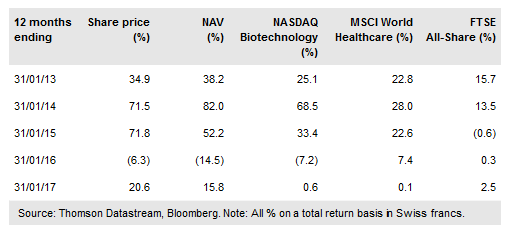

BB Biotech AG (DE:BIONn) is a long-established investor in biotech innovation, offering access to a concentrated portfolio of c 30 companies covering a range of therapeutic areas. It seeks to provide long-term capital growth, but also offers a yield of c 5% as a result of a capital distribution policy adopted in 2012. Performance has been strong both over the long term and more recently, with the fund ranking first among peers (in Swiss franc terms) over one and five years, and also outperforming the benchmark NASDAQ Biotechnology Index over one, three, five and 10 years. Although biotech and healthcare stocks may continue to see some near-term share price volatility as the direction of US policy becomes clearer, BION’s managers point to lower-than-average biotech valuations as a source of support.

Investment strategy: High conviction approach

BION is managed by specialist healthcare investment manager Bellevue Asset Management, whose mainly Europe- and US-based portfolio management team includes qualified medical doctors, bioscientists and economists. The team uses a four-stage investment process, with an emphasis on clinical assessment, to filter the global biotech universe of c 800 companies down to a concentrated and high-conviction portfolio with around half its assets invested in five to eight core holdings. Investments are made across the market cap spectrum to ensure exposure to fast-growing smaller companies that could be the market leaders of tomorrow.