As the world transitions from deflation to inflation, investors need to engage in serious sector rotation or they risk being left behind.

Income growth in China/India, US government tax cuts, central bank rate hikes, and quantitative tightening are the main fundamental forces of this transition.

The paint is barely dry on Trump’s first tranche of tax cuts, and he’s already talking about round two!

Trump is a businessman and a realist, and that means he knows the US government has no hope of paying off its debt. None. Nada. Zilch. Tax cuts are bad news for government, and good news for corporations and citizens, with the caveat that the cuts are inflationary. That’s win-win for gold!

While Janet Yellen did hike rates, she did so at a snail’s pace. Rates are still very low and quantitative tightening has barely started.

That means corporate buybacks continue at a breakneck pace.

Some of the corporate piggy bank money created by the tax cuts has definitely gone to workers and business expansion, but most appears to have been used for stock buyback programs.

That’s kept financial ratios like earnings per share at reasonable levels while stock prices have advanced. It can be persuasively argued that most of the US bull market in stocks since March 2009 has been created by these buybacks.

More alarmingly, corporations are not just using operational cash for the buybacks, but borrowing money to leverage the action! Technically, it makes financial sense to borrow at 2% if you can buy stock that pays a 3% dividend. With this scheme, the use of leverage can create substantial profits (and equally substantial bonuses for directors who issue themselves reward with no risk).

The “endgame” of these buybacks is good for gold. Here’s why: If Jay Powell is aggressive enough with rate hikes and QT to halt the buybacks, the US stock market might crash.

With “safe haven” bonds pressured lower and the stock market crashing in an inflationary environment, institutional money managers will turn to gold stocks. On the other hand, if there is no stock market crash, higher rates and QT are going to incentivize banks to make more loans.

Corporations will continue buybacks, but at a slower pace. As they allocate funds to business investment, the tightening labor market is going to lead to workers demanding higher wages. This is only the very beginning of that trend.

Simply put, the last catalyst to push a lot of institutions into gold stocks in a meaningful way is wage inflation, and that tends to follow a rise in interest rates and higher bank profits.

Bank stocks around the world are surging.

It’s unknown how many more rates hikes and how much QT will be required to usher in serious wage inflation and a reversal in money velocity. What is known is that the time is near.

The bottom line: Investors who want significant wage inflation that pushes gold stocks to new highs will get what they want, but patience is required. Nothing good happens before its time.

Regardless, my strongest recommendation is for all investors to own a serious position in both bank stocks and gold stocks to get maximum benefit from the transition to an “inflationary era”.

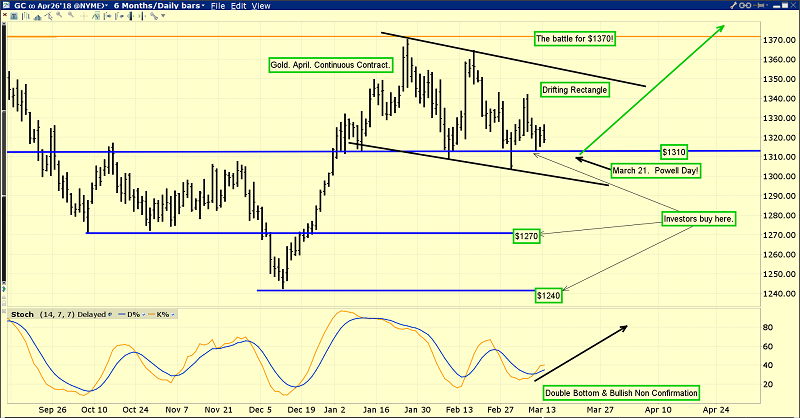

I’ve predicted that gold will go nowhere until the next Fed meeting.

That meeting is now just eight days away. With Chindian demand decent but not huge, the gold price is likely to continue in the drifting rectangle pattern that I’ve annotated on that daily gold chart until the Fed meeting ends.

Gold previously had a tendency to sell off quite dramatically ahead of past rate hikes, probably because “Fed speakers” made a lot of dollar-positive statements ahead of the hikes. Institutional money managers are becoming less concerned with the fact that gold doesn’t pay interest while the dollar does, and much more concerned that higher rates could cause tremendous damage to the US government bond market.

Powell may have suggested to his “speakers” that less talk about the supposed benefit of higher rates for the dollar is the wiser plan of action for now. Regardless, with Powell at the helm, there’s no question that the Fed has been a lot quieter, and the gold price action has been very solid ahead of this Fed meeting.

What I’m looking for after the meeting ends is not a “free money to the sky” gold price super surge, but more stability, more institutional money manager concern about the US bond market, and more talk about the potential for a reversal in US money velocity.

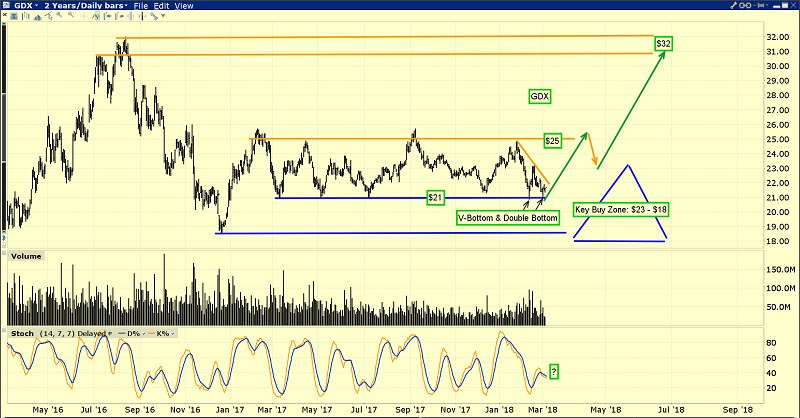

The big buy zones for gold stock enthusiasts are $21 and $18 on this GDX chart. Most individual gold stocks (with a few exceptions) track GDX, so when GDX reaches a key buy zone, investors can buy their favorite individual gold stocks at that point in time.

Investors who want to fully participate in the “Inflation Era” should have a portfolio of bank stocks (or ETFs for the sector) in one hand, with a focus on small banks. Those stocks are surging higher now, and should accelerate their advance with more rate hikes and QT. In the other hand should be a nice portfolio of gold and silver mining stocks. The surging bank stocks bring immediate satisfaction and the surge to come in the miners will bring maximum satisfaction!

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?