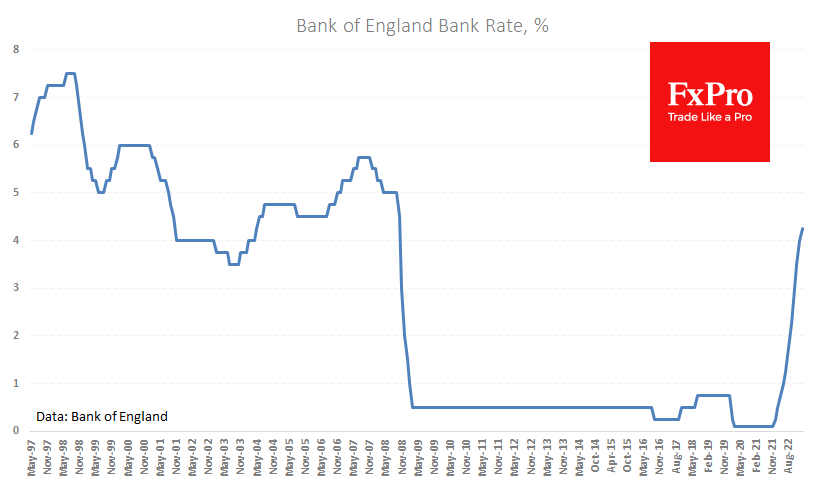

The Bank of England raised its interest rate by 25 points to 4.25%, in line with market expectations. Two members voted to keep rates on hold for the third meeting, while seven others voted against it.

Commenting on the decision, the BA noted the improved global growth outlook and now expects UK GDP to grow in the second quarter, up from a 0.4% contraction previously. Separately, the fall in gas and oil futures prices is noted.

The Bank of England has described the recent unexpected rise in inflation as temporary and continues to see a significant slowdown over the year. This is in no small part due to the current budget changes.

The Bank of England said further policy tightening might be needed if there is evidence of additional inflationary pressures in wages and services costs. This sounds like relatively dovish commentary, expressing more hope than confidence in a sustained return of inflation to the 2% target and the financial sector's resilience. Indirectly, the regulator's rhetoric suggests that the baseline scenario remains for rates to stay on hold.

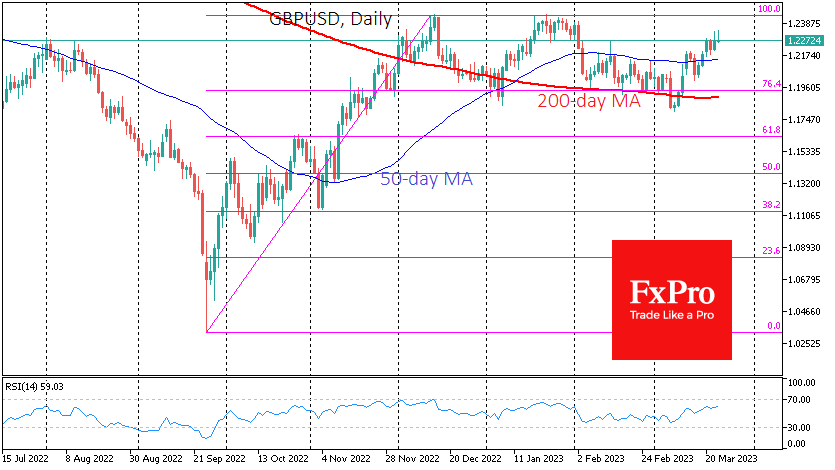

GBP/USD initially reacted positively to the rate decision, returning to the day's high of 1.2340, but at the time of writing has pulled back below 1.2300. At the same time, the Pound's momentum against the Dollar is primarily driven by the US Dollar.

In our view, the GBP/USD completed an almost three-month correction in early March, with the next target near the upper end of the trading range since December at 1.2430. Likely, the strengthening will not stop there, and the pair will have further strength to reach a new level, targeting 1.30.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bank of England Raises Interest Rate, Notes Improved GDP Outlook

Published 03/23/2023, 10:07 AM

Updated 03/21/2024, 07:45 AM

Bank of England Raises Interest Rate, Notes Improved GDP Outlook

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.