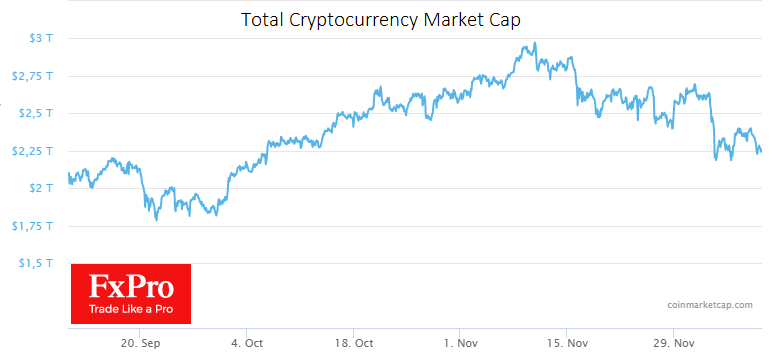

The crypto market has lost 4.2% of its capitalisation in the past 24 hours and now stands at $2.27 trillion. From the peak levels reached a month ago, capitalisation has dropped by 23%, allowing us to speak of the start of a bear market for the sector, at least like the one we saw in April-July.

The cryptocurrency fear and greed index dropped from 29 to 24, slipping into the extreme fear territory.

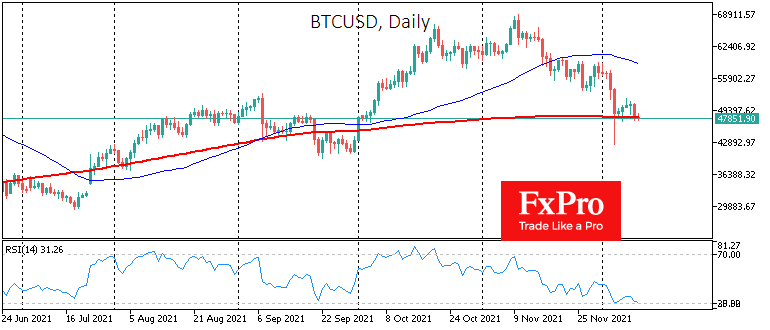

Alarmingly, the overall capitalisation this time was pulled down by altcoins. The first cryptocurrency lost around 3% over the day, returning to $48.3, where the 200-day moving average runs and touched the oversold area again.

A significant short-term indicator for the market promises to be the 200-day average for Bitcoin. An ability to bounce back above that line would indicate bullish sentiment prevails and promises new attempts to climb above $50K or $60K this month. A sharp fall would formally clear the way for a deeper correction to $41K or even $30K.

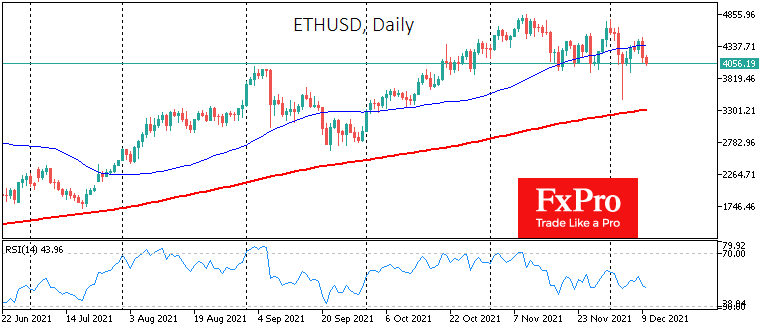

ETH/USD has been losing 6% over the last 24 hours and is dangerously close to the psychologically significant $4000 level. The latest momentum of the decline pushed the first altcoin away from the 50-day moving average, and a deeper correction may follow.

Ether fell out of the bullish uptrend from the end of September and went into a prolonged consolidation. The declines yesterday and this morning brought the coin back to the lower end of the consolidation range, and a dip under $4000 would open a straight road down with a potential target at $3300 or further to $2700.

Bitcoin’s share of the crypto market has started to rise again, reaching 40.3%. We see this growth in a falling market as an additional sign of fear of the crypto market.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin’s Fall Under $48,000 Will Open The Way To $41,000 Or $30,000

Published 12/10/2021, 06:58 AM

Updated 03/21/2024, 07:45 AM

Bitcoin’s Fall Under $48,000 Will Open The Way To $41,000 Or $30,000

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

hello sirA significant short-term indicator for the market promises to be the 200-day average for Bitcoin. An ability to bounce back above that line would indicate bullish sentiment prevails and promises new attempts to climb above $50K or $60K this month. A sharp fall would formally clear the way for a deeper correction to $41K or even $30K

hi

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.