Over the last four trading days, performance of banking stocks was largely bullish, with fourth-quarter earnings cheering investors. Banks were able to surpass earnings estimates along with reporting a decent overall financial performance.

While expected weakness in trading, dismal mortgage banking and rise in credit costs hampered significant improvement in earnings, higher interest rates, modest loan growth and solid investment banking lent support. Further, banks were able to manage costs well.

But what cheered investors the most was the upbeat 2018 guidance related to interest income and loan growth. Also, though banks recorded significant one-time charge related to the tax act, favorable management comments regarding the same was a tailwind.

(Read: Bank Stock Roundup for the week ending Dec 8, 2017)

Important Earnings of the Week

1. Like always, JPMorgan (NYSE:JPM) kick started the earnings season. The company’s fourth- quarter adjusted earnings of $1.76 per share easily beat the Zacks Consensus Estimate of $1.69. Results exclude one-time tax related charge of $2.4 billion or 69 cents per share. (Read more: JPMorgan Q4 Earnings Beat Thanks to Investment Banking)

2. Wells Fargo’s (NYSE:WFC) fourth-quarter 2017 adjusted earnings of 97 cents per share improved from the prior-year quarter earnings of 96 cents. The Zacks Consensus Estimate came in at $1.04. The reported figure excluded 67 cents benefit from the Tax Cuts & Jobs Act, gain of 11 cents from the sale of Wells Fargo Insurance Services and charge of 59 cents related to litigation accruals. (Read more: Wells Fargo Q4 Earnings Improve, Tax Law Benefits)

3. Though fixed income trading income slumped as expected, Citigroup (NYSE:C) delivered a positive earnings surprise of 7.6% in fourth-quarter 2017 on prudent expense management and strong consumer banking. Adjusted earnings per share of $1.28 for the quarter easily outpaced the Zacks Consensus Estimate of $1.19. The figure excluded non-recurring non-cash charge related to the tax reform of $8.43 per share. (Read more: Citigroup Beats on Q4 Earnings, Records $22B Tax Charges)

4. Despite the trading slump, loan growth and impressive investment banking performance drove Bank of America’s (NYSE:C) fourth-quarter 2017 earnings of 47 cents per share, which outpaced the Zacks Consensus Estimate of 44 cents. Notably, the results exclude a one-time charge of 27 cents related to the tax act. (Read more: BofA Beats Q4 Earnings on Loan Growth, Higher Rates)

5. U.S. Bancorp’s (NYSE:USB) fourth-quarter 2017 adjusted earnings per share of 88 cents surpassed the Zacks Consensus Estimate by a penny. The figure came ahead of the prior-year quarter earnings of 82 cents. The earnings in the reported quarter excluded benefit from the tax act and other notable items. (Read more: U.S. Bancorp's Beats Q4 Earnings Estimates, Costs Up)

6. BB&T Corporation’s (NYSE:BBT) fourth-quarter 2017 adjusted earnings of 84 cents per share outpaced the Zacks Consensus Estimate of 80 cents. The bottom line recorded 7.7% improvement from the year-ago quarter. The figure in the reported quarter excluded charges of 5 cents related to tax reform and merger-related and restructuring expenses of 2 cents. (Read more: BB&T Q4 Earnings Beat on Higher Revenues, Costs Rise)

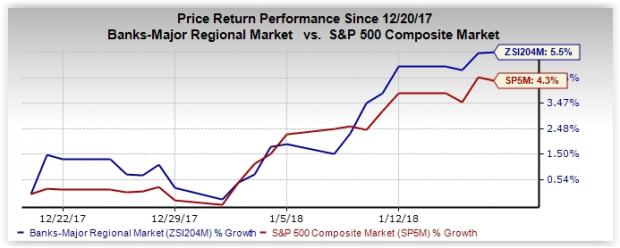

Price Performance

Here is how the seven major stocks performed:

Company | Last Week | 6 months |

JPM | 0.5% | 25.6% |

BAC | 0.9% | 32.0% |

WFC | 2.2% | 18.1% |

C | 0.7% | 17.1% |

COF | -1.9% | 28.3% |

USB | -1.5% | 9.0% |

PNC | 1.7% | 22.9% |

In the four trading sessions, Wells Fargo and PNC Financial Services Group (NYSE:PNC) were the major gainers, with their shares rallying 2.2% and 1.7%, respectively. However, Capital One (NYSE:C) and U.S. Bancorp (NYSE:USB) moved down 1.9% and 1.5%, respectively.

BofA and Capital One were the best performers over the last six months, with the banks’ shares jumping 32% and 28.3%, respectively. Also, shares of JPMorgan climbed 25.6%.

What’s Next?

In the coming five days, Capital One and Fifth Third Bancorp (NASDAQ:FITB) are scheduled to announce results on Jan 23. Performance of bank stocks will depend on the results and management guidance for this year.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

J P Morgan Chase & Co (JPM): Free Stock Analysis Report

BB&T Corporation (BBT): Free Stock Analysis Report

PNC Financial Services Group, Inc. (The) (PNC): Free Stock Analysis Report

U.S. Bancorp (USB): Free Stock Analysis Report

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Bank of America Corporation (NYSE:BAC): Free Stock Analysis Report

Capital One Financial Corporation (NYSE:COF): Free Stock Analysis Report

Original post

Zacks Investment Research