- Bear markets create stress, and merger arbitrage is an example of the impact

- The style comes with plenty of risks, but also opportunities

- This article walks through the style and an example in Black Knight (NYSE:BKI)

Bear markets are difficult by definition. Even bears have trouble making money (see the summer rally).

One reason is that ‘correlations go to one’ in a crisis, as the old saying goes. All the fancy asset allocation, or diversification, or stock picking goes out the window if everything goes down.

Which is one of the reasons so-called special situations get more interesting in times of crisis. Special situations – investment opportunities based on a specific catalyst not directly related to market events or fundamental performance – offer returns uncorrelated with the market direction. At least in theory. Merger arbitrage, the focus of this article, is a sub category of special situations.

In practice, these situations exist in the real world, and financial market conditions do weigh on them. Fears of financial stress widen merger arbitrage spreads, and higher interest rates affect the attractiveness of holding arbitrage positions.

The 2022 market is offering a number of wide merger arbitrage spreads, and it’s one of the areas I highlighted as worth picking through in the current market. Let’s go over what merger arbitrage entails, the general and 2022-specific risks, and an example of an interesting deal.

Merger Arbitrage Investing

The concept of arbitrage is fundamentally that something is available for one price in one place and another somewhere else, and an arbitrageur takes advantage of the difference between those two prices.

Merger arbitrage means buying the shares of a company that is going to be bought out when it is still trading below its final acquisition price. To use an obvious example, Elon Musk signed a contract to buy Twitter (NYSE:TWTR) for $54.20, Twitter shares trade at $38.62, so there is a 40.3% spread, and someone buying here would have the opportunity for 40.3% returns when the deal closed.

Reasons For Risk

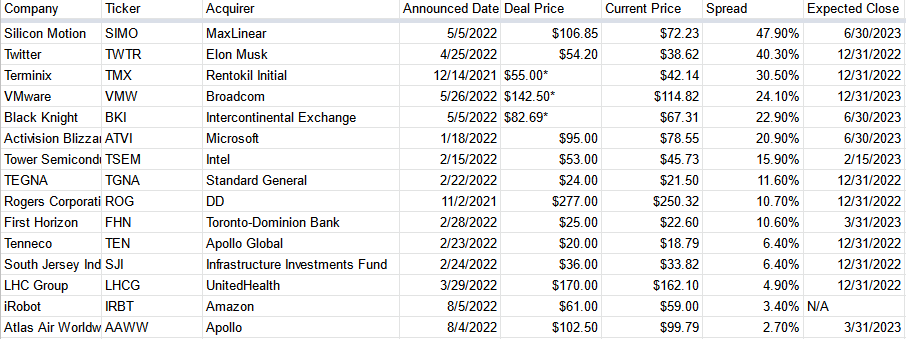

Like everything else in markets, merger arbitrage deals are not that easy. Merger arbitrage deal spreads have been unusually high this year. Here’s a selected list of some of the highest spreads still available.

Source: StreetInsider

Here are a few of the reasons deal spreads exist, non-Musk category:

Added anti-trust risk

The Federal Trade Commission (FTC) is charged with reviewing most mergers in the U.S. and is headed by Lina Khan, a noted anti-trust scholar. The EU has also increased its scrutiny of mergers in recent years. Regulatory risk is higher, then, than in past years.

Financing concerns

As markets are volatile, the financing for deals becomes harder to cinch up. Meaning: if a deal is made for all stock, as in Zoom’s attempted bid for Five9 (NASDAQ:FIVN), and Zoom’s stock drops a lot, the deal becomes less attractive for Five9. Or if a company is looking to raise debt to afford the deal, and financing conditions get tighter, it becomes harder to close and some of the planned synergies in the deal are lost.

Interest rate concerns

Climbing interest rates also make merger arbitrages less appealing. Arbitrages are supposed to be relatively low-risk, with a signed merger deal and a clear timeline for when a deal is supposed to close, but the opportunity cost is higher when the risk-free rate rises.

Those are explanations for the current market. There are also a couple more reasons to be cautious about merger arbitrage, and one to still consider them.

Binary Risk

In most cases, a merger either will or will not happen. Either you get the full merger consideration, or the deal breaks and the acquisition target’s stock plummets. That can be unpleasant to work through. One can figure out the market’s implied probability of a given deal, being sure that you get the probability right is hard. If the market is pricing in a 50% chance of Twitter getting bought at $54.20, I think there’s a 75% chance, and I’m right but the 25% chance plays out, does it matter if I was right?

