A recent post on CNBC discussed Bob Farrell’s 10 Investing Rules. These rules have withstood the test of time as it relates to long-term investing.

Here’s a list of Farrell’s 10 rules:

- Markets tend to return to the mean over time

- Excesses in one direction will lead to an opposite excess in the other direction

- There are no new eras—excesses are never permanent

- Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways

- The public buys the most at the top and the least at the bottom

- Fear and greed are stronger than long-term resolve

- Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names

- Bear markets have three stages—sharp down, reflexive rebound and a drawn-out fundamental downtrend

- When all the experts and forecasts agree—something else is going to happen

- Bull markets are more fun than bear markets

However, given more than a decade of QE-driven bull market advance, I wondered what they might be like if Bob Farrell was alive today. Would he have changed his mind?

With this in mind, I present Bob Farrell’s 10 Investing Rules For A “QE” Driven Market. (Tongue firmly implanted into the cheek, of course.)

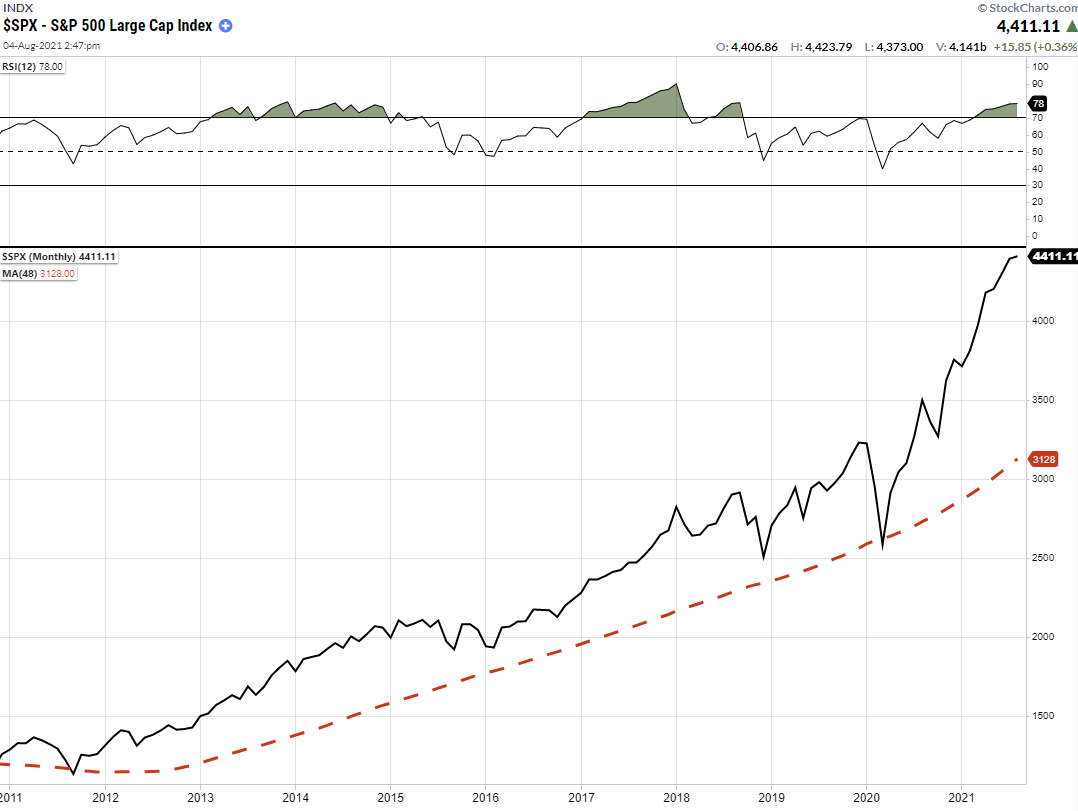

1. Markets Remain Deviated From The Long-Term Means Over Time

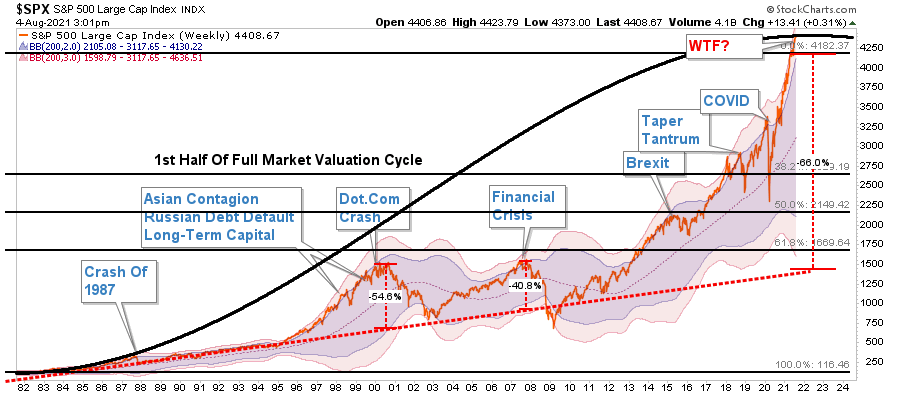

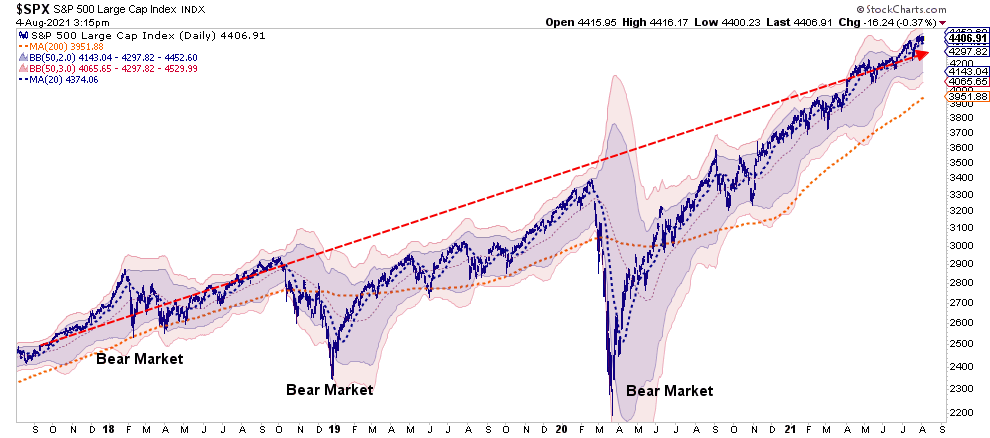

Bob believed that stock prices get anchored to their moving averages. As such, with regularity, prices must and will revert to and beyond those means over time.

However, as any young retail investor will tell you, such “boomer” ideas must be “put out to pasture,” as they say in Texas. All you need is a fresh round of “stimmies,” some “rocket emojis,” and you have all the ingredients necessary for a bull market.

Sure, prices certainly get overextended, but any dip is a buying opportunity because the “Fed put” ensures any downside is limited.

2. Excesses In One Direction (On The Upside) Lead To More Excesses

“Ole’ Boomer Bob's” antiquated notion that markets, which can and do overshoot on the upside, will also overshoot on the downside, is also clearly wrong. The further markets swing to the upside, the higher they should go.

