Over the last five trading days, investors’ pessimistic stance continued for the banking stocks. Release of the minutes of the Federal Reserve’s July meeting indicated a divide over the timing of interest rate hikes. The primary reason for this is the expectation of inflation staying below the Fed’s targeted level of 2% for an extended period.

While banks, at present, are reaping benefits from higher rates (easing margin pressure and increase in interest income), it now seems uncertain when the next rate hike will occur. This is perhaps one of the reasons that affected investors’ confidence in the banking stocks to some extent.

Also, disbanding of President Donald Trump’s American Manufacturing Council and the Strategy & Policy Forum indicate continued disruptions happening in the White House. Though this development is not likely to directly affect several proposed policy initiatives that are expected to strengthen the economy, investors now seem to be concerned over the timing.

Apart from these macro factors, banks continue to reel from litigation and regulatory probes. Legal headwinds pertaining to business malpractices in the pre-crisis period persist.

On the other hand, banks are intending to boost profitability through streamlining strategies. Also, with an aim to focus more on diversifying revenue base, banks are increasing market share in lucrative sectors.

(Read: Bank Stock Roundup for the week ending Aug 11, 2017)

Important Developments of the Week

1. Per a lawsuit filed in U.S. District Court, Wells Fargo & Company’s (NYSE:WFC) merchant services division has been accused of charging small business with unacceptable fees for credit card transactions. Also, the bank has been alleged to have charged excessively high fees for early termination. (Read more: Wells Fargo Accused of Levying High Early Termination Fees)

2. A lawsuit has been filed in the federal court in Manhattan by three public pension funds against six major banks. In the suit filed by the Iowa Public Employees' Retirement System, Orange County Employees' Retirement System and Sonoma County Employees' Retirement Association, the banks have been accused of collaborating and conspiring to remove competition from the stock lending market.

The accused banks are Bank of America Corp. (NYSE:BAC) , JPMorgan Chase & Co. (NYSE:JPM) , The Goldman Sachs Group, Inc. (NYSE:GS) , Credit Suisse (SIX:CSGN) Group AG, Morgan Stanley (NYSE:MS) and UBS Group AG.

In the stock lending market, investors can sell a stock without owning it through a process called short selling. Investors or firms borrow stock with the help of agents by paying a fee and then sell it expecting to buy it again in the future at a lower price.

Some upstart lending platforms were developed to help various borrowers and lenders interact directly without the use of middlemen.

However, the above mentioned banks have been accused of trying to boycott and hence block the development of such lending platforms over the years. This was done to remove competition from the lending market and thereby charge higher fee from borrowers who wanted to engage in short selling. The act is in violation of the federal antitrust law.

Moreover, in order to prevent borrowers from going to other places in the market to get better prices, the banks had created a lending platform of their own called EquiLend LLC. It is through this platform that the banks have been trying to develop anticompetitive strategies in the market to safeguard their interests.

3. Capital One Financial Corp. (NYSE:COF) is laying off nearly 400 employees at its Rolling Meadows office in Chicago, with an intention to give more importance to automatic digital support over human customer services. Per Chicago Tribune, majority of the job cuts will take place within the company’s service department, which supports the credit card call center. (Read more: Capital One to Cut Jobs as Need for Digital Tools Grow)

4. KeyCorp (NYSE:KEY) , through its the corporate and investment banking unit, KeyBanc Capital Markets Inc. signed a deal to acquire Cain Brothers & Company, LLC. The company aims to expand its existing healthcare investment banking with this buyout. The financial terms of the deal, expected to close in late 2017, were not disclosed. (Read more: KeyCorp Expands Healthcare Advisory, to Buy Cain Brothers)

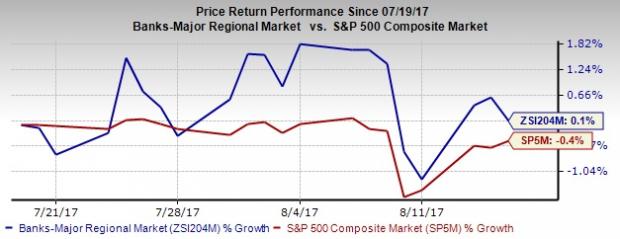

Price Performance

Here is how the seven major stocks performed:

Company | Last Week | 6 months |

JPM | -0.8% | 1.6% |

BAC | -0.9% | -3.0% |

WFC | -0.3% | -9.6% |

C | -0.3% | 11.5% |

COF | -1.0% | -9.8% |

USB | -0.6% | -4.7% |

PNC | -0.6% | 1.4% |

In the last five trading sessions, Capital One and BofA and were the major losers, with their shares dropping 1% and 0.9%, respectively. Furthermore, JPMorgan moved down 0.8%.

Citigroup (NYSE:C) and JPMorgan were the best performers over the last six months with their shares increasing 11.5% and 1.6%, respectively. On the other hand, Capital One and Wells Fargo declined 9.8% and 9.6%, respectively.

What’s Next?

In the coming five days, performance of bank stocks is likely to follow a similar trend, unless there is any unprecedented event.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

See Stocks Now>>

J P Morgan Chase & Co (JPM): Free Stock Analysis Report

KeyCorp (KEY): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

Capital One Financial Corporation (COF): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

Goldman Sachs Group, Inc. (The) (GS): Free Stock Analysis Report

Original post

Zacks Investment Research