The euro posted strong losses on the day as the ECB’s monetary policy meeting saw Mario Draghi announcing an end to QE in December 2018. While the current QE at the pace of 30 billion euro is expected to run until September, a reduced amount of 15 billion euro is expected to continue until December.

Draghi however ruled out an interest rate hike any time soon which led to the declines in the common currency. The U.S. dollar was also seen trading stronger as economic data showed that retail sales increased 0.8% on the month while core retail sales increased 0.9% on the month, beating estimates by a strong margin.

Following the BoJ’s monetary policy decision, the economic calendar is relatively quiet for the remainder of the day. Data from the Eurozone is expected to show the final inflation figures while in the U.S. trading session, the Empire state manufacturing index is expected to be released.

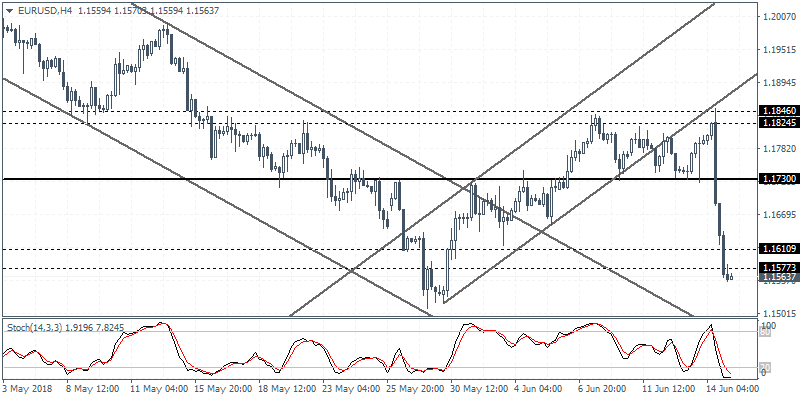

EUR/USD intra-day analysis

EUR/USD (1.1563): The EUR/USD currency pair posted strong losses on the day as price action was seen drifting lower to the previous support formed at 1.1577. The break down below this level is expected to see either the currency pair posting further losses, or a potential rebound in the making. Still, unless the EUR/USD closes back above the 1.1610 level of support, we expect to see the currency pair staying weak. Near term resistance at 1.1730 is expected to keep the EUR/USD currency pair trading sideways.

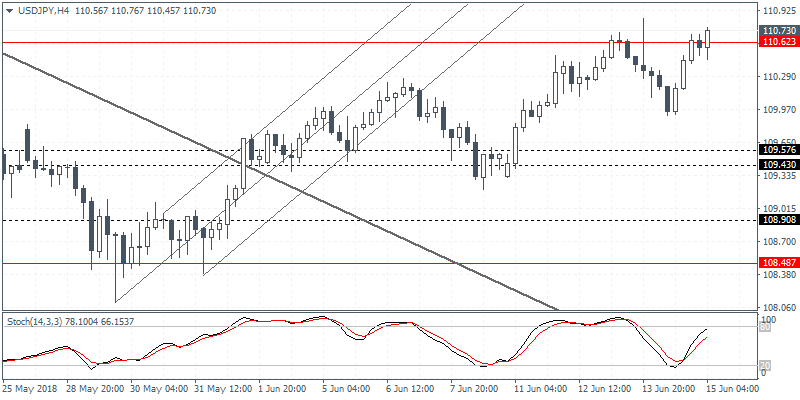

USD/JPY intra-day analysis

USD/JPY (110.73): The USD/JPY currency pair was seen reclaiming the resistance level at 110.62. Price action is however showing signs of exhaustion unless there is a clear breakout above this level. To the upside, the next main target comes near 111.20 level. To the downside, in the event of a reversal, we can expect the USD/JPY currency pair to drift lower to testing the support at 109.57 - 109.43 region.

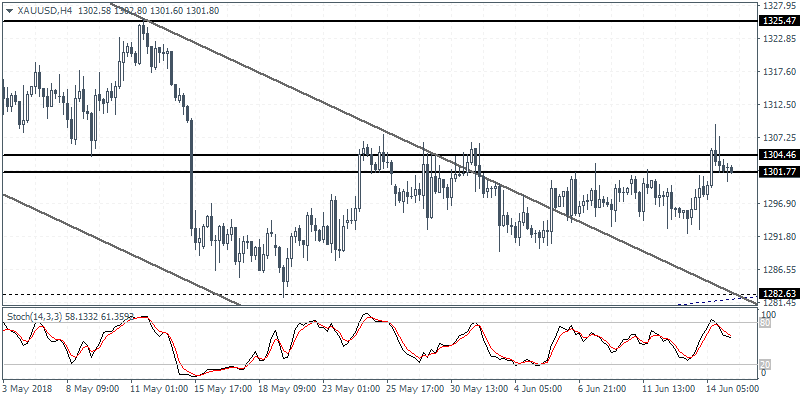

XAU/USD intra-day analysis

XAU/USD (1301.80): Gold prices posted modest gains but price action is seen stuck near the resistance level of 1304 - 1301 region. This potentially points to a decline in price action. The lower support at 1282 remains a likely downside target. However, gold prices could remain range bound within the mentioned levels for a considerable period of time. The sideways price action also indicates that gold prices might be forming a bottom. A breakout above 1304 and a potential retest of this level to establish support could confirm the upside in gold prices.