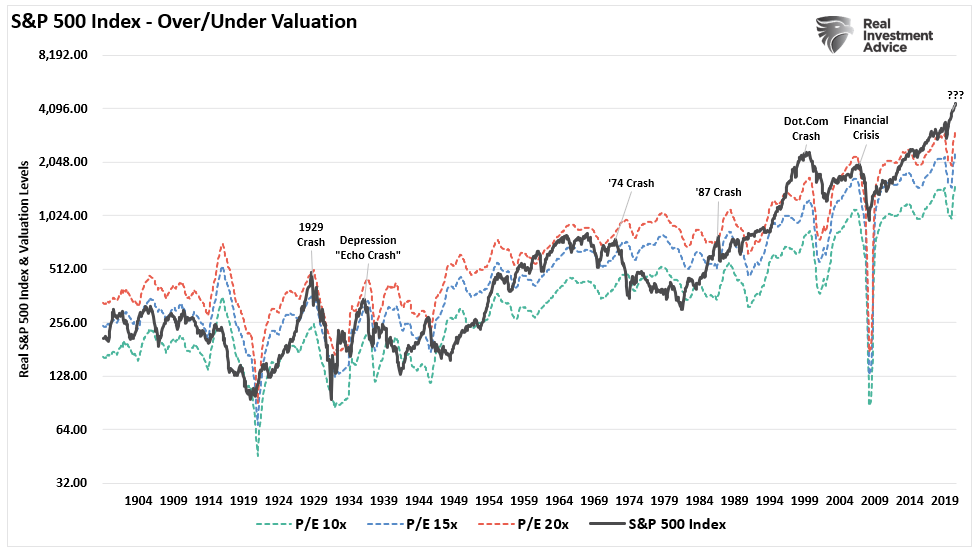

There is no reason not to buy stocks as long as there are low interest rates, liquidity, and a mobile trading app. Sure, prices are a “smidge” above fair value, but valuations are such an antiquated metric. Also, plenty of articles suggest the “P/E” ratios are terrible market timing devices, so why even pay attention to them?

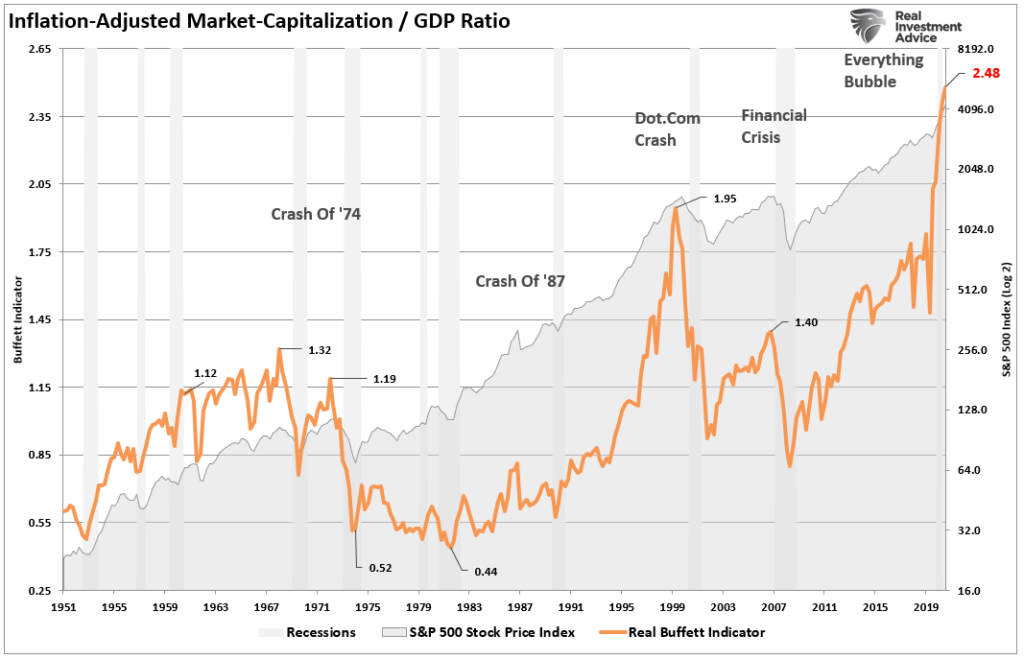

Sure, the market-capitalization ratio is almost 3x what the economy can produce, but we have never been in a market like this before. With all the Fed and Government money paying for everything, there is no reason to be productive when everyone can stay home, trade stocks and play “Call of Duty – Warzone.”

