- RBA Governor Lowe defends rate hike

- Fed expected to hit rate trigger

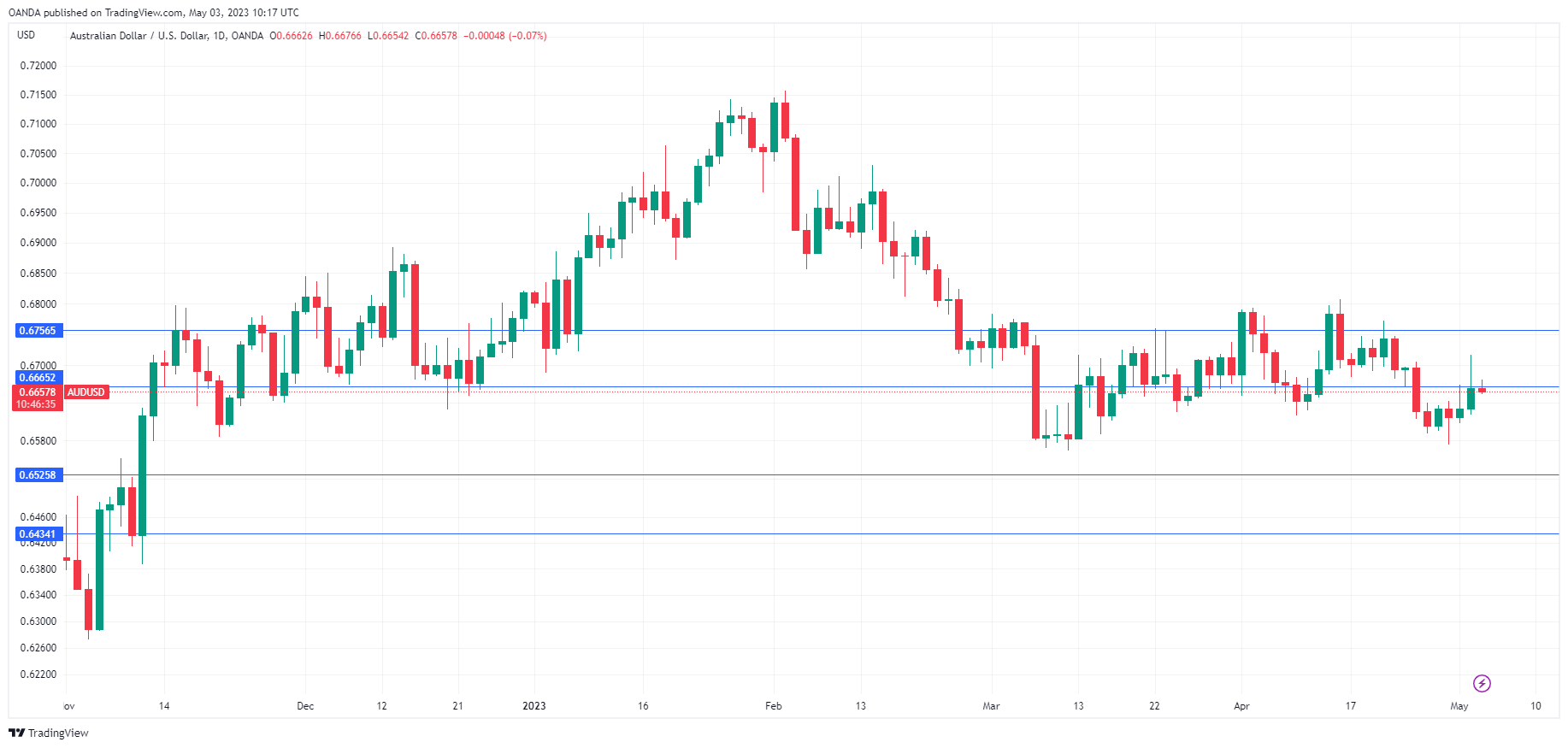

- AUD/USD is pushing pressure on resistance at 0.6665. Above, there is resistance at 0.6756

- 0.6525 and 0.6434 are providing support

The Australian dollar is almost unchanged on Wednesday, with AUD/USD trading at 0.6658.

RBA’s Lowe says rate hike was needed

The RBA decision to raise rates by 25 basis points caught the markets off guard, as expectations were high that the central bank would pause rates for a second straight month. The move has raised eyebrows, as just one month ago, the RBA took a pause, saying it needed to monitor the effects of 10 consecutive hikes Governor Lowe is well aware that the zig-zag could damage the Bank’s credibility and took pains to defend the rate hike.

Lowe provided a slew of reasons for the rate hike, starting with the tight labour market and the stickiness of service price inflation. Lowe noted that services and energy price inflation remained high and was “likely to remain so for some time” and the RBA needed to act or inflation expectations would adjust higher. Additional factors which supported a rate hike, Lowe added, were the increase in house prices and the weak Australian dollar.

The RBA’s resumption in raising rates means more financial pain to households, which are struggling with rising mortgage payments and high inflation. Critics of the move are predicting that the high rates will severely dampen growth and push the economy into a recession in the second half of this year. The RBA is determined to bring inflation back to the 2-3% target, but at what price?

The blackout in Fed communications ahead of today’s rate decision hasn’t stopped the swings in market pricing. The odds of a 25-basis point have dropped to 87%, down from 93% on Tuesday. That still means that a pause would be a shocker. This could be the “one and done” hike which wraps up the current rate-tightening cycle, and investors will be carefully monitoring the rate statement and Jerome Powell’s follow-up conference for hints about future rate policy.

AUD/USD Technical