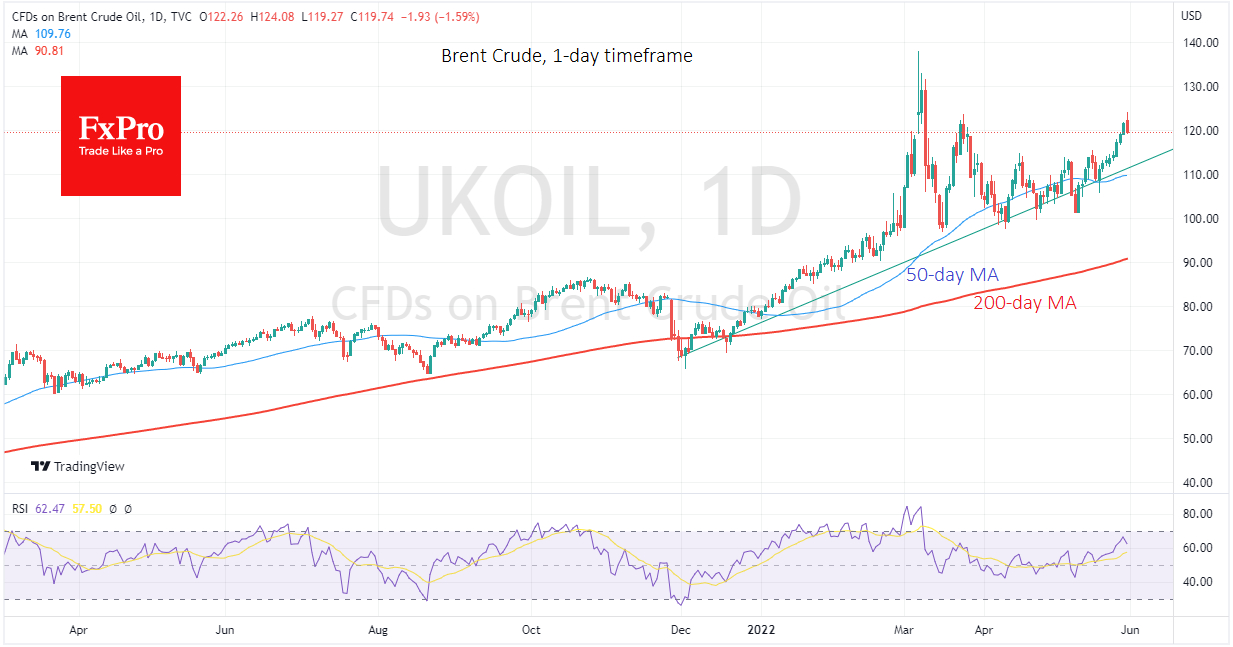

Brent spot prices were approaching $120 earlier today on news that the EU managed to agree on an immediate embargo on 2/3 of oil imports from Russia. We saw oil trading above current levels for just a couple of days in March.

Over the last four days, as discussions on the ban on oil imports have continued, its price has risen by more than 7%, and much of the news may already have been priced in.

Current levels are at a considerable distance from the highs of 2008 at $146 and below the peaks of 2011 and 2012 when they briefly went above $126. However, from a historical perspective, prices are close to unsustainably high levels.

Already, high energy costs are causing a decline in retail consumption in Europe and the US, the world’s wealthiest regions. No doubt developing countries are experiencing an even more significant slowdown in their economies because of prevailing high fuel prices.

Oil is susceptible to fluctuations in supply and demand. Hence, a shift in the balance of supply and demand by a couple of percent sometimes triggers movements of tens of percent, as happened more than once in the past decade.

The high cost of fuel is already causing a reduction in consumption, which, combined with higher quotas in OPEC+, will shift the balance towards the buyers in the coming months.

From current levels, we would venture to guess that oil has minimal short-term upside potential to bounce back from the news emotionally. A prolonged lull could follow, with movement in the $100-120/bbl range until the end of the year, during which time demand and supply will adjust to the new reality.

The longer-term prospects remain an open question. The chances are now roughly equal that the oil market at levels near $120 remains at the foot of an extended multi-year rally or is ready to repeat the collapse of 2014 or 2008.