The U.S. dollar posted gains on Wednesday. Economic data on the day showed that German factory orders fell 1.6% on the month missing estimates of a 0.3% decline. Revisions to the previous month's report showed an upward revision of a 0.2% decline from 1.0% decline previously reported.

Canada's building permits rose 6.0% on the month beating estimates of a 0.9% decline and extended gains from a revised 2.1% increase from the month before. The Ivey PMI fell to 54.7 from 59.7 previously missing estimates by a substantial margin.

In the U.S., the trade balance figures showed that the trade deficit narrowed in December to 49.3 billion. However, this was below estimates.

Mixed Data

The overnight trading session saw the New Zealand quarterly employment report coming out. Data showed that the labor market reversed most of the gains made from the third quarter of 2018.

New Zealand's unemployment rate rose to 4.3% in the fourth quarter following a revised unemployment rate of 4.0% in the previous quarter. The quarterly employment change rose just 0.1%.

Later in the night, Fed Chair, Jerome Powell was speaking. In his speech, Powell said that the U.S. economy was now in a good place. Powell, however, did not make any direct references to monetary policy.

The European session starts off with the release of the German industrial production figures. Forecasts show that industrial production increased 0.8%, reversing some of the declines in activity from the month before.

The ECB will be releasing its economic bulletin. Investors will be looking into the assessment of the central bank on the Eurozone's economy and inflation forecasts.

The Bank of England will be holding its monetary policy meeting today. No changes are expected to the interest rates, but the Bank of England is likely to take a hawkish stance signaling a rate hike soon. The NY trading session is relatively quiet today.

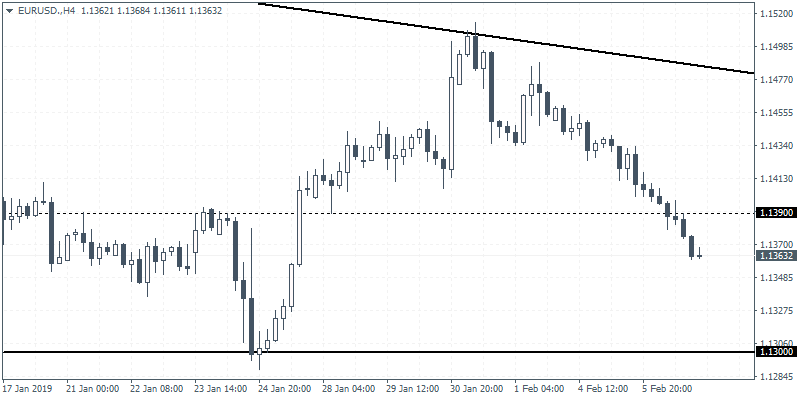

EUR/USD Intraday Analysis

EUR/USD (1.1363): The EUR/USD currency pair closed bearish for the third consecutive day. Price action broke past the support at 1.1390 level and might retest the January 24 lows at 1.1300 potentially. Establishing support at this previous low could stall the declines for the moment. However, a break down below 1.1300 level could see the EUR/USD extending the declines even lower. In the near term, the breached support at 1.1390 could be tested for resistance on a rebound.

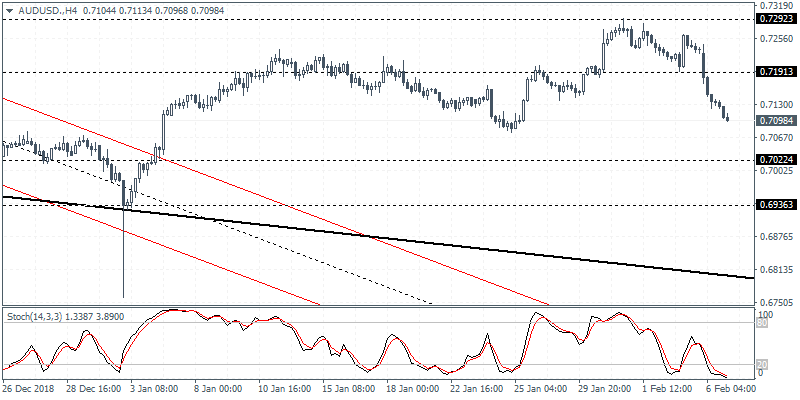

AUD/USD Intraday Analysis

AUD/USD (0.7098): The Australian dollar extended the declines after price action broke past the lower support at 0.7191. The drops came after a brief period of consolidation between 0.7191 and 0.7292 levels of support and resistance respectively. The recent break down below the support could now see the Australian dollar extending the declines lower to test the support at 0.7022. A retest of this level to establish support could potentially mark the downside correction in prices. Alternately, any short term recovery in price could see the AUDUSD retesting the breached support level at 0.7191 to establish resistance.

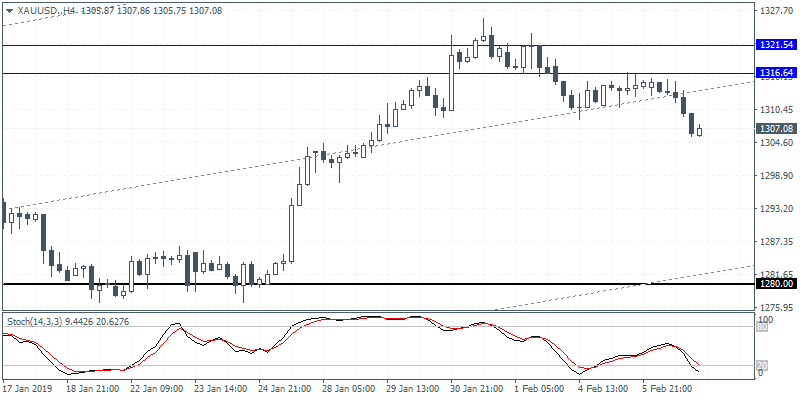

XAU/USD Intraday Analysis

XAU/USD (1307.08): Gold prices closed bearish on Wednesday with price action extending the declines following a brief period of consolidation just below the resistance level of 1316 level. In the short term, a reversal could send gold prices to retest the previously held lows at 1310.25. As long as this level holds out as resistance, we could expect gold prices to test the next support that could be formed at 1303.05. The longer-term downside target in gold remains at 1280 level.