Performance of banks that have reported second-quarter results so far has not been very impressive.

The banking industry faced a few challenges in the quarter. Despite hikes in interest rates by the Fed (twice this year), banks have been struggling to improve their net interest margin, owing to lower treasury yields.

Further, lack of any tangible progress on the reforms proposed by the Trump administration affected the lending scenario.

Moreover, non-interest income reported by banks so far seems to be under pressure, owing to sluggish trading activities and insufficient equity issuance and M&As in the quarter.

Nevertheless, the chances of a significant rise in expenses are low, though a marginal increase in expenses could occur owing to digitization.

Per our latest Earnings Outlook, overall earnings for Banks-Major and Banks & Thrifts are expected to witness year-over-year growth of 8.6% and 17.9% respectively in the second-quarter.

Our quantitative model offers some insights into stocks that are about to report their earnings. Per the model, in order to be confident of an earnings beat, a stock needs to have the right combination of two key ingredients — a positive Earnings ESP and a favorable Zacks Rank — Zacks Rank #3 (Hold) or better. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Let’s see what’s in store for the following banks that are scheduled to report second-quarter 2017 results on Jul 24.

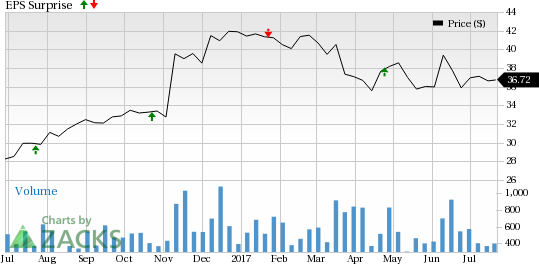

NBT Bancorp Inc. (NASDAQ:NBTB) is set to come up with results after the market closes. Our proven model does not conclusively predict if the stock will be able to beat the Zacks Consensus Estimate this time around, as it has an Earnings ESP of 0.00% and a Zacks Rank #3.

Moreover, the Zacks Consensus Estimate of 49 cents per share has remained stable over the last 30 days. The estimate reflects a year-over-year improvement of 5.4%.

Notably, NBT Bancorp witnessed an average positive surprise of 0.6% in the trailing four quarters as depicted in the chart below.

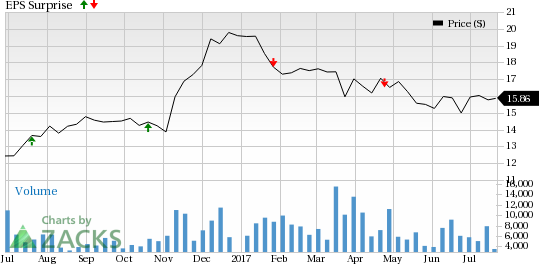

The Zacks Consensus Estimate for Independent Bank Group, Inc. (NASDAQ:IBTX) , which is slated to release results after the market closes, has remained stable at 82 cents over the last 30 days. Nevertheless, the estimate reflects year-over-year growth of 10.4%.

It is quite unlikely that the stock will be able to beat the Zacks Consensus Estimate this time around given its Earnings ESP of -3.66% and Zacks Rank #4 (Sell).

However, the company has an impressive earnings surprise history, as it surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average beat of 5%.

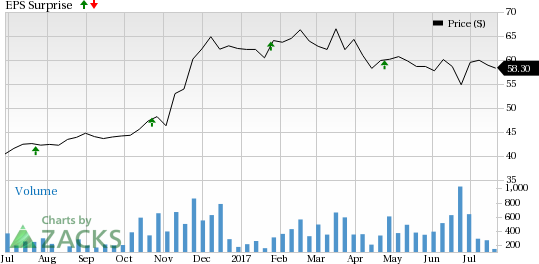

Chances of Bank of Hawaii Corporation (NYSE:BOH) beating the Zacks Consensus Estimate in the to-be-reported quarter are also low. This is because, despite carrying a Zacks Rank #2, the stock has an Earnings ESP of -0.97%. The company will report before the market opens.

Moreover, the Zacks Consensus Estimate of $1.03 per share has remained stable over the last 30 days.

Nevertheless, the company boasts a decent earnings surprise history with an average positive surprise of 5.9% in the trailing four quarters, as depicted in the chart below.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

NBT Bancorp Inc. (NBTB): Free Stock Analysis Report

Independent Bank Group, Inc (IBTX): Free Stock Analysis Report

Bank of Hawaii Corporation (BOH): Free Stock Analysis Report

TCF Financial Corporation (TCF): Free Stock Analysis Report

Original post

Zacks Investment Research