It’s summertime earnings season – and as I’ve written about before, I expect this to be the beginning of a deep global earnings recession. . .

Things are in the early stage – but the next 12 months will be ugly for investors.

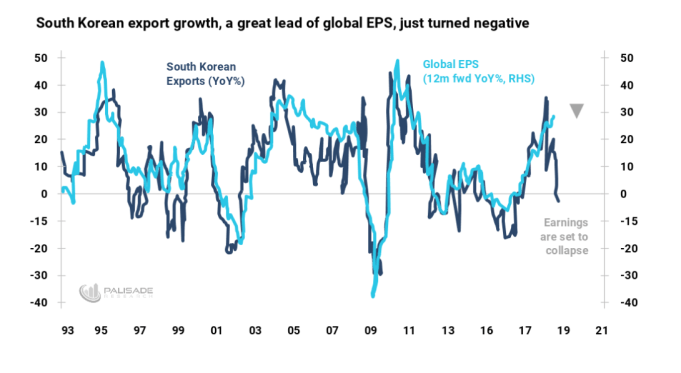

As a brief recap: it all started in early May when the little-used-yet-historically-accurate South Korean Export Growth Indicator (SKEG) signaled a coming collapse in global earnings.

But the mainstream paid no attention to this at all – analysts actually increased their earnings estimates.

Now since then – we’ve seen. . .

1. Declining year-over-year world trade volumes

2. The corporate bond yield curve inverting and the potential Trade war impact for markets

3. Tightening monetary policy by Central Banks worldwide

4. A looming global dollar shortage and collapsing foreign currency values

5. The prominent ‘Global Wave’ indicator showing economic growth has peaked and now huge downside ahead

The above add to the hypothesis that a global earnings recession is all but certain in the near future.

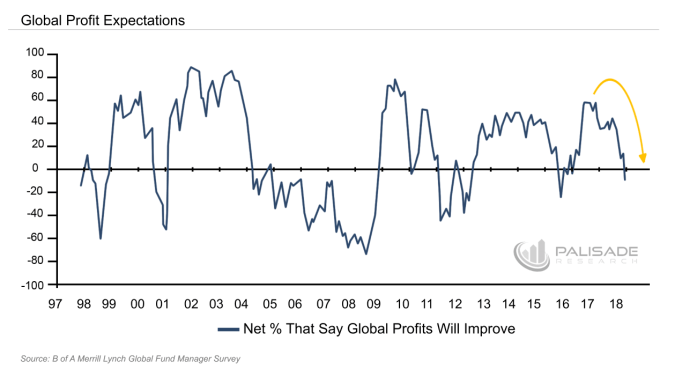

And making matters worse – the recent Bank of America (NYSE:BAC) survey that polls 230 panelists with over $660 billion of assets under management (AUM) show us that investor sentiment is slipping.

First

Global profit expectations have collapsed significantly over the last few months.

This shows that the ‘smart’ institutional money is now beginning to see danger in corporate profits – which means declining earnings.

And as Central Banks worldwide continue their tightening – the short end of the curve will rise – which further flattens and inverts the yield curve.

This will put significant pressure on banks worldwide – since they depend on ‘borrowing short and lending long’. And the last thing the markets need to worry about are bank solvency issues.

But – don’t forget that it will also put pressure on corporate bonds and cause rising interest payments for corporations – pushing profit margins lower.

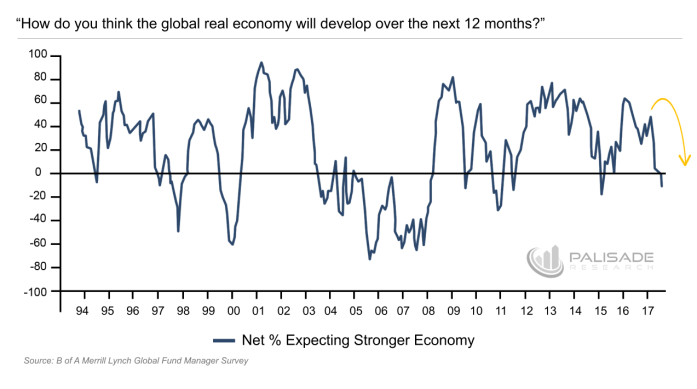

Second

These 230 panelists have soured on the mainstream’s growth agenda. Their expectations of the global economic output have declined sharply over the last few months.

Slowing growth and increasing debt burdens from rising interest is a dangerous recipe for business.

And when it comes to a global earnings recession – both collapsing economic growth and declining corporate profits pair together like whiskey and cola.

Just to make it clear – these kinds of surveys don’t mean much to me. It’s anybody’s guess what will happen tomorrow.

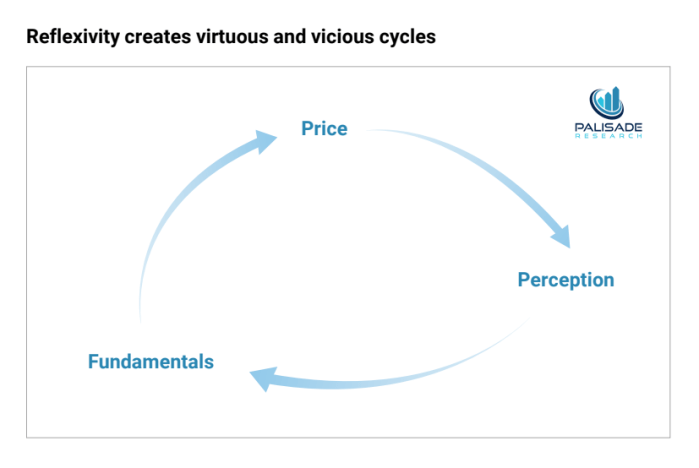

But as we learned from billionaire investor George Soros and his Theory of Reflexivity, in markets and economies (things that are driven from the herds view) – perceptions can drive prices which then alter fundamentals – at least in the short run.

That is, until prices become so far stretched from reality that perceptions will revert sharply – like a rubber band stretching slowly back then suddenly snapping. Hence why Soros always said there’s the constant violent boom-bust cycle.

I wrote about Reflexivity in early May to help explain the U.S. Dollar’s huge rally – and why it would continue for the immediate future (but ultimately reverse in the long run).

The more investors believe in trade wars, slowing growth, and Emerging Market instability – the more they buy U.S. treasuries and dollars. This then causes Emerging Market capital outflows and currency declines – ‘a flight to safety‘. Which then causes more treasury buying and an even stronger dollar – and so on goes a vicious feedback loop.

So even though these surveys are based on the panelists subjective expectations, we still have an idea of what the money managers with over $660 billion in AUM are collectively thinking.

And when we know what they’re thinking, we can get an idea of how their positioning. And how those actions will shape markets.

Since they’re becoming more bearish on the economy and corporate profits – as shown above – expect them to be risk averse.

Two Takeaways

- The economic and corporate profit outlooks are both bleak – and worsening. This shows us that the global earnings recession hypothesis is becoming more likely as the ‘smart’ money catches on.

- thanks to Reflexivity, because these perceptions are becoming more bearish, we can expect the dollar to continue rallying and the yield curve to continue flattening – until eventually inverting. This will keep pressure on banks and emerging markets especially.

For the contrarians thinking ahead of the curve – position for the ‘global earnings recession’ and be prepared for the ‘rubber band whiplash’ in the markets once the mainstream catches on.

It appears that ever since May when the SKEG indicator went off signaling the coming earnings collapse – more new data and information continue to prove this hypothesis.

In my opinion, the writing’s already on the wall for what’s next.