From the BOE's policy statement:

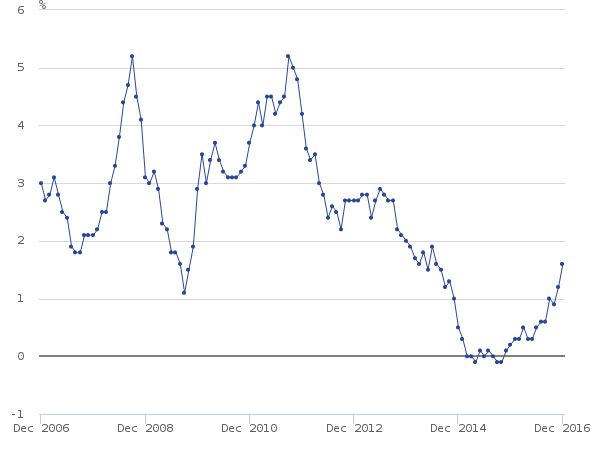

The value of sterling remains 18% below its peak in November 2015, reflecting investors’ perceptions that a lower real exchange rate will be required following the UK’s withdrawal from the EU. Over the next few years, a consequence of weaker sterling is that the higher imported costs resulting from it will boost consumer prices and cause inflation to overshoot the 2% target. This effect is already becoming evident in the data. CPI inflation rose to 1.6% in December and further substantial increases are very likely over the coming months. In the central projection, conditioned on market yields that are somewhat higher than in November, inflation is expected to increase to 2.8% in the first half of 2018, before falling back gradually to 2.4% in three years’ time. Inflation is judged likely to return to close to the target over the subsequent year. Measures of inflation compensation derived from financial markets have stabilised at around average historical levels, having increased during late 2016 as concerns about a period of unusually low inflation faded.

Several statistical sources show UK price pressures. The latest report from the ONS shows strong price increases, especially over the last few months:

And yesterday's Markit manufacturing release reported prices increased at the fastest pace in quarter century, due to a combination of the weak sterling and rising commodity prices.

What's important in the latest BOE statement is that the bank will accept higher inflation. This indicates the bank probably wants to hedge their bets in case domestic growth begins to slow due to the Brexit situation.