Crude oil prices dropped again but are now trying to recover. On Monday, Brent is crawling up to 79.80 USD. The situation in the market supports buyers. On the one hand, investors enjoy the weak dollar, buying crude oil efficiently. When the USD dropped, oil became more affordable.

On the other hand, there is some good news – for example, the US Minister of Energy announced a test purchase of 3 million barrels of crude oil by a new scheme using fixed price contracts. This purchase was meant for the US SPR, and it is the first one after mass sales of oil reserves, which is a great signal for the oil sector.

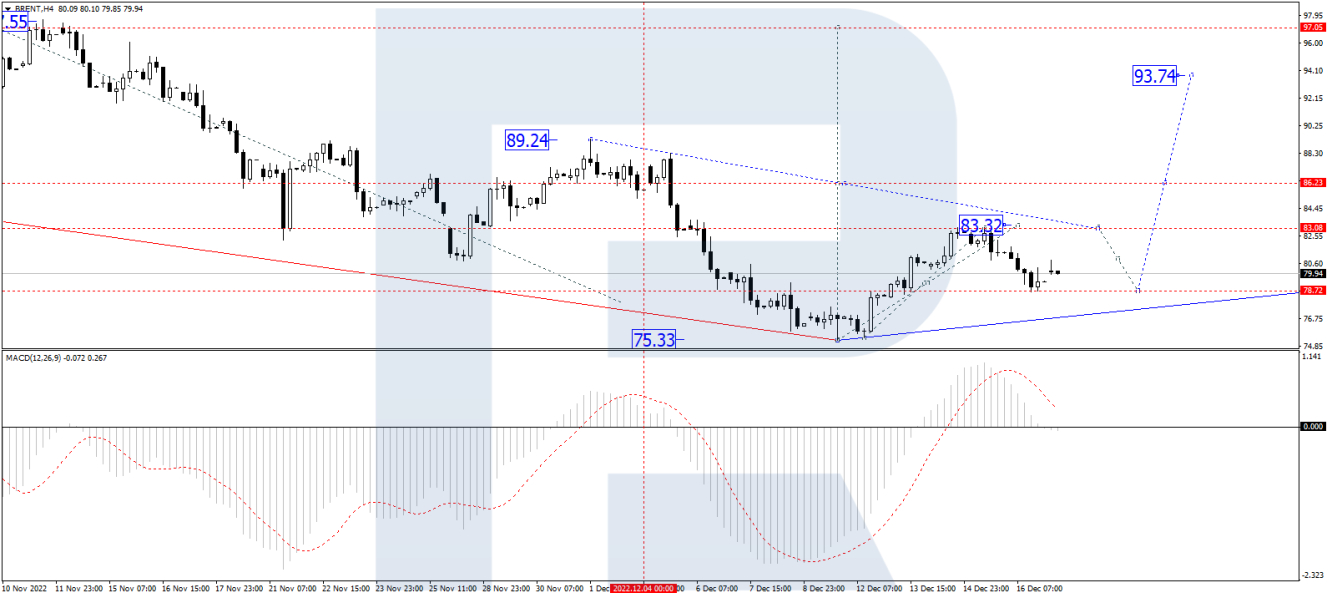

In H4, Brent corrected to 78.78. Today it might grow to 86.25. With a breakaway of this level, a pathway to 93.73 will open. The goal is local. Technically, this scenario is confirmed by the MACD: its signal line is heading for zero and is likely to bounce off it upwards and aim at new highs.

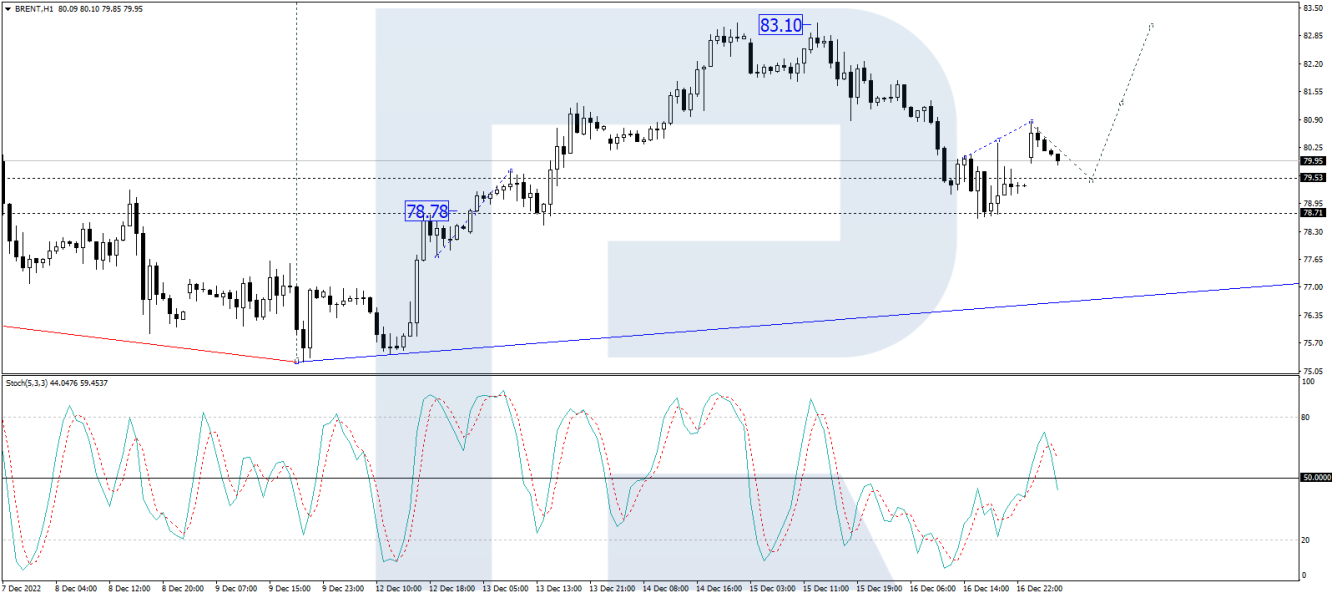

On H1, Brent has formed a correctional structure of 78.78. Today another impulse of growth to 80.86 is expected. A link of correction to 79.55 is not excluded, followed by growth to 86.30. After it is reached, a new consolidation range should form. The Stochastic confirms the scenario: its signal line is above 50, and growth to 80 is expected.

Disclaimer: Any forecasts contained herein are based on the author's opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews.