The Australian dollar posted slight gains at the start of the trading week. AUD/USD is trading at 0.6801, up 0.10%.

RBA likely to deliver 25-bp hike

The Reserve Bank of Australia meets on Tuesday and is expected to hike by 25 bp for a third straight time. This would bring the cash rate to 3.10%. There is a chance that the RBA could take a pause and not raise rates, although the case for a modest 25 bp seems stronger.

Inflation remains the RBA’s number one priority, and the Bank’s steep rate-tightening cycle is showing results, with CPI falling to 6.9% in October, down from 7.4% a month earlier. Still, it is premature to say that inflation has peaked, and consumer inflation expectations measures have been mixed.

The RBA’s rate policy has been a bumpy road, which led Governor Lowe to issue an apology about the rate policy last week. Lowe said it was regrettable that people listened to the RBA saying it wouldn’t raise rates before 2024 but delivered seven oversized rate hikes in 2022. Many Australians took out mortgages based on the RBA assurance but are now getting squeezed by huge mortgage payments.

The week ended with the US employment report, which was stronger than expected. The economy created 263,000 jobs in November, slightly lower than the October reading of 284,000 and stronger than the consensus of 200,000. Wage growth also outperformed, as the reading of 5.1% y/y was up from 4.9% and beat the forecast of 4.6%.

The labor market continues to show a surprising resiliency, and the increase in wage growth will drive inflationary pressure. The solid employment numbers haven’t changed the likelihood of a 50-bp hike in December (80% according to CME FedWatch). Still, they should serve as a reminder to the markets that the Fed’s tightening cycle could continue into 2023.

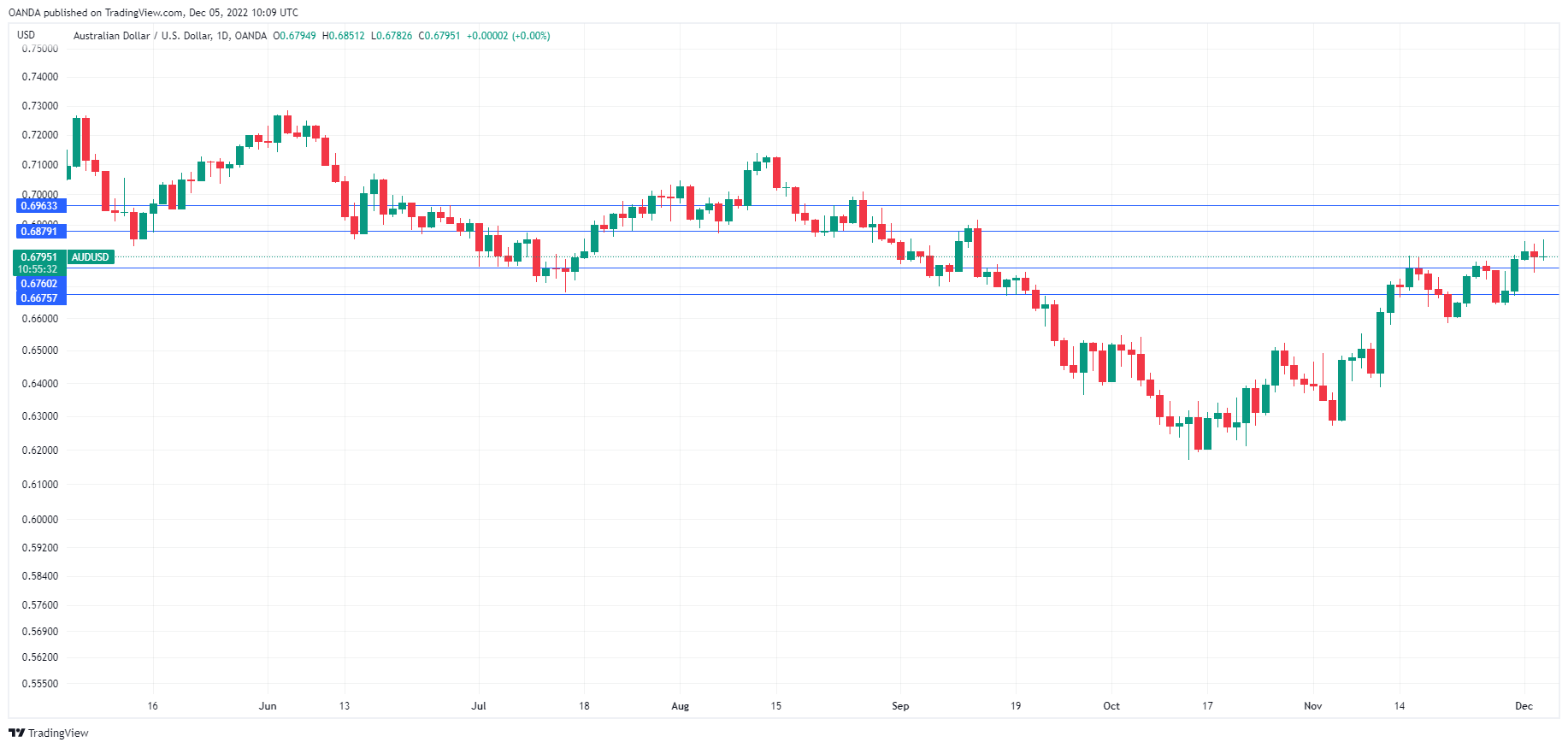

AUD/USD Technical

- AUD/USD faces resistance at 0.6878 and 0.6962

- There is support at 0.6760 and 0.6676