3. There Are No New Eras – Except This Time As Excesses Are Permanent

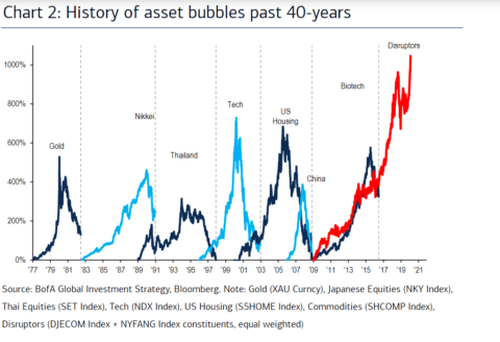

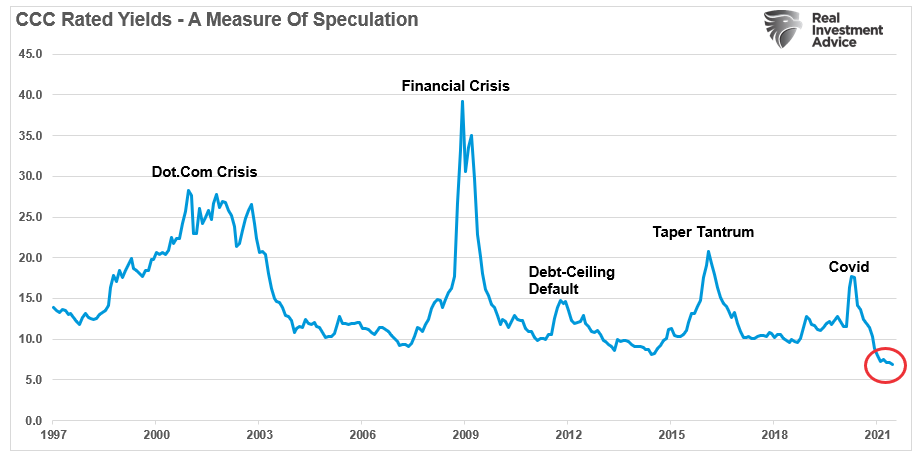

There will always be some “new thing” that elicits speculative interest. Over the last 500 years, there were speculative bubbles involving everything from Tulip Bulbs to Railways, Real Estate to Technology, Emerging Markets (5 times) to Automobiles, Commodities, and Bitcoin.

Jeremy Grantham posted the following chart of 40-years of price bubbles in the markets. During the inflation phase, each got rationalized that “this time is different.”

But Jeremy is an old “boomer” that doesn’t understand current markets.

Multiple media sources pen articles stating valuations don’t matter. As long as interest rates are low, the Fed provides liquidity; stocks can only go up. That is a much better narrative, and if I put out a 1-minute video on “Tik-Tok,“ I can get a bunch of followers.

4. Rapidly Rising Markets Go Further Than You Think, But Correct By Going Even Higher.

The reality is that excesses, such as we are seeing in the market now, can indeed go much further than logic would dictate. However, these excesses, as stated above, are never worked off simply by trading sideways. Instead, excessively high prices are “corrected” by prices just going higher in this new market.

That makes complete sense to me.

