Last week marked the official start of autumn—or so we’re told. Here in San Antonio, the daytime high temperatures are still hovering in the mid-90s.

The week also felt like a huge pivotal shift in global central banks’ fight against sticky price inflation. Monetary policymakers added 350 basis points (bps) in rate hikes, bringing the total amount of hikes in the world’s top 10 largest economies to a massive ~2,000 bps so far this cycle, according to Reuters. The single holdout is Japan, which is still facing only moderate inflation of under 3%.

Central banks aren’t close to being done, of course. The Federal Reserve projects that the U.S. rate will be 4.4% by year-end, before peaking at 4.6% in 2023. Some macro research firms believe we’ll see 5%.

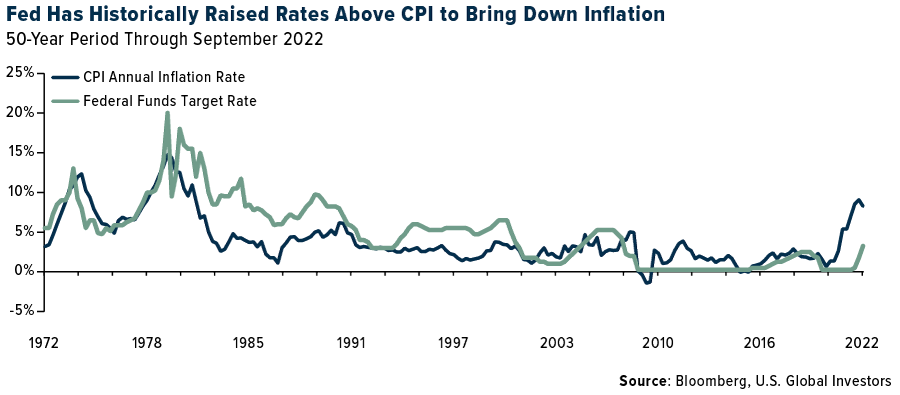

The question is: Will this even have an effect on inflation? The Fed has historically had to raise rates well above the annual consumer price index (CPI) to make a difference, but that’s been a tall order for Jerome Powell, whose starting point was essentially 0%.

Will Higher Rates Trigger A Recession?

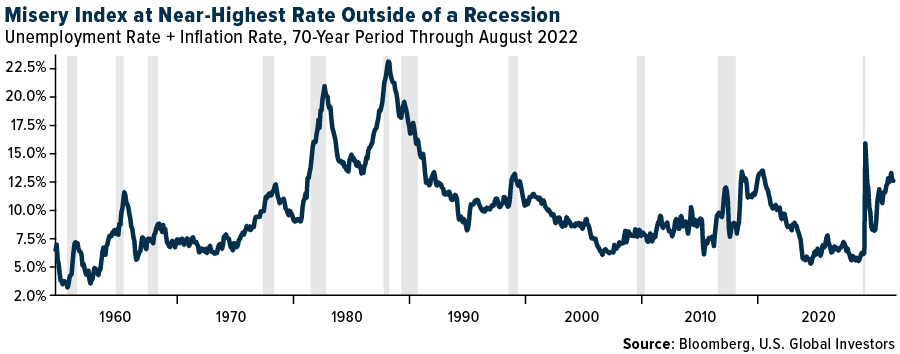

The risk is that the Fed’s medicine could be ineffective yet come with serious side-effects. It’s possible that current rate hikes won’t be enough to bring down inflation, but they may be enough to trigger a recession. Then we’re dealing with stagflation, the toxic combination between rising prices and rising unemployment. The next CPI report is scheduled to be released on October 13, and I’m hopeful we’ll see that inflation continue to slow.

Below is the so-called Misery Index, which adds together the monthly unemployment rate and monthly inflation rate. We haven’t reached 1970s levels yet, but the trend is clearly going in the wrong direction. If we’re not in a recession already, this may be as close to being the highest level outside of an economic pullback as we’ve ever seen.

