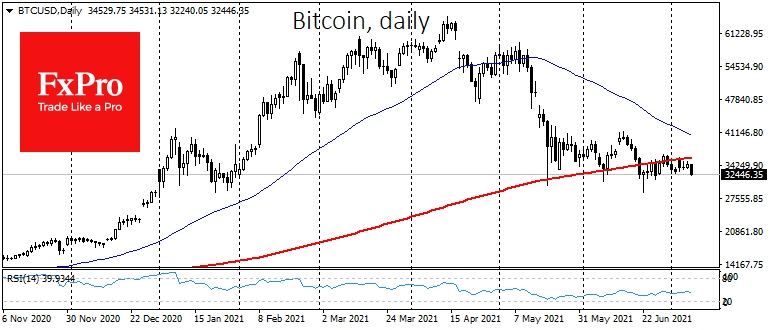

There is a summer lull in the crypto market, which, however, may just be the calm before the storm. Over the past 24 hours, Bitcoin has lost 7% and is trading around $32.3K. The price dynamic of the first cryptocurrency with seriously reduced trading volumes is considered a worrying sign. After all, if the market is affected by a small number of open positions, then any small storm could turn into a large-scale sell-off, disrupting an avalanche of stop orders.

The current levels near the local lows of the last two months make us watch with bated breath for further movements. The decline of the first cryptocurrency under $30k is likely to trigger a new wave of liquidation. But the most alarming thing for crypto-enthusiasts is that such an outcome will underscore the prolonged nature of the correction, increasing speculation around a new "crypto winter" like in 2018.

Whether this is true or not, we will find out in the near future, but for now, all major altcoins duplicate the price dynamics of the first coin. The leading altcoin Ethereum is losing almost 6% in the last 24 hours, trading around $2,250, which is quite a comfortable level. The project is consistently moving along the roadmap of the transition to PoS. The developers have the confidence of market participants, and Goldman Sachs (NYSE:GS) recently called Ethereum more promising than Bitcoin.

If you try to summarise the number of projects and directions working on this blockchain, there is an understanding that Ethereum may indeed, in the long term, supersede BTC in terms of usage, which will be the foundation of the price. Stablecoins, De-Fi, and NFT tokens are running on the Ethereum blockchain. Since the beginning of 2021, $2.5 billion worth of NFT tokens have been sold.

Visa's (NYSE:V) data also looks encouraging, showing that more than $1 billion in transactions have been made through cryptocurrencies since the beginning of 2021. Various companies are increasingly offering cryptocurrency-based products to customers. The ability to peg a cryptocurrency wallet to one of the leading payment processors will significantly increase the use of crypto products.

At this point, big capital may be watching the process of miners moving. After the Chinese authorities banned miners, the hash rate in the blockchain fell by almost 50%, which led to significant changes in both the difficulty of the algorithm and the profits of the remaining online miners. At the moment, they are making income as if Bitcoin is worth about $60K. The miners' likely choice of location for their work could affect the market outlook. Moving to the U.S. could improve the image of the first cryptocurrency, but there are suspicions that miners fear the U.S. authorities as much as the Chinese. Kazakhstan, Mongolia and other neighbouring countries with cold climates and access to cheap energy could become new locations.

For now, according to Glassnode, the time of calculations of one block has reached the highest value in Bitcoin history. While this could cause problems for the network in the event of high demand, the recalculation of difficulty will correct for any changes in the hash rate. On the other hand, we are now seeing a lucky combination in the market, with some miners stopping mining new coins and spending their savings due to the move, while others are mining significantly more than they are spending.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Is At Dangerously Low Levels

Published 07/08/2021, 07:46 AM

Updated 03/21/2024, 07:45 AM

Bitcoin Is At Dangerously Low Levels

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.