Bitcoin Non-Commercial Speculator Positions:

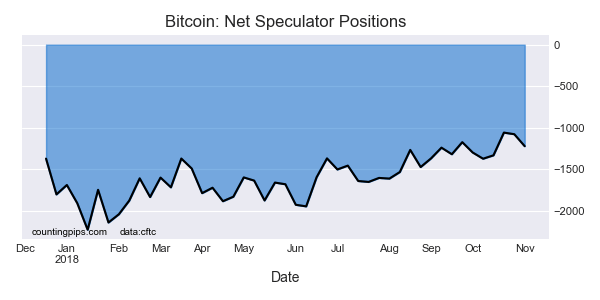

Large cryptocurrency speculators pushed their bearish net positions higher in the Bitcoin futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,221 contracts in the data reported through Tuesday November 6th. This was a weekly change of -144 net contracts from the previous week which had a total of -1,077 net contracts.

This week’s net position was the result of the gross bullish position falling by -183 contracts to a weekly total of 1,492 contracts compared to the gross bearish position total of 2,713 contracts which saw a reduction by just -39 contracts for the week.

The speculative Bitcoin position has now had increasing bearish net positions for two straight weeks. The spec position, despite two weeks of rising bearish bets, remains to be at the lower end (less bearish) of its range since the beginning of bitcoin futures trading.

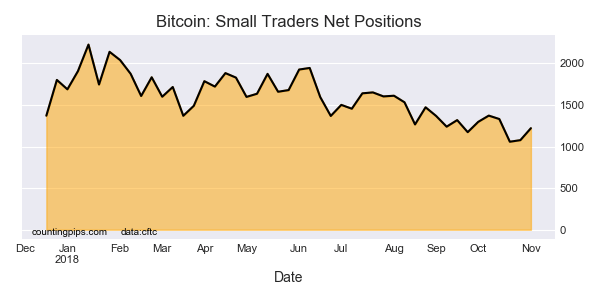

Meanwhile, the small traders position, which is on the opposite side of this market from the speculators, raised their existing bullish positions higher this week by an equally offsetting 144 contracts to a current bullish level of 1,221 net contracts.

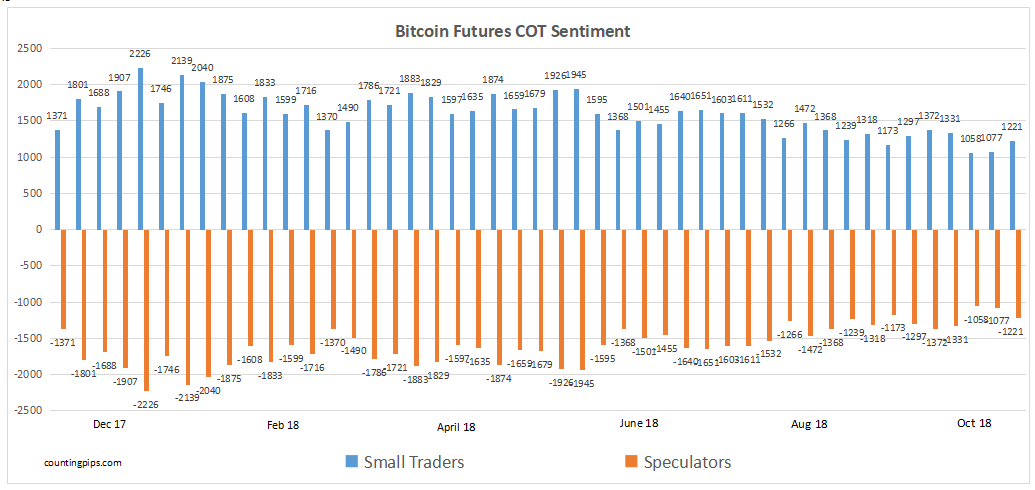

Bitcoin Futures COT Data is Speculators vs Small Traders

The Bitcoin futures data is in its forty-seventh week since the start of the cryptocurrency futures data releases on December 19th 2017. The data includes trader classifications of only speculators and small traders and without any commercial traders (typically business hedgers or producers of a commodity).

Speculators started off and have remained on the bearish side since the beginning of the bitcoin data releases while the small traders have continued to be on the bullish side of this cryptocurrency market.

Bitcoin Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $6415 which was a rise of $170 from the previous close of $6245, according to unofficial market data.