- BoE announces emergency intervention in UK bond markets

- Global yields come crashing down, stock markets rally in relief

- Dollar surrenders some ground, but yen cannot capitalize properly

BoE steps in

The Bank of England hit the panic button on Wednesday, announcing it will step into the UK government debt market to buy £65bn in bonds over the next two weeks to restore stability. Yields on UK bonds had gone through the roof in recent days after the government rolled out a budget that contained unfunded tax cuts, sparking debt sustainability concerns.

It was the threat of financial contagion that really forced the BoE to intervene, amid reports that the implosion in the bond market was chipping away at the collateral held by institutions such as pension funds, raising the risk of insolvency and more forced selling of bonds to raise cash. To stop this domino effect, policymakers will inject billions of pounds into the system by buying longer-dated bonds.

This process will add fuel to inflationary pressures but the BoE didn’t have any choice - it had to act to prevent a deeper crisis. As for the pound, this is a net-negative development. While the intervention will calm some nerves around contagion, it will also keep longer-term yields pinned down, placing more pressure on sterling through the interest rate differential channel. Ultimately, this will neutralize some of the tightening the BoE has already implemented.

Stock market relief

Global bond yields came crashing down in the aftermath of the intervention, which came as a breath of fresh air for equity markets. Investors interpreted the BoE’s move as a signal that if push comes to shove, systemic risks threatening the financial system override inflation concerns, forcing central banks into action.

In other words, the Fed might also get cold feet and throw the markets a lifeline in case insolvency risks appear on the radar, even if that exacerbates the inflationary fire storm. Nobody wants another financial crisis. The S&P 500 rose by nearly 2%, although this recovery was rather underwhelming considering just how massive the retracement in yields was.

Futures suggest most of this rebound will be wiped out when markets open today, pushing Wall Street towards its recent lows. It will be hard for those lows to hold because from a valuation perspective, the market is still too expensive. The S&P 500 is trading at more than 16 times forward earnings, while market bottoms this past decade were formed closer to 14 times. And since we are in a higher interest rate regime, the bottom in multiples might be even lower this cycle.

Dollar retreats, yen cannot shine

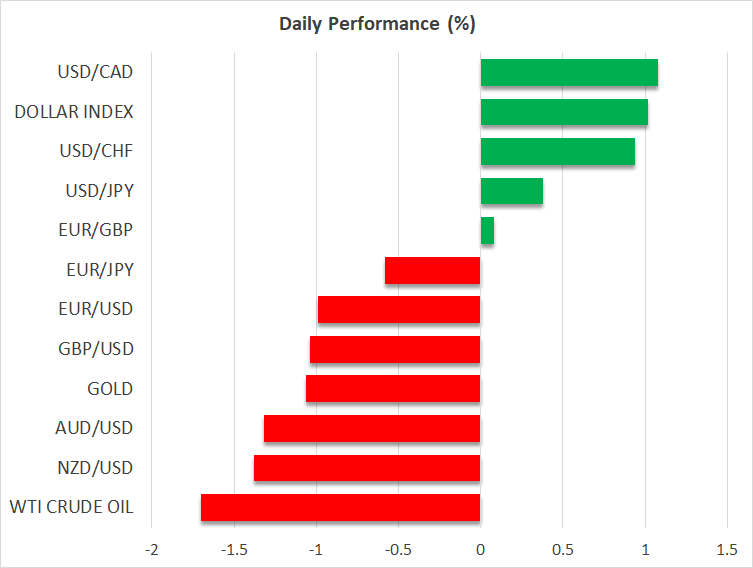

Over in the FX arena, the US dollar surrendered some ground across the board as rate differentials narrowed to its detriment and safe-haven demand for the reserve currency dried up. It was a classic case of profit-taking after a stunning run in the dollar, which has already resumed its upward trajectory.

The striking part is that the yen was the second-worst performer yesterday. Soaring yields across the world have inflicted serious damage on the Japanese currency this year, so when those yields retreat dramatically, one would expect the yen to benefit the most. Instead, it seems the improvement in risk sentiment eclipsed the compression in rate differentials.

This is a bad omen for the yen. When a currency cannot shine on good news, it is unlikely to shine at all. With the Bank of Japan refusing to consider higher rates and last week’s FX intervention failing to accomplish much, dollar/yen seems ready to take another stab at the 145 region.

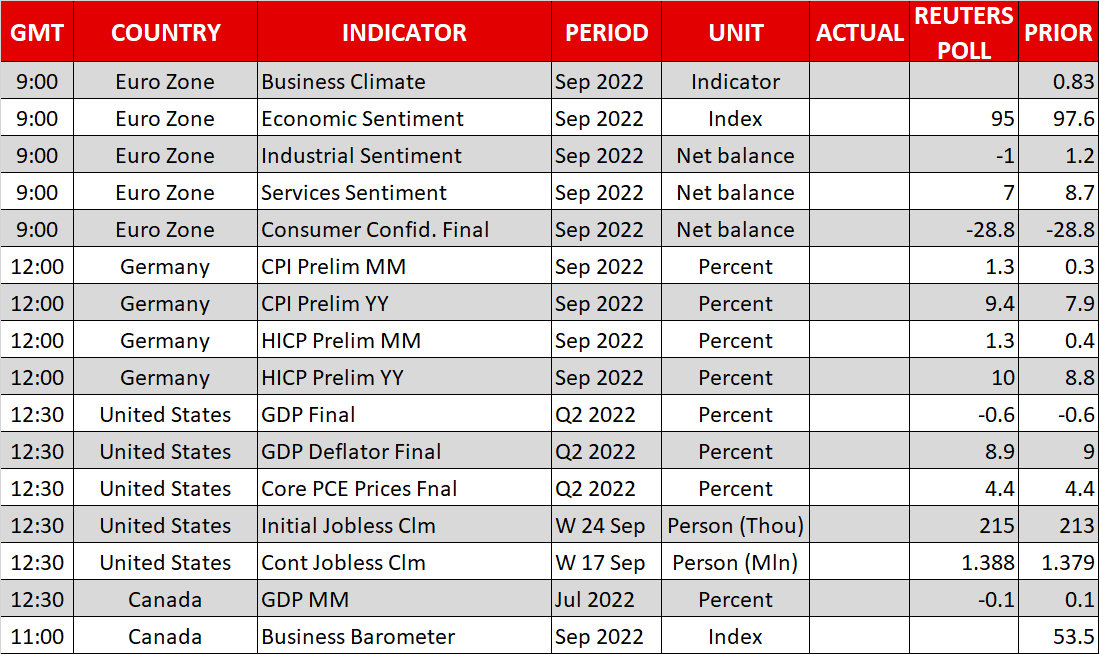

As for today, Germany’s inflation stats will top the economic calendar, alongside some remarks from BoE officials that might add some color around yesterday’s decision.