On Tuesday, the dollar added around 0.5% to a basket of the six most popular currencies on turbulence in some market sectors. The "buy rumours, sell facts" model played out in full force yesterday and may continue to dominate the markets for quite some time.

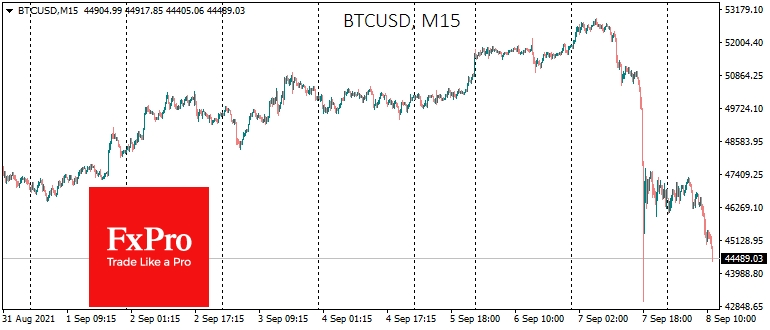

Bitcoin has officially become legal tender in El Salvador. Both media and social media have spurred interest in the event in recent weeks. The price reaching the $53k area triggered big profit-taking, which quickly escalated into a margin call that pushed the price back by $10k at one point.

Bitcoin is profoundly entwined with the financial system, so its volatility affected the overall demand for risk.

There was a telling sell-off in precious metals, where gold lost about 1.5% to $1800, while silver and platinum fell over 2%, to $24.2 and $1000, respectively. These metals were pushed back to critical technical levels, once again raising the question that investors are ready to switch to long position liquidation mode very quickly.

This was also reflected in the Wall Streets Fear Gauge, the VIX, which jumped 15.7% on Tuesday. Remarkably, the local lows of the index have been increasingly higher since July, which means that the lull in the markets is becoming less and less calm.

The drop in Bitcoin and gold and the jump in the VIX points to increased nervousness in the markets. In such an environment, investors often perceive a relatively neutral news backdrop as an excuse to tread carefully to lock in profits.

However, the dynamics of the same Bitcoin clearly show how quickly the market can move from this phase to margin calls, when a broad pull into the most liquid and defensive securities is formed, triggering strong demand for the dollar.

Historically, September is considered the worst month for the stock market, as funds and investors often lock in profits towards the end of the US financial year. And we already see a clear manifestation of this traction in instruments sensitive to the pull into risky assets.

The FxPro Analyst Team