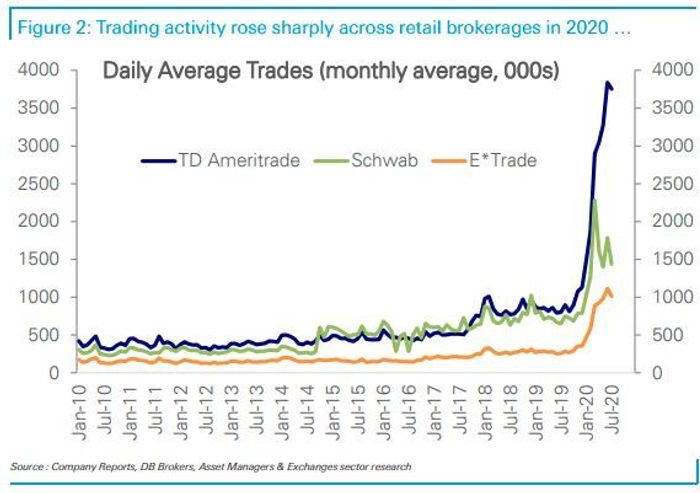

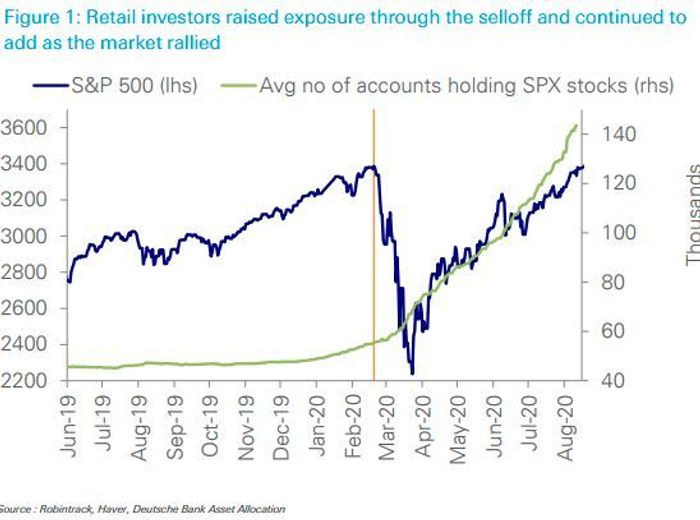

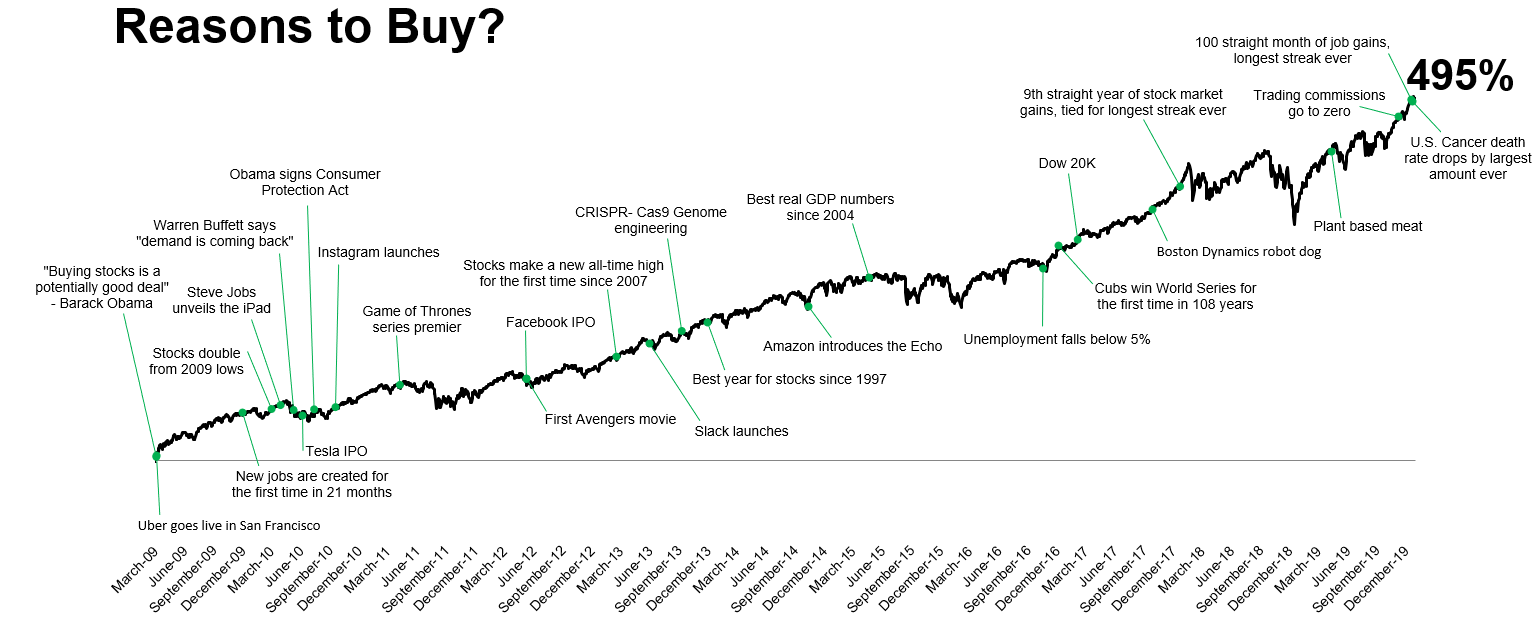

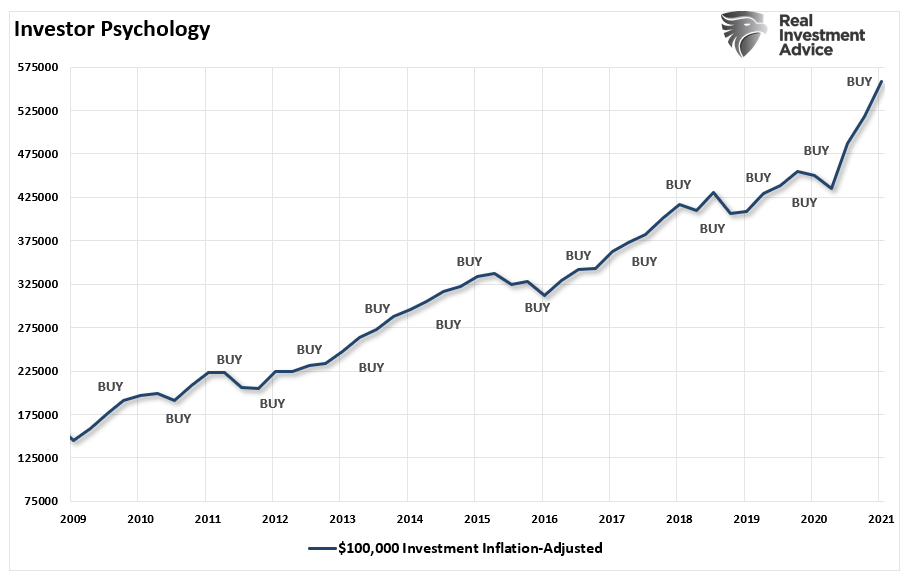

5. The Public Buys The Most At The Top, And More At The Next Top

After more than a decade of Fed interventions, investors believe that buying at the current “top” will be a bargain compared to an even higher top coming. Sure, logic would dictate the best time to invest is after a sell-off, but if you have “Diamond Hands,” you need to keep buying because prices will only go up.

6. Fear (Of Missing Out) And Greed Is All That Matters

As stated in Rule #5, emotions cloud your decisions and affect your long-term plan.

“Gains make us exuberant; they enhance well-being and promote optimism,” says Santa Clara University finance professor Meir Statman. His studies of investor behavior show that “Losses bring sadness, disgust, fear, regret. Fear increases the sense of risk and some react by shunning stocks.”

What is clear is that Meir Statman does not have “Diamond Hands.” While he is correct, there are only two primary emotions any investor should have.