Smarter Investors

There’s a whole class of professional investors and sharp individual investors chasing arbitrage deals. The market may not appear efficient on its face when you look at the wide deal spreads, but chances are most participants know, say, that Twitter’s legal case is much stronger than Elon Musk’s on its face, and still have logical reasons for thinking the deal still won’t go through at the full price.

At the same time, that class of professional investors is zeroed in on the deal. They are only thinking in a time horizon of “until the deal closes/breaks.” Which is appropriate, and in a case like Twitter, a requirement: it’s not realistic to think that Twitter shareholders will get anything close to their money back from here any time soon if the deal breaks, barring a huge market reversal.

There are cases, though, where that near-term focus, or where the factors the arbitrageurs are weighing most, can open an opportunity for individuals. Here’s a non-Twitter example of an interesting merger arbitrage situation right now.

Black Knight – Intercontinental Exchange

Black Knight is a leader in software for mortgage providers. Intercontinental Exchange (NYSE:ICE) is a leading financial exchanges company. ICE signed a deal to buy Black Knight for $68 in cash plus 0.144 shares of ICE stock per share of BKI. BKI trades at $67.31/share as of its September 1st close, vs. the current value of the deal of $82.69 based on ICE’s September 1st close, a 22.9% spread. The deal is expected to close in the first half of 2023.

That 22.9% spread is the obvious attraction. BKI is even trading below the cash value of the deal, and is also only trading 13.6% higher than it was before news leaked that BKI was up for sale. So it would seem the risk/reward isn’t extreme, though I’ll come back to that below.

That news leaked as BKI was considering another offer from a private equity group for $73-75/share (indeed, the news may have been leaked to spur ICE into making an offer). This gives us a second reason to not stress as much about the downside if the deal breaks – there seems to be sustained acquiring interest in BKI, as the company received an offer from that same private equity group in 2021 as well (at a higher price).

A third reason is that if anti-trust is the reason this deal doesn’t go through, ICE owes Black Knight $725M as a break-up fee. That amounts to more than 3x Black Knight’s 2021 income. So that would provide us a nice cushion to a deal breaking. And anti-trust is the most likely reason the deal wouldn’t go through, leading us to risks.

Anti-trust Risk

The anti-trust risk seems non-trivial – Intercontinental Exchange bought Ellie Mae in 2020, and that’s basically what they would combine with Black Knight. Ellie Mae used to cite Black Knight as its primary competitor. The Community Home Lenders Association asked the Department of Justice to “undertake a comprehensive anti-trust review” of the deal a month after it was announced.

Intercontinental Exchange has made the case that this is a complementary acquisition, and that they spent exhaustive time reviewing the likelihood of approval and were comfortable making the deal. The market isn’t buying that, it seems.

Time & Market Risk

The deal not closing for at least six months affects the relative attractiveness of the deal from a pure ROI perspective. It also widens the window for things to go wrong - ICE's share dropping, localized risk to Black Knight's business, prolonged recession, whistleblowers, etc. In theory none of that prevents the deal from closing, but the window is for a deal to close the more uncertainty.

Downside is priced within context of the market. The S&P 500 and the Russell 2000 are down about 13% since news leaked that BKI was for sale; BKI is up 13% since then. A reasonable downside calculation accounts for that market drop and potentially a steeper drop due to the turmoil from a merger break and the mortgage market slowing down. It also accounts positively for the $725M break fee.

Merger Arbitrage: A Whole Basket of Risks

I am interested in BKI because I imagine most arbitrage players are pricing in the probability of the deal break vs. deal completion scenario fairly, and ignoring the after-break scenario.

I estimate a downside of ~$53.5/share: the pre-leak news price $59.27 plus a 15% drop, then adding back in $3.5/share in after-tax proceeds from the break-up fee. That gets us a market probability of roughly 47% chance the deal goes through and 53% it breaks at the current price.

One reason to buy is if you have an informed view that 47% is too low, and that the probability this closes is higher. The other is if you see a company that has turned down two offers at a 15-30% premium to the share price previously, and whose peer (Ellie Mae) was sold twice in the last three years, and think that BKI won’t be long for public markets one way or the other. Unlike in the Twitter scenario, I think that’s a valid position to take, and a way to have a different outlook than the professionals playing the arbitrage.

I’m already long Twitter – its own drama – and more significantly, VMware (NYSE:VMW), which is being bought by Broadcom (NASDAQ:AVGO) and trades at a wide spread (I owned before the deal). My merger arbitrage is higher than I’d usually like as a result. So I’m not yet inclined to add Black Knight.

This is a curious situation though, and as seen above, there are a lot like it. It’s an option for more advanced investors to consider putting cash in a very tricky market.

Note: I found this article helpful and a useful alternative (more bullish) take.

Disclosure: I am long TWTR, ZM, and VMW.