the emerging markets.

Brown-Forman rose nearly 1.6% in the pre-market trading session following the earnings release. However, Brown-Forman shares have gained 14.3% in the last three months, against the industry’s decline of 0.1%.

Quarter in Detail

Brown-Forman’s gross profit increased nearly 11% to $610 million, while gross margin expanded 20 basis points (bps) to 66.7%. However, underlying gross profit improved 8%.

Selling, general and administrative (SG&A) expenses remained flat from the year-ago quarter at $163 million, while on an underlying basis it declined 1%. This was primarily backed by stringent cost controls.

However, advertising expenses rose 4% year over year to $111 million, while underlying advertising costs increased 3%. The rise in advertising costs can be attributed to rise in investments for the Jack Daniels family of brands and further growth of the fast growing bourbon and tequila brands.

Nevertheless, operating income grew 19% to $346 million, with operating margin expanding 280 bps to 37.9%. On an underlying basis, operating income of this Zacks Rank #2 (Buy) company increased 16%.

Balance Sheet & Cash Flow

Brown-Forman ended the quarter with cash and cash equivalents of $212 million, long-term debt of $1,719 million and total debt of $1,954 million. The company’s total shareholders’ equity was $1,647 million as of Oct 31, 2017.

In first-half fiscal 2018, the company generated $214 million cash from operating activities.

On Nov 16, 2017, the company declared a regular quarterly dividend of 19.75 cents per share on Class A and Class B shares, reflecting an 8.2% increase from the previous dividend rate. This results in annualized dividend rate of 79 cents per share. The raised dividend is payable on Jan 2, 2018, to shareholders on record as of Dec 7, 2017.

Fiscal 2018 Guidance

While the global economic environment has improved modestly, the company anticipates continued volatility in the emerging markets. Further, the company notes that competition has intensified in the developed economies, which can hinder results.

However, the company remains confident of persistent growth in the second half of fiscal 2018 and consequently raised guidance.

Management now projects 6-7% growth in underlying sales. Earlier, the company had forecasted underlying sales growth of 4-5%.

Nevertheless, the company expects the positive operating leverage experienced in the first-half to reverse in the second half. The reversal will stem from higher cost of sales and increased operating investments in the second half mainly related to the favorable environment for the company’s brands.

Consequently, the company expects a moderate increase in SG&A expense on an underlying basis. Further, underlying A&P growth is anticipated to be nearly in line with sales growth.

Despite incorporating higher costs, underlying operating income is anticipated to increase 8-9% in fiscal 2018, compared with 6-8% growth expected earlier. Further, the company now estimates earnings per share in the range of $1.90-$1.98, compared with the previous guidance of $1.85-$1.95.

Other Stocks to Consider

Other top-ranked stocks in the same industry are Boston Beer Co. Inc. (NYSE:SAM) , sporting a Zacks Rank #1 (Strong Buy), Constellation Brands Inc. (NYSE:STZ) and Craft Brew Alliance, Inc. (NASDAQ:BREW) , both carrying Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Boston Beer has jumped nearly 24.1% in the last three months. Further, the company has a long-term earnings growth rate of 5%.

Constellation Brands has gained nearly 7.2% in three months. Moreover, it has a long-term earnings growth rate of 18.4%.

Craft Brew Alliance has surged 13.7% in the last three months. Further, the company has a VGM Score of A.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Brown Forman Corporation (BF.B): Free Stock Analysis Report

Constellation Brands Inc (STZ): Free Stock Analysis Report

Craft Brew Alliance, Inc. (BREW): Free Stock Analysis Report

Boston Beer Company, Inc. (The) (SAM): Free Stock Analysis Report

Original post

Zacks Investment Research