- FEAR – The “Fear Of Missing Out;” and,

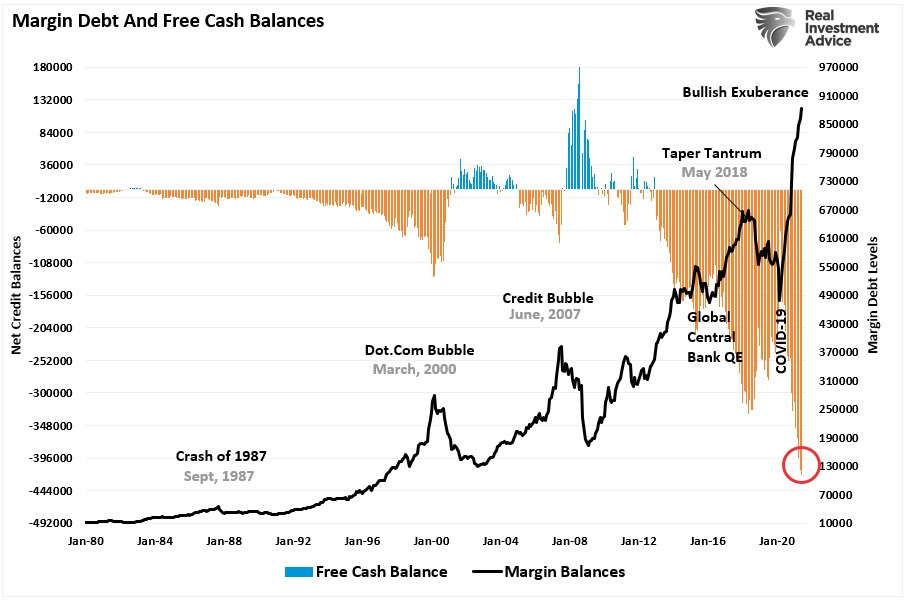

- GREED – The “Cojones” to take out debt, lever up. and ramp your “risk bets” in this one way market.

In the words of Warren Buffett:

“Buy when people are fearful and sell when they are greedy.”

Clearly, “Boomer Buffett” doesn’t get it either. But, of course, he is the same idiot sitting on $150 billion in cash whining because he can’t find anything to buy. So if he was indeed an “Oracle,” why didn’t he load up on AMC and GME?