Cash Is King, But Bonds Also Look Attractive

With a recession potentially making landfall, and the S&P 500 slipping a further 4.7% last week, investors may wonder what their next move should be. Perhaps making no move is the best path forward, for now. It’s often said that cash is king in recessions, and today may be no exception. The Bloomberg Dollar Spot Index (NYSE:USDU) has advanced more than 14% so far in 2022, compared to the S&P 500, which has declined 22%, wiping out the past two years.

Government bonds are also having one of their worst years in recent memory. The iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY), the largest such ETF with over $26 billion in assets, is currently down 4.4% for the year. This puts SHY on pace for its worst year in its 20-year history.

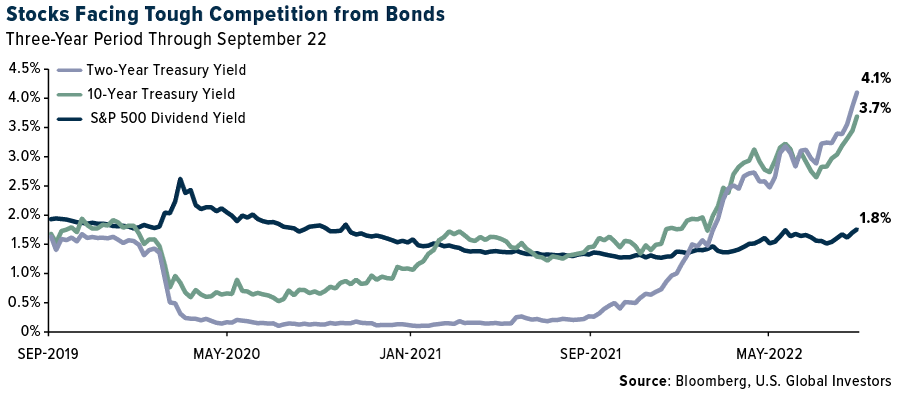

And yet if you know anything about bonds, it’s that as prices drop, yields rise. For this reason, Treasury bonds are starting to look like a possible buy again. The yield on the 10-year bond has climbed to nearly 3.7%, its highest since 2011, while 2-year paper is trading with a yield as high as 4.1%, a level last seen in 2007. In both cases, that’s well above the S&P 500 dividend yield.

I should pause to point out that the spread between the short-term yield and long-term yield is now at its most pronounced since 2000, around the time of the tech bubble. This inversion indicates that investors are becoming more pessimistic of the U.S. economy over the next two years. What’s more, since 1955, every yield curve inversion has been followed by a recession in the subsequent months.

A Case For Optimism

Having said all that, I still urge readers to remain optimistic, even though nearly every sign points to further economic and financial pain.

There are many misconceptions about optimism, by the way. Some people maintain it’s the belief that only good things will happen. Others believe you have to be naïve to express optimism, or that only extraordinarily happy people can be optimistic.

I don’t think any of those things. I believe optimism is simply the acknowledgement that, while there may be setbacks along the way, some of them major, the odds of things working out in the end increase over time.

A perfect analogy is the stock market. Huge selloffs like the one we’re witnessing at the moment warp some people’s attitudes about investing. They see that the S&P is in correction territory and may conclude that investing is too risky. The reality is that stocks have been up three out of every four years, historically speaking.

I’ve been in the game for decades, and one of the most important lessons I’ve learned is that an optimistic attitude helps you identify opportunities where a pessimist may see only risks. There are always going to be risks, as we all know. Sometimes it’s best to avoid the risk altogether. Other times, taking on the risk dramatically increases your odds of achieving rewards beyond your wildest dreams.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Bloomberg Dollar Spot Index tracks the performance of a basket of ten leading global currencies versus the US dollar. Each currency in the basket and its weight is determined annually based on their share of international trade and FX liquidity. The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The dividend yield is a financial ratio that tells you the percentage of a company’s share price that it pays out in dividends each year. A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.