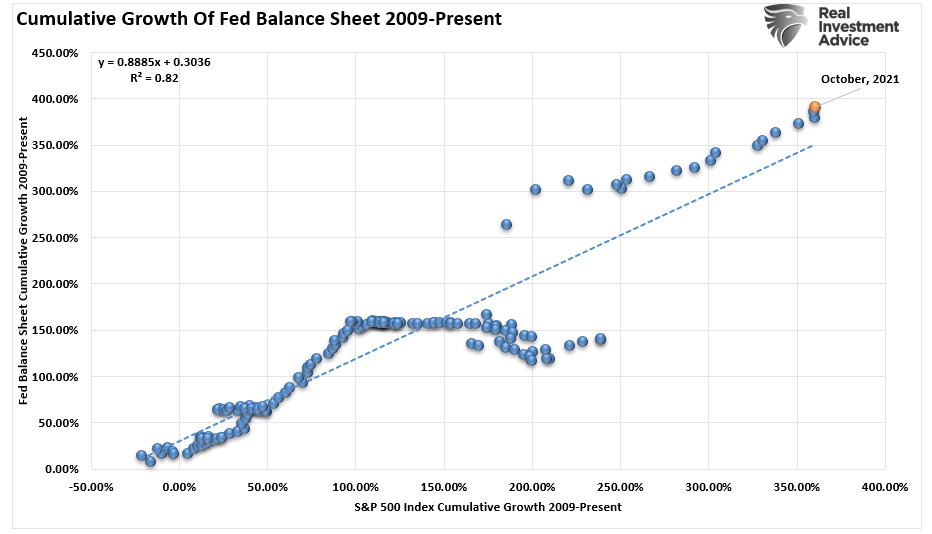

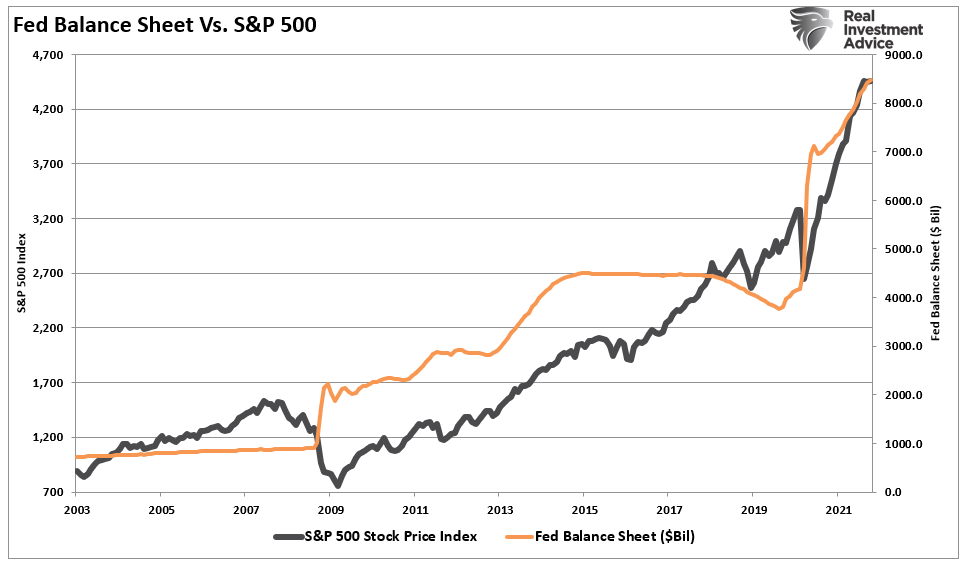

7. Markets Are Strongest When The Fed Is Dumping Liquidity Into The System

“Breadth is important. A rally on narrow breadth indicates limited participation and the chances of failure are above average. The market cannot continue to rally with just a few large-caps (generals) leading the way. Small and mid-caps (troops) must also be on board to give the rally credibility. A rally that “lifts all boats” indicates far-reaching strength and increases the chances of further gains.” – Every “Old” Technical Analyst

Sure thing, “Boomer.”

To crush the market, all you have to do is buy the 10 fundamentally worst companies that have the highest short-ratios, leverage it up with margin debt and options, and sit back. Then, the “ATM” will start spitting out money.

All you need to watch is for a change in the Fed.

“The high correlation between the financial markets and the Federal Reserve interventions is all you need to know to navigate the market.“

Those direct or psychological interventions are all you need to justify taking on all the speculative “risk” you muster.

8. Bear Markets Have Three Stages – Up, Up, and Up.

“We don’t have no stinkin’ bear markets.”

Any decline in the market is just a good reason to take on even more risk. Given the Fed will stop any market crash by injecting trillions in liquidity, buy.

After all, before the “economic shutdown,” I had to work three jobs (UBER, LYFT, and Amazon delivery) to make ends meet. Now, I sit at home, trade stocks, and make “TikTok” videos about all the money I am making. Plus, once I get to 100,000 followers, I increase my income by doing affiliate marketing and getting my followers to trade on Robinhood (NASDAQ:HOOD).

What could go wrong with that?

9. When All Experts Agree – Whatever They Agreed On Is Likely To Happen

Another old “boomer,” Sam Stovall, the investment strategist for Standard & Poor’s, once quipped:

“If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell?”

Well DUUHHHH!!! Who wants to sell? That is just stupid.

10. Bull Markets Are More Fun Because Bear Markets Don’t Happen Any Longer

What should be clear by now to anyone is that after 12 years of monetary interventions, “Bear Markets” can no longer happen.

So, suck it up, quit your complaining, and “Party On Garth.”

This Time Isn’t Different

If you detected a hint of sarcasm in today’s post, don’t be surprised.

Like all rules on Wall Street, Bob Farrell’s rules are not hard and fast. There are always exceptions to every rule, and while history never repeats exactly, it often “rhymes” closely.

Nevertheless, these rules get ignored during periods of excess in markets as investors get swept up into the “greed” of the moment.

Yes, this time certainly seems different. However, a look back at history suggests it isn’t. When the eventual reversion occurs, individuals, and even professional investors, try to justify their capital destruction.

“I am a long term, fundamental value, investor. So these rules don’t really apply to me.”

No, you’re not. Yes, they do.

Individuals are long-term investors only as long as the markets are rising. Unfortunately, despite endless warnings, repeated suggestions, and outright recommendations, getting investors to manage portfolio risks gets lost in prolonged bull markets. Unfortunately, when the fear, desperation, and panic stages get reached, it is always too late to do anything about it.

Those with “Diamond Hands” will eventually sell at the worst possible time.

Just remember, “Old ‘Boomer Bob'” did warn you.